- English

- عربي

On my week ahead video, I looked at weekly implied volatility in G10 FX and other heavily traded instruments. Where everything at that time looked calm and collected. Shockingly, GBP vols have rocketed higher from here and I wanted to highlight this to traders, as the market is now saying the UK election this week is a genuine event risk. Well, we all knew that, but now the options market is crying out that things have just got real and Thursday night (Friday day session in Asia) could be a volatility event.

Timings to concern yourself with

In terms of the election itself, polling stations open across Britain on Thursday from 07:00GMT and close at 22:00 GMT (18:00AEDT to 09:00AEDT Friday), with exit polls expected to be seen shortly after. We should hear from Sunderland as the first result off the rank and that should be released sometime around 00:00GMT (Friday at 11:00AEDT).

The period then between 00:00GMT and 03:00GMT, or what is the late morning trading session in Asia (Friday), could be quite lively for the GBP and to an extent, the FTSE 100. It is expected we will know the result of the election by 03:00GMT (14:00AEDT). There are a number of key battlegrounds and marginal seats which will be influential, and the outcomes of these seats could cause sudden and rapid moves in UK assets.

Current UK election expectations

Firstly, the outcome from tonight’s YouGov MRP poll (due out at 22:00GMT/09:00AEDT tomorrow) could be quite influential, as this should go some way to cementing and re-assessing expectations around the current Tory majority, where recent polling gives them a 10-percentage point lead. Most would consider anything over 5-ppt as a big enough cushion to avoid a hung parliament.

If we look at the betting sites, they have the Conservative party gaining 348 seats, which would be 28 more than the 320 required to gain a majority. On the Betfair exchange, the market is pricing a 59.5% chance of the Tories getting 340 seats (or more), with the next highest probability being 330-339 seats, where we see a 16% probability.

Basic UK election playbook

Given polling and betting market expectations, which we can then extrapolate into GBP price action and the recent run of form in the GBP, I have devised a very simplistic playbook for the day. (Please don’t take this as a political view):

- Conservatives get 340 seats or more – GBP rallies 0.5% to 1%, with gains likely seen in our UK100 index on the idea of a ‘strong’ government, and a potential return of business confidence. While hung parliament hedges are unwound, although this outcome, in theory, is largely discounted

- Conservatives get 320-330 seats – GBP falls 0.5% or so, on the idea that Johnson may find it problematic extending the ‘Transition Period’ past the deadline of end-2020, that is, assuming he passes his recent EU deal through the Commons

- Hung parliament (Conservative get 319 seats or less) – This outcome really can’t be ruled out and is a material risk for GBP and UK100 longs. GBP will find strong selling activity here, given the uncertainty in the period ahead, where the number of Tory seats will dictate the sell-off as traders look at the probability of Johnson forming a coalition with the Brexit Party

- Look for small weakness here in the EUR, with GER30 and FRA40 following moves in the UK100

- Gold may see modest gains here, although the big event risk for gold is whether or not the 15% tariffs on $160b of Chinese exports (to the US) are actually implemented

- A Labour victory – Given betting sites give Labour around 225 seats, it would be a huge shock for Corbyn to get a majority and would almost certainly cause a meltdown in the GBP and the UK100. However, it is not out of the realms of possibility but would need to see a hung parliament first.

Other trading considerations

If I look at market positioning, leveraged traders have reduced GBP shorts and are currently running a flat net position. Although, if we take the pool of players out, GBP shorts held by non-commercial accounts are still held short to the tune of 30k contracts.

We should consider the anticipated move in GBP through the event and coming 5-days. Here we see GBPUSD 1-week implied volatility (vol) at 17.7%, which if we remove the spike we saw during the Brexit referendum, vols are clearly at the top percentile. The options market is pricing a move in GBPUSD.

To quantify this, we can use this implied vol structure and see the market pricing (with a 68.2% level of confidence) a weekly move (up or down) of 298-pips in GBPUSD, or 251-pips by the 13 December expiry. That is clearly a punchy move for some, and therefore if that doesn’t suit your strategy it is a risk that should be looked at. Of course, other traders love higher vol periods.

I can take the expectations and see that the market sees an 80% level of confidence that GBPUSD should be contained within a range of 1.3548 and 1.2639 – although that would be seen as an extreme move.

It's not just GBPUSD, but here we see GBP 1-week implied volatility against other major currencies. GBPJPY is the one the market really sees the potential for fireworks.

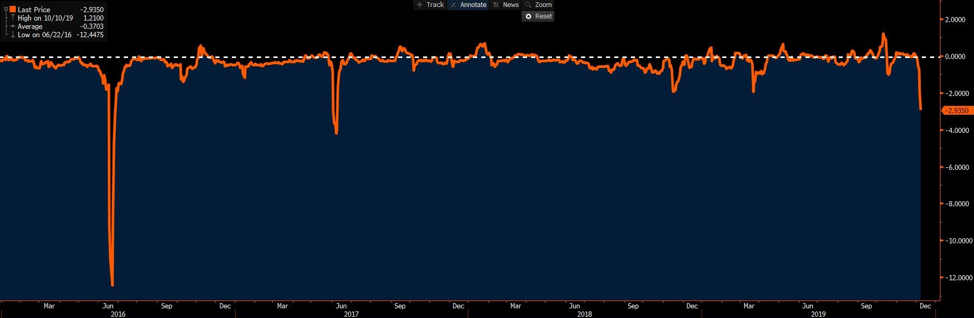

GBPUSD 1-week risk reversals – Risk reversal look at the skew or the difference between call and put 1-week implied volatility. If this number is negative like it is in GBPUSD (at -2.9), then we know put volatility is higher than call volatility, so the demand for downside options is relatively higher than the upside. While we are not seeing this play through in GBPUSD spot, it appears that traders have sensed the risk of a hung parliament and used cheap put options to hedge this risk.

Consider the risk around the event and chose whether this risk event is one you want to be involved with. Do focus on your account dynamics and adequate funding if holding positions over the event.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.