Top 5 ETFs to trade as CFDs

Available to trade on the MT5 platform, and with the same commission structure as Share CFDs ($0.02 per share, per trade), these unique investment vehicles track the the performance of underlying market sectors, regions and exchanges, removing the hassle of individual stock picking when trading momentum in market thematics.

When trading ETFs it can be incredibly advantageous to follow the flow. As market conditions change, economic events occur and thematics play out, the success of an ETF is all down to capital inflows and outflows. We take a look at a few of the top ETFs to trade right now in terms of flow, current market thematics and volatility.

1) SPDR S&P Bank ETF

The SPDR S&P Bank ETF (KBE.P) attempts to replicate the performance of the S&P Banks Select Industry Index by investing in large, mid & small cap banks, asset managers, diversified financial service providers and mortgage companies.

Where the US yield curve (difference between 2s & 10s) steepens, banks tend to rally. Capital flows into the banking sector in incredible volumes. But it can be hard to put your eggs into one basket, and knowing which bank stocks to buy to take advantage of a banking sector on the rise can be tough. That’s why the SPDR S&P Bank ETF is a great option, providing the diversity many find appealing.

Instead of hedging your bets through JPM, Citibank, BOA and the like, you can go long on this banking sector ETF with some comfort of knowing that a poor performance from an individual stock during a period of uplift won’t put as much of a dent in the P&L.

You can see in the below graph that when the 10 yr yield has increased relative to the 2yr (yield curve steepening), the SPDR S&P Bank ETF has risen. More recently, where the curve has flattened and contracted, we see a period of consolidation and then depreciation in this banking sector ETF, especially since a recent rise in the 2yr.

2) VanEck Vectors Junior Gold Miners ETF

This ETF tracks the performance of about 100 small-cap gold and/or silver mining stocks, and seeks to mirror the performance of the MVIS Global Junior Gold Miners Index. It’s a global fund so you have country diversification, but it's heavily weighted towards Canadian, Australian and US miners.

One of the exciting things about this gold ETF is that it tracks small-cap stocks which are inherently more volatile than mid-large caps, and so its beta with the underlying gold market price (XAUUSD) is higher. That means when gold is moving, the VanEck Vectors Junior Gold Miners ETF is moving too, only faster.

