- English

- عربي

Trader Thoughts - Fed Governor Waller lays out the path to rate cuts

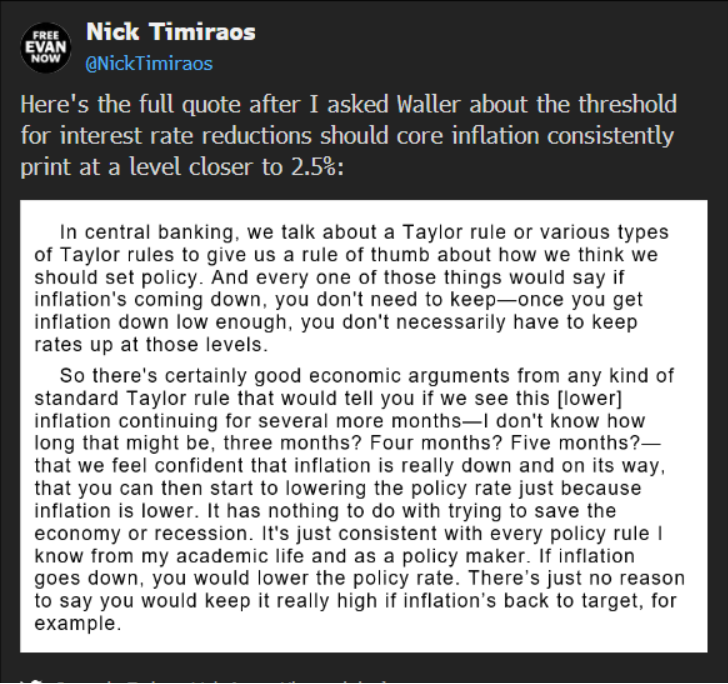

In a WSJ interview with Nick Timiraos, Waller has thrown open the possibility that we could see cuts as soon as March. The key passage from the tweet is:

So there are certainly good economic arguments from any kind of standard Taylor rule that would tell you if we see this [lower] inflation continuing for several more months - I don't know how long that might be, three months? Four months? Five months? - that we feel confident that inflation is really down and on its way that you can then start to lower the policy rate just because inflation is lower."

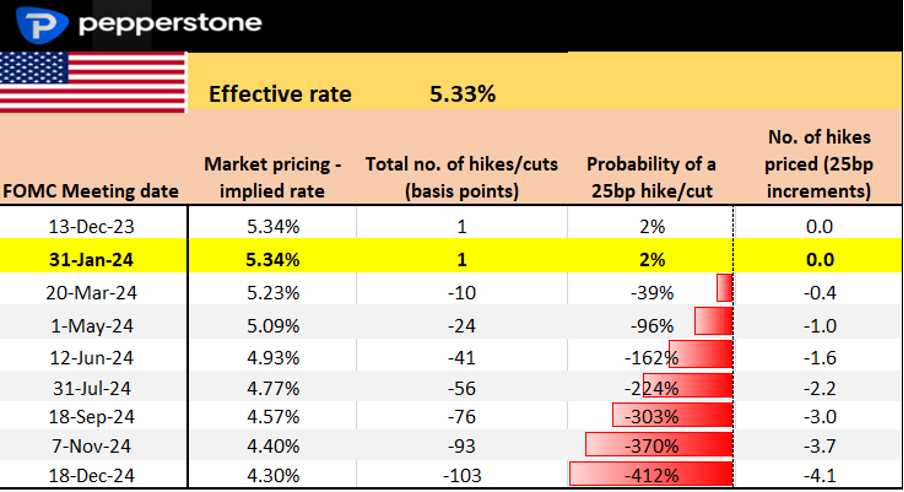

If we look at the US swaps pricing, we see the March FOMC meeting (a la 3 months’ time) pricing 9bp of cuts (or a 36% chance of a 25bp cut), May FOMC meeting at 25bp (100%) and June FOMC meeting at 39bp (or 1.5 cuts). Further out US SOFR futures are pricing 115bp of cuts in 2024.

