- English

- عربي

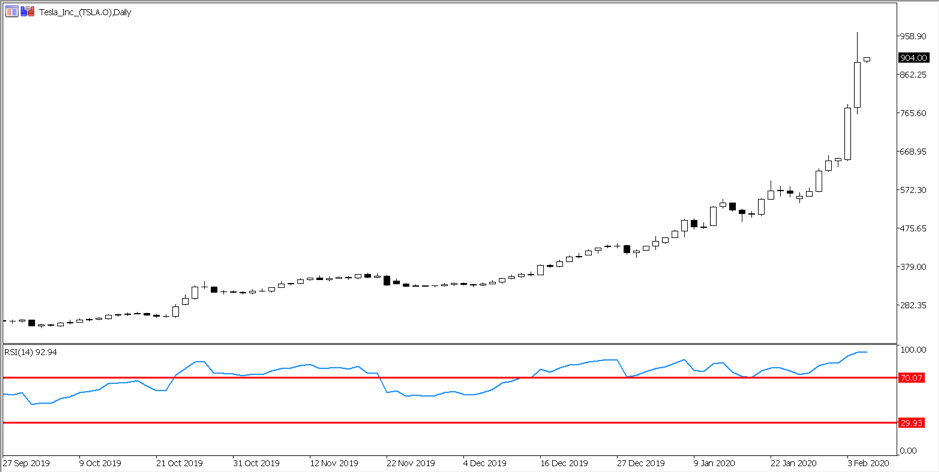

You rarely get a stock with a market cap of over $100bn undergoing a parabolic move.

Not only has Tesla moved with such genuine ferocity, but on Tuesday, we saw some 60 million shares traded, taking the value traded on the day to five times that of Apple’s turnover. Apple is a company worth nearly nine times that of Tesla.

What we’ve seen on social media has been a frenzied and sometimes heated debate.

There’s been a collapse in short interest, where on the last read (15 January) short interest as a percentage of the free float stood at 17%. Given the stock has gained a further 70% since the 15th, one could suspect that level of short interest is presumably now well below 10% and the recent rally has been positively affected by a giant short squeeze.

So where are we now?

The bear case

To the Tesla cynics, the rally has diverged from any kind of commercial reality, understanding that at this juncture Battery Electric Vehicle (BEV) sales are still just 2% of the global auto production. And, while Tesla’s earnings profile is indeed improving, we’re still looking at a company with worrying free cash burn, very high debt and a huge reliance on the capital markets for funding. To these players taking short positions with Pepperstone into $900 makes sense, their conviction aided by the fact so many technical factors suggest the move has gone too hard too fast.

The bull case

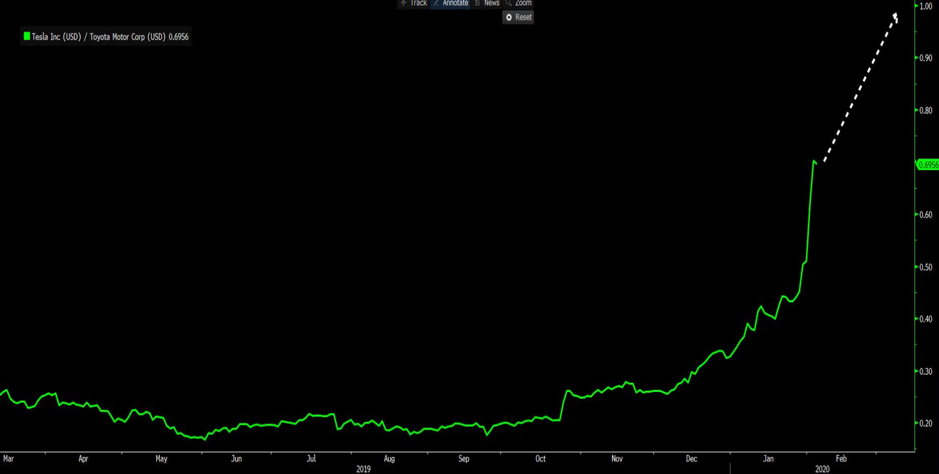

To others, this juggernaut is on a one-way ticket through $1000, with price targets emerging in excess of $7000. The bulls will point out that those looking at valuation, especially in contrast to the wider auto sector is flawed and that Tesla should be considered a tech company. If this bull trend continues it seems a matter of time that Tesla’s market cap surpasses that of Toyota – the world’s biggest listed auto-company, and that will confirm that the market sees Tesla as a tech company.

The ratio of Tesla’ market cap to Toyota - both priced in USDs

Source: Bloomberg

So, it's a tech company?

If you think of Tesla as a tech company, you can certainly consider the valuation in a different light: where having a high multiple, increasing CAPEX and cash flow burn is consistent with all the great tech plays.

Up, up and away

Investors are buying into the concept of Elon Musk revolutionising the way we not only think about our driving experience, but how we envisage space travel.

Whether you’re bullish or bearish on Tesla, join in this fascinating debate. Express a view and take a position. Trade Tesla as a CFD with us today.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.