- English

- عربي

The USD has followed US 2-year Treasury yields and has broken some key levels across the various pairs on my radar. I would absolutely stop shy of saying the US CPI print changes the game. However, given the CPI form guide, a weaker-than-forecast CPI print is a rarity, and the market has had to reposition.

The fact that US 2yr (now 3.21%) moved so aggressively off the lows of 3.07% tells me this inflation read isn’t a game changer, and the market is still unsure if we get a 50bp or 75bp hike in the 21 September FOMC - but for those hoping for a ‘peak inflation’ there was some encouraging signs.

Would I be selling USDs now? I guess that depends on the strategy and timeframe of course, but the set-ups on the USD dailies offer me insights to work into the lower timeframes – EURUSD has broken the ceiling at 1.0275 but is now pushing into the regression channel resistance, where we’ve seen good interest to fade the rally above 1.0300. AUDUSD has broken the inverse head and shoulders neckline at 0.7044 and may start to trend higher, and needs work – one for the momentum traders, but it wouldn’t surprise to see a retest of the breakout zone to test support.

USDJPY aside, USDCHF is perhaps looking the most compelling way to trade a weaker USD, although I’d be looking for higher levels to sell into – as always, the reaction is what we trade, but 0.9485 looks a compelling area for shorts on the day.

In US equity markets, the NAS100 leads the charge, rallying 2.9%, and given the follow-through buying in Asia today, on the daily the NAS100 looks the goods right now. With the key breakout of the January downtrend and it feels to me that the risks are skewed for further upside into 13,600.

Talk on the traps is that CTA funds – systematic trend followers – continue to close short S&P500 future positions and the fact the VIX index has moved below 20% has seen volatility-targeting hedge funds adding capital to the market. Don’t discount the impact this sort of flow type activity is having on pushing equity markets higher, and of course, for retail traders, this is hard intel to get, so this is why we respect the tape and the price action.

Some view that the US500 could test the 200-day MA at 4319, after having been below it for 80 days. The US30 is testing the May highs, which also marry with the Jan downtrend, so this could be an area for the scalpers to look at – but a break would be very positive.

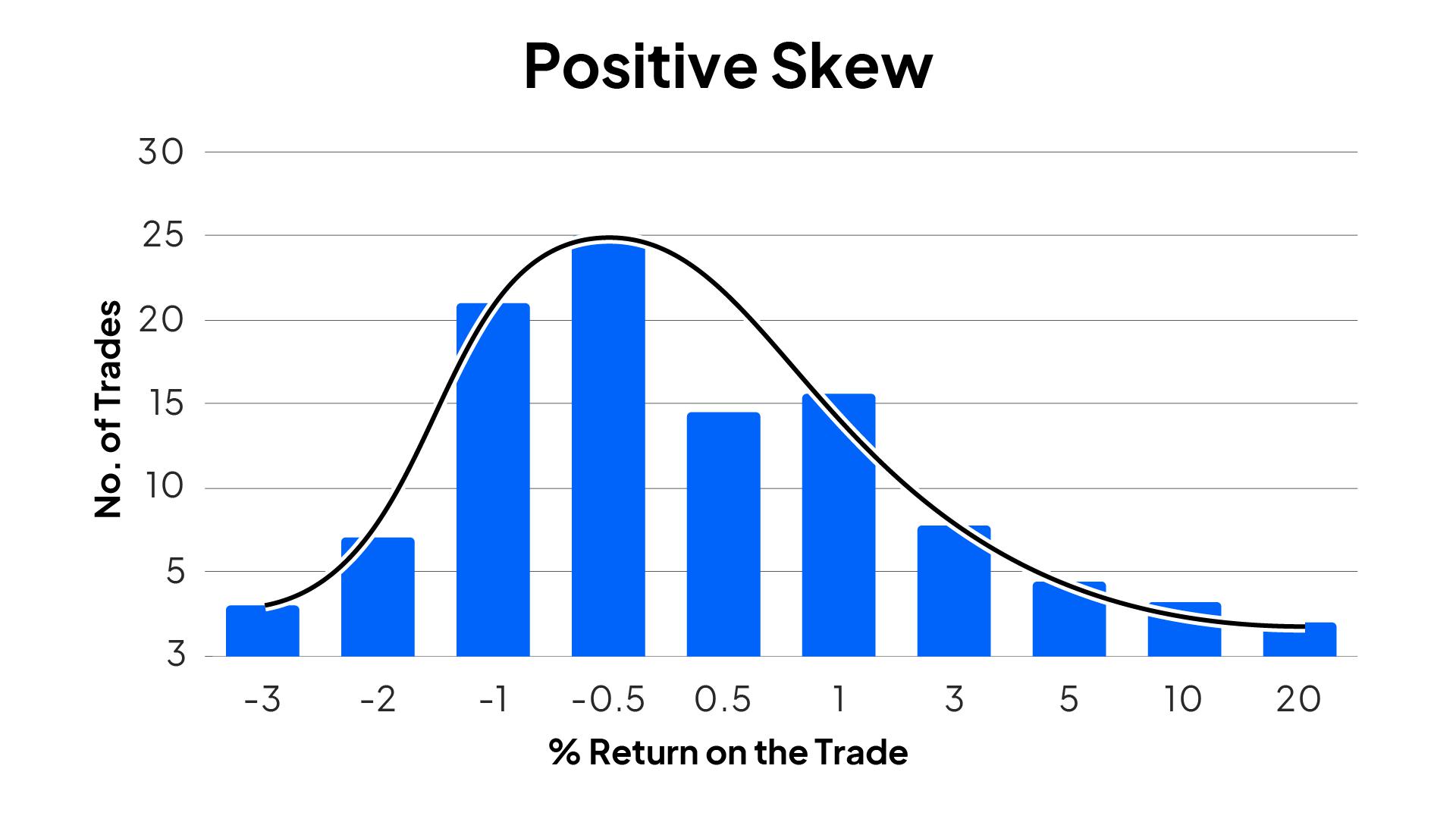

I’ve been pushing the Ethereum chart for a while, and finally got the breakout – I have no conviction if this rallies from here, but the job of the momentum/trend trader is to not think – just follow and be ready to close if it proves to be a failed break – this is the art of trading a positive skew strategy – that is, you have a low win rate but target big winners. This distribution chart highlights this well.

Today’s The Trade Off has just dropped - take a look. Market news, views and ideas delivered differently - https://youtu.be/XNtlwi2VZTQ

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420)