Naturally, the US Treasury market has lit up, with huge buyers seen in the 2 & 5-year maturities, with the 5-year making new trend lows and eyeing a move into the 200-day MA at 4.12%. US real rates have broken down, and the market is making a statement that when US growth is cooling possibly to 0.5% by Q3 and with the US labour market likely to record average payrolls of 30-50k by Q224, the US doesn’t need real rates at 2.2%, and they should be closer to 1%-1.5%.

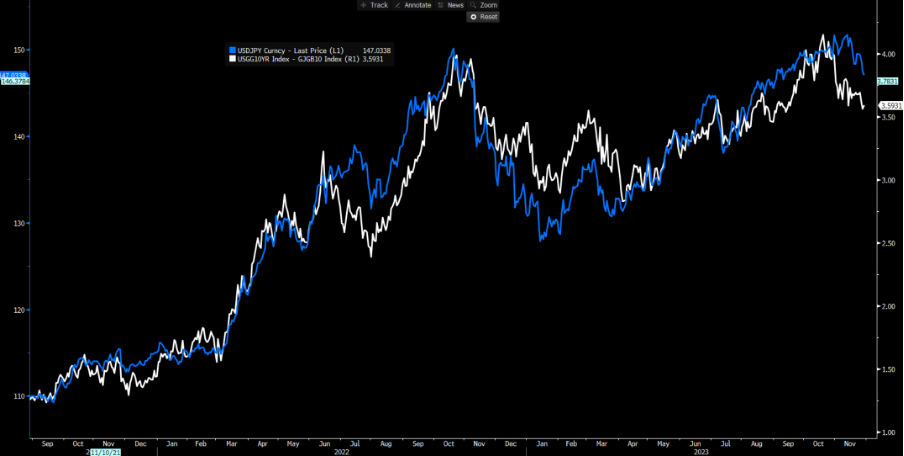

USDJPY vs US-JP 10yr yield differentials

Lower US bond yields, especially when seen relative to the yield on offer in European, UK, and Japanese bond markets have become relatively less attractive, and it’s this falling US yield premium that has smacked the USD.

We can also add in a poor 7-year US bond auction, as well as additional CTA (systematic trend followers) flow.

Waller has planted a seed that could set off a trend from other Fed member in their guidance - and while the market is positioned for cuts this is the first time a core member of the Fed has offered a clear pathway and credible timetable towards easing.

So we now start the obsession of data-watching again.

Next week’s US nonfarm payrolls (NFP) will therefore get huge attention, as the labour market is key to compelling rate cuts. The 3-month average NFP is currently 204k, so to get the 3m average below 200k, we’ll need to see a NFP print below 150k. This may be a tall order, but it is possible.

The unemployment rate is eyed to remain at 3.9%, but a lift to 4% would get the market talking as it would trigger the SAHM recession rule, although it's easy to be sceptical about its efficacy this time around.

On 13 November we get the November US CPI print, and many will recall the USD reaction to the October CPI print, which set off a wave of USD selling. The market will be expecting 0.1% mom headline CPI and 0.3% mom on core inflation, although we seem to be working to two decimal places these days. A core print below 0.25% would likely lead to USD selling, and one questions the possibility of a negative month-on-month print in headline CPI. From a pure semantics perspective, that would get the market talking.

From a risk perspective, with rate expectations so rich and after such a move in the broad USD we need to be cognisant that the USD will become very sensitive to any upside surprises in US economic data, which could trigger a wave of USD short covering.

With month-end flows still in play we may see further downside momentum in the USD, but many will be looking for a turn into December and positioned aggressively for a potential short-covering rally. However, to cause a lasting rally we will need to see USDCNH higher, and notably US bond yields rise at a faster clip than other sovereigns, and higher cross-asset volatility wouldn’t hurt either. That may hinge on the NFP and CPI report though, so these are dates for all trader's diaries.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.