- English

- عربي

RBA meeting preview - when will the RBA move towards market pricing?

As always, there's many moving parts, but could the RBA deliver a surprise?

Here are a few core considerations.

- Rates pricing – There is currently a 0% chance of a hike for this meeting, but we see 170bp (6.8 hikes) priced for end-2022 and 320bp (c. 13 hikes) for end-2023.

- Interest rate markets are pricing the first hike and lift-off for the June meeting, although the case for a 15bp hike earlier to get the cash rate to 25bp has risen – will the RBA statement go anyway to meet these expectations

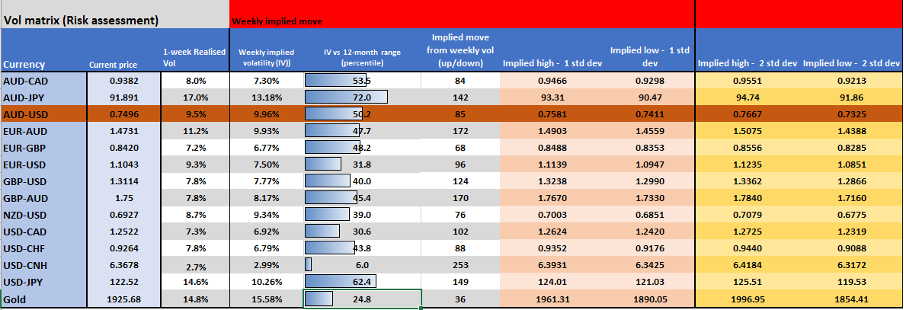

- AUDUSD 1-week implied vol at 9.96% (from Friday’s close) - this is the 50th percentile of the 12-month range – the implied move over the week is 86-pips – this suggests a trading range of 0.7581 to 0.7411 (with a 68.2% level of confidence) and 0.7667 to 0.7325 (95% level of confidence). Whilst there are obviously other drivers, the market is not expecting any glaring surprises from this meeting – could they be proved wrong?

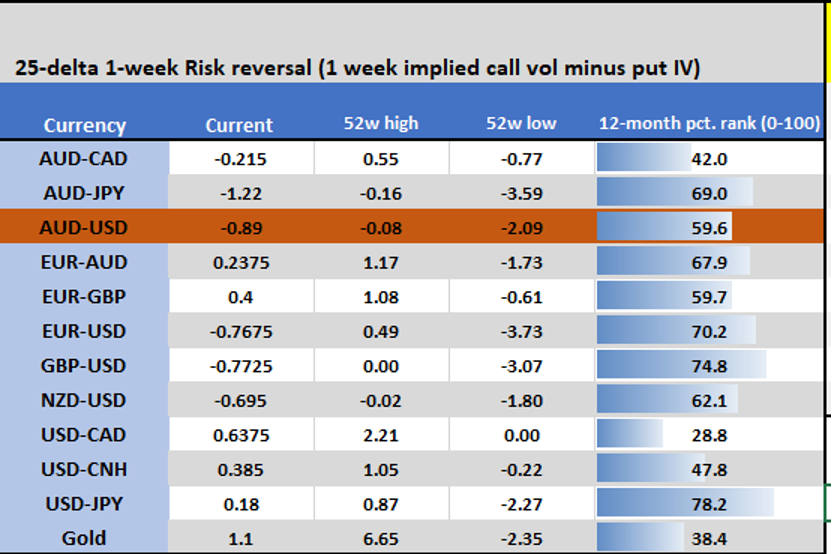

- AUDUSD 1-week call volatility trades at a 0.89 discount to 1-week put vol – this skew is the 59th percentile of the 12-month range – on balance, the market feels if there is a move the risks are symmetrical.

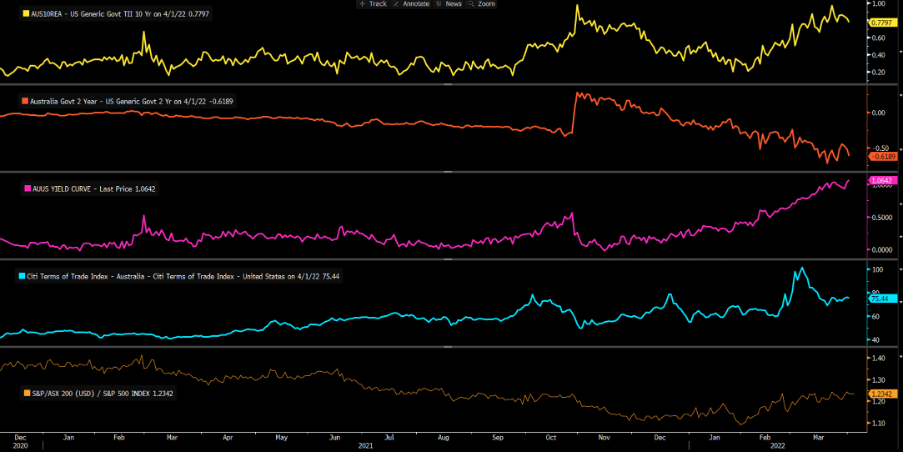

Fundamentals supporting the USD - AUDUSD 6 and 12-month forward rates sit at 26 and 44 points respectively – so carry on rolling forward rates modestly favours USD longs. We also see US 2 year Treasury yields commanding a 62bp premium over Aussie 2yr bonds.

Supporting the AUD - AUD terms of trade are moving higher vs US ToT. We also see a steeper relative Aussie curve and Aus 10yr real yields hold a 77bp premium to US 10yr real rates.

The ASX200 is also outperforming the S&P 500 (currency hedged).

Technicals - On the daily price holds a short-term consolidation range of 0.7540 to 0.7457 – which way does it break? An upside break suggests a potential target of 0.7683 (138% fibo extension of 0.7165 to 0.7540 rally).

Positioning – retail traders are skewed short AUDUSD (we see 73% of all open positions held short, 74% on AUDJPY) – on the CFTC report, leveraged funds hold a 25,878-contract short position, asset managers are short 2,574 contracts but have been reducing short – so retail, leveraged and real money all still structurally short AUD.

Other key Aussie events for the dairy – RBA financial stability report (8 April), Aussie employment report (4 April), Q1 CPI (27 April), May RBA meeting (3 May), Q1 wage price index (18 May), Federal election

At some stage the RBA seem destined to move towards the market – could it be this meeting?

Implied volatility matrix

(Source: Pepperstone - Past performance is not indicative of future performance.)

1 week implied call volume

(Source: Pepperstone - Past performance is not indicative of future performance.)

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.