- English

- عربي

We see a 60% chance of a hike priced into interest rate futures, with the market having a high conviction that if they don’t hike next week then they will almost certainly in December. 21 of 24 economists (surveyed by Bloomberg) are calling for the hike.

The doves do have a case for the RBA keeping rates on hold, but the case to hike seems stronger., with Aussie economic data consistently beating expectations since early October. This should culminate in the RBA increasing its inflation forecasts for Dec-23 and June-24 by 25bp, with its trimmed mean CPI estimate likely revised higher by around 50bp. Given Q2 GDP came in 50bp above the RBA’s forecasts we should see its growth measures increase as well.

One can argue that leaving rates on hold would risk the bank being seen as getting behind the inflation curve, and we can see market pricing of 5-year inflation expectations rising to 2.81% - approaching the highest levels since 2011.

Some have also focused on Treasurer Jim Chalmers recent comments that the Q3 CPI print did not represent a “material” worsening in the inflation outlook, and by leaving rates on hold it could be seen as a sign of reduced central bank independence.

The RBA to review the stress on households

We can look ahead to the upcoming bank earnings reports with WBC (6 Nov), NAB (9 Nov) and ANZ (13 Nov) and review their asset quality given lending rates have increased so rapidly. In the prior trading updates, there was no clear evidence that borrowers were facing broad difficulties. In fact, projections that total scheduled P&I payments will push to 9.75% of household disposable income in 2024, suggest servicing this debt is still manageable. We also see over 40% of households are ahead on mortgage payments and have enough savings to cushion a further increase.

In terms of volumes, APRA’s September lending data showed total gross loans and advances grew 0.7% m/m in September, with household lending growth +0.3% m/m and business growth +1.2% m/m. Credit card volumes increased 1.2%. And with house prices still on the rise, these are factors that will lean the RBA towards a hike.

The RBA will be cognisant of the impact a further lift in the cash rate will have on households and businesses – but while some will be negatively impacted and undergo real stress, on the whole borrowers should be able to readily absorb more hikes.

Trading the RBA meeting

Given market expectations and pricing, should the RBA leave rates on hold but retain a hawkish bias, then we should see the AUDUSD drop 50 pips or so off the bat, with a solid rally likely seen in the AUS200.

With the base case being we see a 25bp hike while maintaining a tightening bias, then all things being equal the AUD should find good buyers, with AUDUSD spiking 30-40 pips.

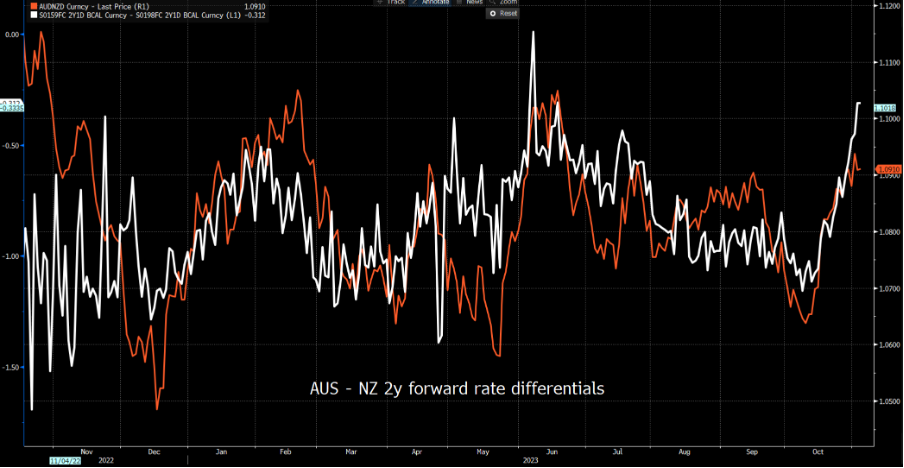

AUDNZD has been the most sensitive to interest rate differentials, as we see here in the AUS-NZ 2-year forward rate differentials. If the RBA hike and imply more then AUDNZD should break the recent highs of 1.0940. In fact, on a simple rates model the AUDNZD cross should be trading closer to 1.1050.

AUDUSD is more of a risk proxy than a rates play, taking direction from S&P500 futures and the HK50 index, but the setup is looking more compelling for longs. I prefer to play this from a momentum standpoint and wait for the close above 0.6445, for a potential move into 0.6600.

EURAUD, AUDCHF and AUDJPY are also risk proxies and have a good relationship with the VIX index. Granted, if the RBA hikes, then we will likely see a pop in the AUD, but after a short period traders will revert to taking its direction from S&P500 futures and cross-asset volatility.

Implied movement

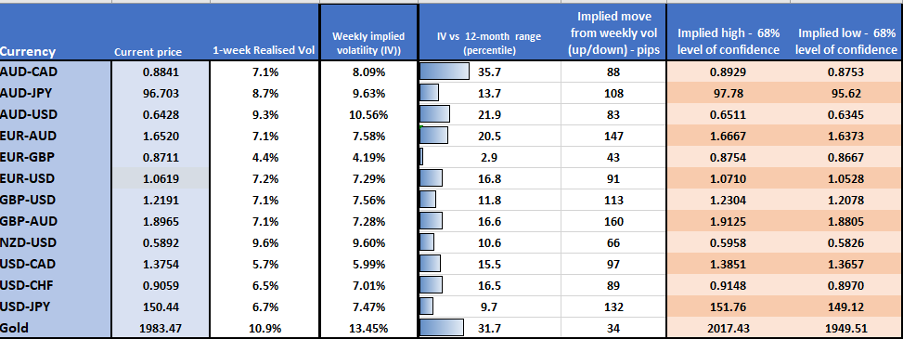

Looking at AUD 1-week implied (option) volatility (vol) we see vols are not showing any real signs option market makers are expecting a significant change in the trading conditions next week. That said, given the split pricing for Tuesday, we could see some rapid-fire moves around the announcement and that is a risk traders need to manage.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.