Trader thoughts - price pressures a major headache for the White House

the White House warned us it would be big, and it was, with broad-based price pressures coming through and headline CPI coming in topside of expectations at 7.5% - core was 6%. The political pressure on the Fed to reduce price pressure ahead of the Mid-terms in November would be deafening now and we’re already hearing from Biden that he is working to bring gasoline prices down.

The first Fed speaker to comment after the CPI print has been St Louis Fed President James Bullard (a voter this year) – he didn’t disappoint – suggesting we could see an inter-meeting hike, calling for 100bp of hikes by July, while being undecided on a 25 vs 50bp hike in March. The interest rate market has come alive, with March fed funds future rising 13bp and at 37.5bp is pricing a 50% chance of a 50bp hike in the 17 March FOMC. We see over 6 hikes (from the Fed) priced by year-end. 2-year US Treasuries have been sold hard and yields are +18bp at 1.54%, while we see the US 10-year above 2%.

The next date the market will look out for to get clarity on a 50bp hike is the payrolls (5 March), ahead of the Fed CPI print (11 March).

Daily of EURUSD

(Source: Tradingview - Past performance is not indicative of future performance.)

Incredibly while the USDX is unchanged, the USD is mostly lower on the day – GBPUSD initially sold off to 1.3523, but then reversed hard into 1.3644 before pulling back below the figure. GBP has been the star performer on the day, with GBPJPY now eyeing a break of the Jan highs – keep an eye on commentary from BoE gov Bailey in the session ahead, and we can see 61% chance of a 50bp hike from the BoE at its next meeting, which is also on the same day as the March FOMC meeting.

EURUSD traded lower to 1.1375 on the CPI print, but then too reversed into 1.1495 and challenged the Jan/Feb double the before sellers have impacted – we’re still eyeing a bullish reversal on the daily and need a daily close above 1.1448 for that – either way, we’ve seen sizeable range expansion.

AUDUSD pushed to the 100-day MA at 0.7249 before sellers were found, but aside from a higher USDJPY and USDSEK (the Riksbank meeting was clearly dovish), the USD is largely heavily. That may change, so let’s see how Asia trades this move.

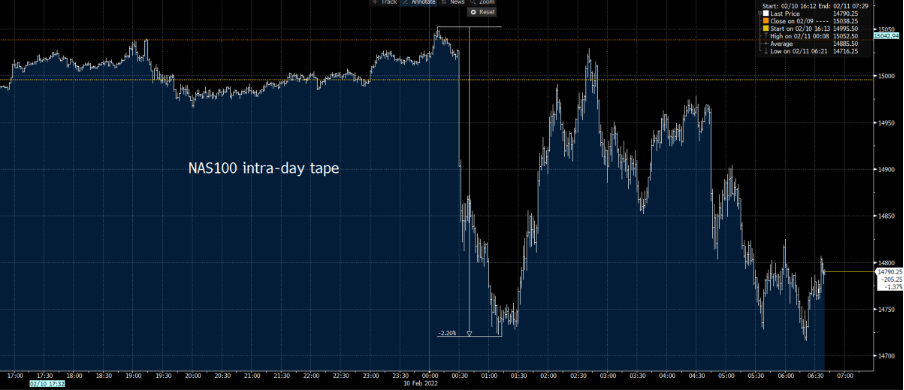

Intra-day moves in the NAS100

(Source: Bloomberg - Past performance is not indicative of future performance.)

Equities have been all over the shop – the NAS100 initially fell 2.2% on US CPI print, as front-end US bond yields spiked, then after reaching a low of 14,731 the bulls stepped back in, pushing the various US indices back to unchanged. When we got there, the bears pulled it back and here we are back near session lows. The intra-day tape has shown a genuine battle of flow. Absolutely one for the nimble day trader, working off far lower timeframes.

XAUUSD is also small higher, which may be a testament to the lack of one-way buying in the USD – but with real rates (bond yields adjusted for inflation expectations) +9bp in 5yr and +7bp in 10yr real rates, once again it's amazing to think gold is not $10-$15 lower on the day. We initially dipped to 1821, but then pushed back and currently sit at 1832.

A similar vibe in crypto, with Bitcoin dropping hard to 43,200, before reversing to 45,842 and we’re seeing better sellers again. Generally crypto is heavy.

For those who missed, do take a look at the weekly ‘Trade Off’.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.