Analysis

Trader thoughts - approaching big levels in USDCHF and the CHF crosses

I suspect this is the case because the CHF is moving but we’re approaching some key levels in a number of the CHF pairs – I’d also add that there is increased discussion on the role of the CHF and whether it has morphed from being an out-and-out funding/safe-haven currency to one driven more intently by cyclical forces, inflation and expected rate hikes.

We can look at the interest rates market and see the market toying with a further 50bp hike from the SNB at their next meeting (September). This would take them out of the negative interest rate regime.

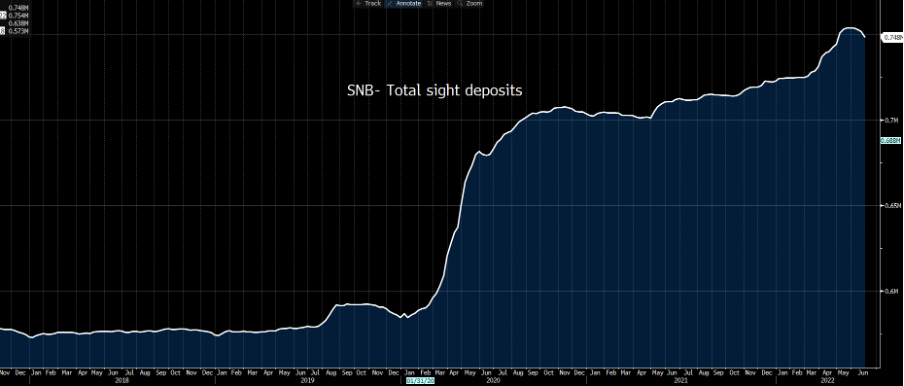

We’ve also seen a formal move away from the SNB buying foreign currency from commercial banks, which has resulted in a rise in the so-called ‘sight deposits’. Those sight deposits are now falling rapidly suggesting the opposite is true and the SNB is now buying CHF to support the currency – this was seen front and centre yesterday, where we saw total deposits fall by CHF 3.37b – the biggest fall since 2012. This is what many are coining ‘reverse currency wars’ – in an environment of high inflation, the race to a stronger currency is on.

(Source: Bloomberg - Past performance is not indicative of future performance.)

Before we get too carried away with SNB currency intervention we note that EURCHF is pushing parity, and the SNB will be looking at this cross rate above others. So, the need to aggressively buy CHF is reduced, and the idea of an aggressive and sustained fall in sight deposits is lowered.

The next big date for CHF traders is the 4 July, when we get Swiss June CPI and while there is no consensus on this yet, the probability is that it builds on the current rate of 2.9% and wears a 3-handle. This should lift the implied probability of another 50-bp hike.

Daily of USDCHF

(Source: TradingView - Past performance is not indicative of future performance.)

With the CHF finding the love, the trade to put on (with hindsight) has been long CHFJPY and that's trending well, although we’re seeing some consolidation in 142.00. NZDCHF has been the next weakest cross over the past month and again this is finding some support and consolidation after a powerful move from 0.6300. The set-up that is getting the most attention is USDCHF though – notably, we see a massive double top in play, with price consolidating into the neckline at 0.9544. If this gives way, the technical target is towards 0.9050, although given the implied volatility has settled down to 8.05%, a move of this magnitude may take time to evolve. One for the radar, if it isn’t already.

However, when it comes to big levels in trading, this is getting some airtime, especially with the wind to the CHF back.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.