S&P500 and NAS100 futures held firm through Asia, but the sellers started to get the upper hand through European trade, with the selling flows accelerating mid-way through US trade. A break above $80 in Brent crude was a trigger to de-risk portfolios, with the market more on edge than ever for imminent market-moving news, as the aggression in the rhetoric increases, in turn, lifting the probability that Iranian crude output could be affected. Talk of systematic players aligning with the evolving bullish trend and adding to long crude futures positions is also adding to the upside tailwinds.

The intraday tape of the S&P500 shows the sellers in control for most of the equity cash session, with the index closing close to session lows. 80% of S&P500 stocks closed lower, with only the energy sector closing in the green. Within the MAG7 plays, Nvidia closed 2.2% higher, but we’ve seen solid declines in Amazon, Apple, Tesla, and Alphabet.

The hedging flows have once again picked up with the VIX index rising to 22.6%, and 1-month S&P500 put volatility pushing to a 7 vol premium to 1-month calls. 1.72m S&P500 puts traded on the day vs 1.24m S&P500 calls. A highlight in the options space was a big buying in S&P500 5700 0DTE puts(zero days to expiry), where 79k lots were traded on the day and given where the S&P500 settled (at 5695), many taking that downside bet would have done well on the day. For index traders, we can see that the options market not only played a factor in driving the S&P500 futures lower, but it also talks about semantics on an intraday basis.

Clearly, this was a night where the bears took the upper hand in the daily battle of supply vs demand, although the war in markets rages on, and for now the macro backdrop is still net supportive of further upside potential. That said, like many, the ability to react and alter one’s view given evolving price action, volatility and broad trading environment is key for short-termism. With that in mind, should we see S&P500 futures break below the recent consolidation lows of 5725.75, with the VIX rising towards 30%, and notably if Brent crude were to continue headed towards and above $85/87, then that would have big implications for how I see the directional risk in markets and considerations on positions sizing.

In FX markets, we see a mixed reaction within the USD flows. We’ve seen better selling flows in the pro-cyclical currencies – COP, NZD, AUD, and CAD, while the funding currencies and the traditional safe-haven plays – CHF, JPY and CNH have outperformed, as one may expect in a nervous, higher volatility market. If crude is our central guide on the unfolding geopolitical news flow, then the CHF would be the default FX hedge to offset that, and so EURCHF or NZDCHF shorts seem attractive. With Europe likely to be more negatively impacted by higher oil prices, and with EU economics already relatively shaky, EURCHF shorts are clearly one for the radar.

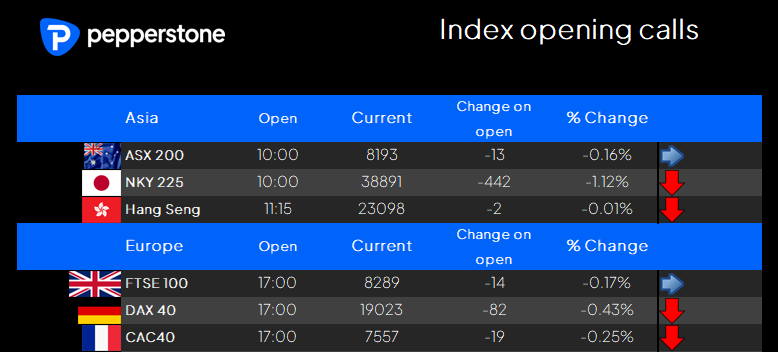

Turning to Asia, our opening equity calls suggest the HK50 and ASX200 hold up well on open, with flat moves expected, while the NKY225 should open 1% lower. We take in a poor lead from Wall Street, and heightened anxiety on the geopolitical headline front, where the clear risk that could come from any imminent headlines is skewed towards higher crude levels.

We also look at how markets digest today's press conference at 10 am local (13:00 AEDT) from the National Development and Reform Commission (NDRC) in China, where we’ll hear more on the intentions around the anticipated fiscal rollout – whether the full suite of measures are announced today is yet to be seen, but the market is expecting bold action with a total fiscal package north of RMB2t. With expectations elevated, notably after such a blistering run in China/HK equity, the risk of disappointment is therefore also elevated, although the government agencies would be aware of that. Let’s see if they can deliver vs expectations.

Good luck to all.

Subscribe to The Daily Fix

Get up-to-the-minute market news and all the economic data you need to place informed trades before the European session opens.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.