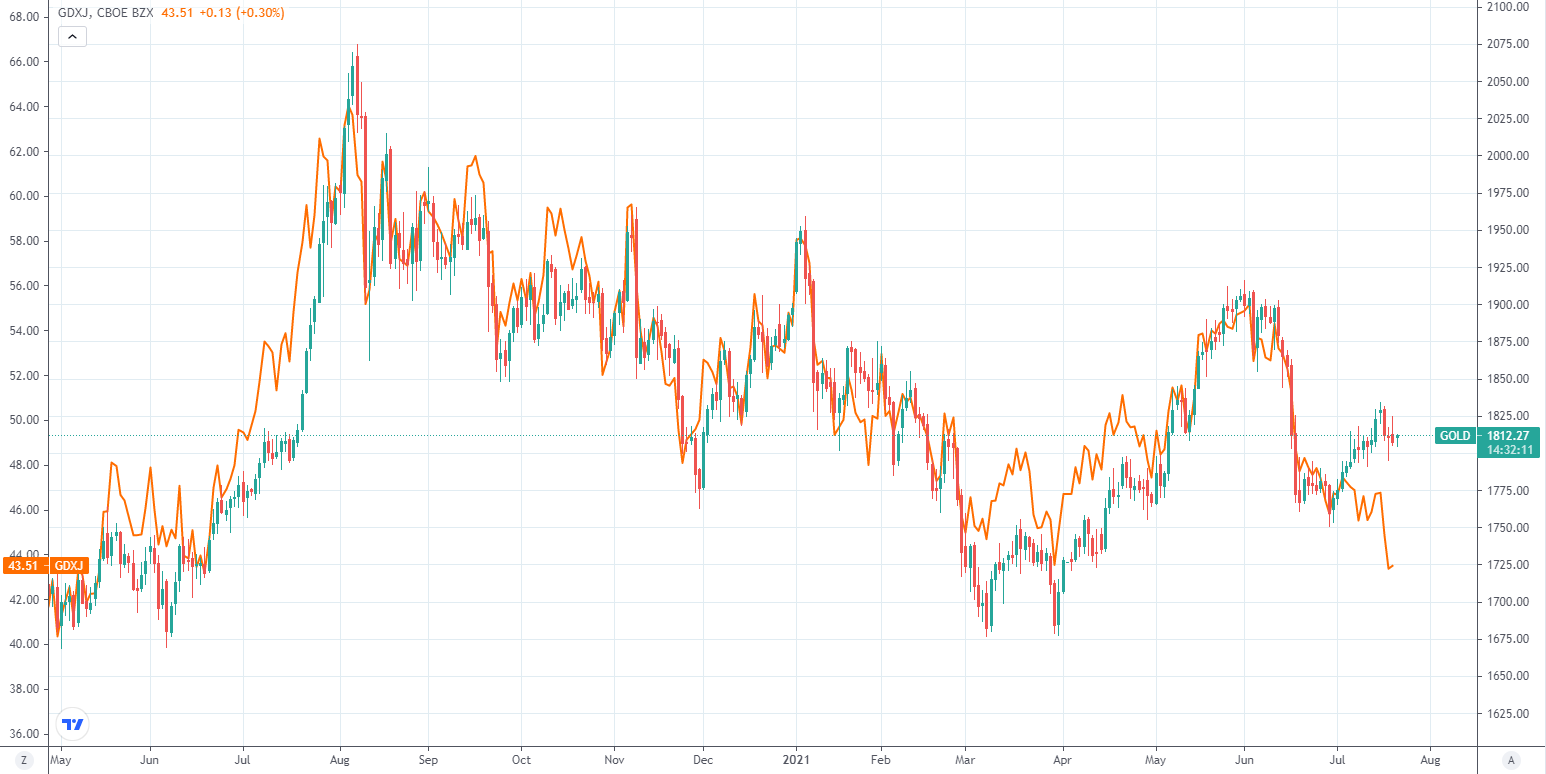

In the graph above you can see just how closely this ETF follows the price of gold, with the market price of the yellow metal being a major determinant of the success of these small mining companies. Where gold has a considerable bullish or bearish move, it's not uncommon to see the Junior Gold Miners ETF experience 2x the volatility.

We saw an example of this most recently in the June 2021 sell-off, where the price of gold fell by around 8%, and a 15% drop in the Junior Gold Miners ETF followed.

Similarly, amidst the strong push from the start of April 2021 to June 2021 where gold rallied from a low of ~$1680 to a high of ~$1910 (a 13.7% increase), we saw the VanEck Vectors Junior Gold Miners ETF jump from $43.5 to $55, a 26.4% increase.

If gold’s your play, consider trading this ETF.

3) SPDR S&P Pharmaceuticals ETF

The coronavirus has crippled global economies, sending billions of people into social isolation to prevent the spread, and an effective vaccine rollout is our only hope. Eyes have never been on big pharma as much as they are now, and that means trading opportunities in pharmaceuticals.

But which one do you pick? Moderna? Pfizer? AstraZeneca? Knowing which of these companies will come out on top and become the global leader in COVID-19 vaccines is incredibly difficult if you’re not a medical professional and aren’t in the know. Issues with vaccine supply and effectiveness make headlines daily. That’s where the SPDR S&P Pharmaceuticals ETF becomes such an interesting trading option.

This ETF tracks the performance of the healthcare and pharmaceuticals sector of the US stock market, investing in around 50 US companies. It’s down off it’s Feb 2021 high of around $56.30, but with a potential 3rd wave breaking out across continents, the SPDR S&P Pharmaceuticals ETF could see some solid appreciation as the likes of Pfizer, Johnson & Johnson and Moderna become so crucial in vaccine rollout to prevent further lockdowns.

If you’re looking for a play at stocks that have become the frontline of the COVID road to recovery, you might want to consider this ETF.

4) Energy Select Sector SPDR Fund

This energy fund is one to watch if you like trading oil and natural gas, or you want to get increased exposure to oil volatility. The SPDR S&P Oil & Gas Exploration & Production ETF looks to provide returns similar to that of the oil and gas exploration, refinement and production segment of the S&P TMI. It includes companies like Exxon Mobil, ConocoPhillips & Chevron, giants in the US oil and gas industry.

Oil has been on a tear since late October 2020 where it increased in price from a low of about $36 to a high of around $75 in mid July 2021 (108%). Over the same period, the SPDR S&P Oil & Gas Exploration & Production ETF rose from its swing low of around $39 to a recent high of $100 in early July 2021. That’s a significant increase of 156%, almost 50% greater than the underlying crude oil price.

This tells us that when crude prices are on the rise, this ETF will be climbing even higher. Similarly, when crude sells off, the ETF will take an even greater hit. This relationship gives a trader greater exposure to the price of crude, with the option to both long and short the ETF and get greater range in terms of % price moves.

5) ARK ETF Trust - ARK Innovation ETF

This is a very interesting ETF, not only because it tracks companies that provide “technologically enabled new products and services that change the way the world works”, but it's actively managed and experiences some serious volatility. That can mean opportunity.

Some major names in this 50 company holding are Tesla, Shopify, Zoom, Coinbase, Spotify & Twitter, all household names that are innovators and creators in different fields. But what is often cited as a major point of concern for this ETF is that it holds considerable portions of some of the smaller tech companies it’s invested in. This means one thing: liquidity issues.

If the ARK Innovation ETF sees significant fund outflows, it has to sell part of its stake in these smaller companies to fund withdrawals. With about 20 or so companies that are at least 10% owned by the ARK Innovation ETF, that means significant sell offs in the stocks it's invested in. With such downside risk, it creates a great shorting opportunity on the CFD.

You can see from the graph above just how volatile ARK has been since the start of the year. It’s gone through significant bullish and bearish periods, all while the S&P500 continued on a steady bullish trend with some short term retracements and sell offs. It gained almost 60% from November 2020 to mid Feb 2021, and fell about 35% from its high of $160 in February to around $100 in mid May. Another 30% bullish run followed that too.

When you’re trading CFDs, volatility is the key. And with the ARK Innovation ETF, volatility is what you get.

Trade ETF CFDs with Pepperstone

If you're ready to trade ETF CFDs today, or you want to practice on a demo account in a simulated trading environment, sign up for an account today. Our award winning Support team is available 24/7 to assist you with your account and trading queries.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.