Resilient Retail Sales Pose Latest Risk To Dovish Fed Outlook

At a headline level, sales rose 0.6% MoM in December, double the 0.3% pace seen a month prior, and the fastest monthly increase in four months, while beating consensus for the sixth straight month.

The ‘core’ measures of the sales report were also promising, and surprised to the upside. Excluding autos, sales rose 0.4% MoM, again double the pace seen in the prior month, and also the most rapid rise since last September. Of more importance, as usual, is the ‘control group’ sales measure, which is used as the basket of goods that feeds directly into the GDP report. Control group sales rose 0.8% on the month, four times more than consensus had expected, and the fastest pace since last July, posing an upside risk to current forecasts for Q4 23 GDP growth, which is currently seen at an annualised pace of around 2%.

Digging further into the data, one can see that the sharp rise in sales was broad-based, with only gasoline and personal health sales acting as a drag on the overall figure, and the decline in gasoline sales being half that seen in the November data.

This modest decrease in gasoline sales speaks to a quirk of the retail sales report in its entirety, in that the data measures nominal spending, not being adjusted for inflation. Consequently, the decrease in gasoline spending likely speaks more to the continued fall in fuel prices over the back end of 2023.

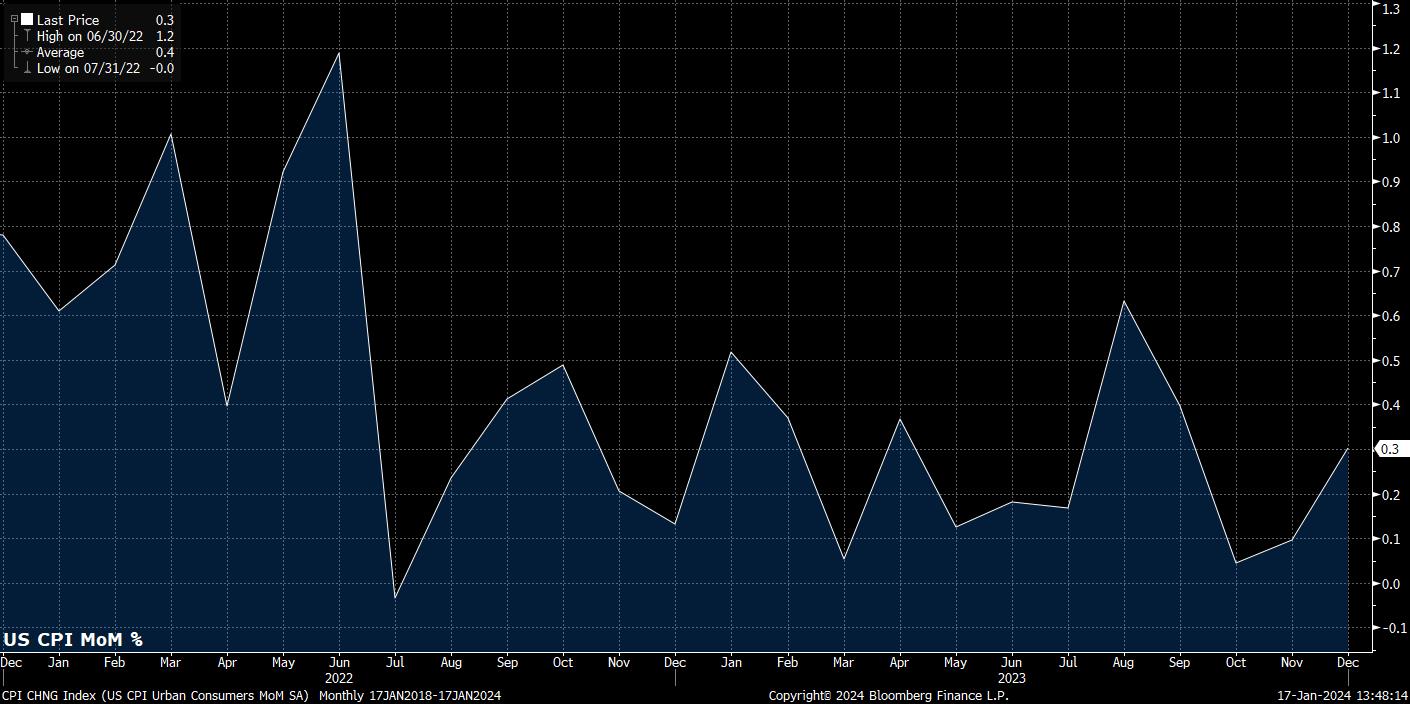

Those of a ‘glass half full’ disposition may say that the opposite is true for the headline sales beat, in that much of the increased spending was driven by the modest uptick in CPI in the month of December, where headline inflation ticked up to a 3.4% annual rate, rising 0.3% MoM, the biggest such increase since September.

It seems, however, over-the-top to pin the entire sales beat on inflationary factors, with the data significantly more likely to be speaking to the ongoing resilience and strength of the US consumer, which continues to benefit from the incredibly tight labour market, having largely weathered the storm of the Fed’s tightening cycle thus far.

On the subject of the Fed, the strong sales report should serve as another reminder that markets have become rather too aggressive in terms of pricing near-term rate cuts, following December’s impressive labour market report, continued disinflation in core CPI, and Governor Waller’s recent remarks which, implicitly, pushed back on the idea of rates being cut as soon as two months’ time.

While the data did result in a modest hawkish repricing of policy expectations, with around 5bp of cuts priced out over the course of the year ahead, and the chances of a March cut having slipped from 62% pre-release, to just under 60% now, the market still appears priced too dovishly for what policymakers are likely to deliver.

Of course, incoming releases will continue to be closely watched as markets continue to second-guess the policy outlook, with the next top-tier print coming in the form of the first estimate of fourth quarter GDP in just over a week’s time. Were that to also beat expectations, one would expect a further hawkish repricing to take place, posing an upside risk to the greenback, and a further downside risk to both equities and Treasuries – though, the long-end is soon likely to begin to offer increasing value, particularly once the easing cycle has begun, and if economic momentum does eventually begin to wane.

_d_2024-01-17_13-49-01.jpg)

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.