- English

- عربي

Austria

Beginning with Austria, where the new equity listings all trade on one of the world’s oldest exchanges, with the Vienna Stock Exchange having been founded in 1771.

Among the new listings are Erste Bank, one of the largest financial services providers in central and eastern Europe, and currently the best performing stock in the benchmark ATX index on a YTD basis, having recently touched a new 52-week high, advancing around 9% already in 2024, continuing the strong upside momentum seen through the latter stages of last year.

Netherlands

Meanwhile, in The Netherlands, one of Europe’s largest, and in fact the world’s most important, companies stands as the most notable listing. This is, of course, semiconductor manufacturer ASML, not only the world’s largest supplier to the semiconductor industry, but also the sole global supplier of specialised EUV (extreme ultraviolet lithography) photolithography machines which are required in the manufacturing of the world’s most advanced and cutting-edge computer chips.

While the stock has, unsurprisingly, soared of late, benefitting from the ongoing AI frenzy sparking a surge in demand, as well as strength in the broader tech sector as a whole, ASML is increasingly the focus of political and geopolitical tensions. Export restrictions on ASML equipment continue to tighten on Dutch national security grounds, as western nations continue in attempts to prevent China stealing ASML technology and information.

Elsewhere, on the Amsterdam market, Stellantis – the world’s fourth largest automaker – are notable, having been formed via a merger of Fiat Chrysler and French-owned PSA Group in early-2021. Other notable names include Europe’s number-one brewer by production volume Heineken, the largest Dutch bank by assets ING, and the biggest music company in the world, record label Universal Music Group.

Spain

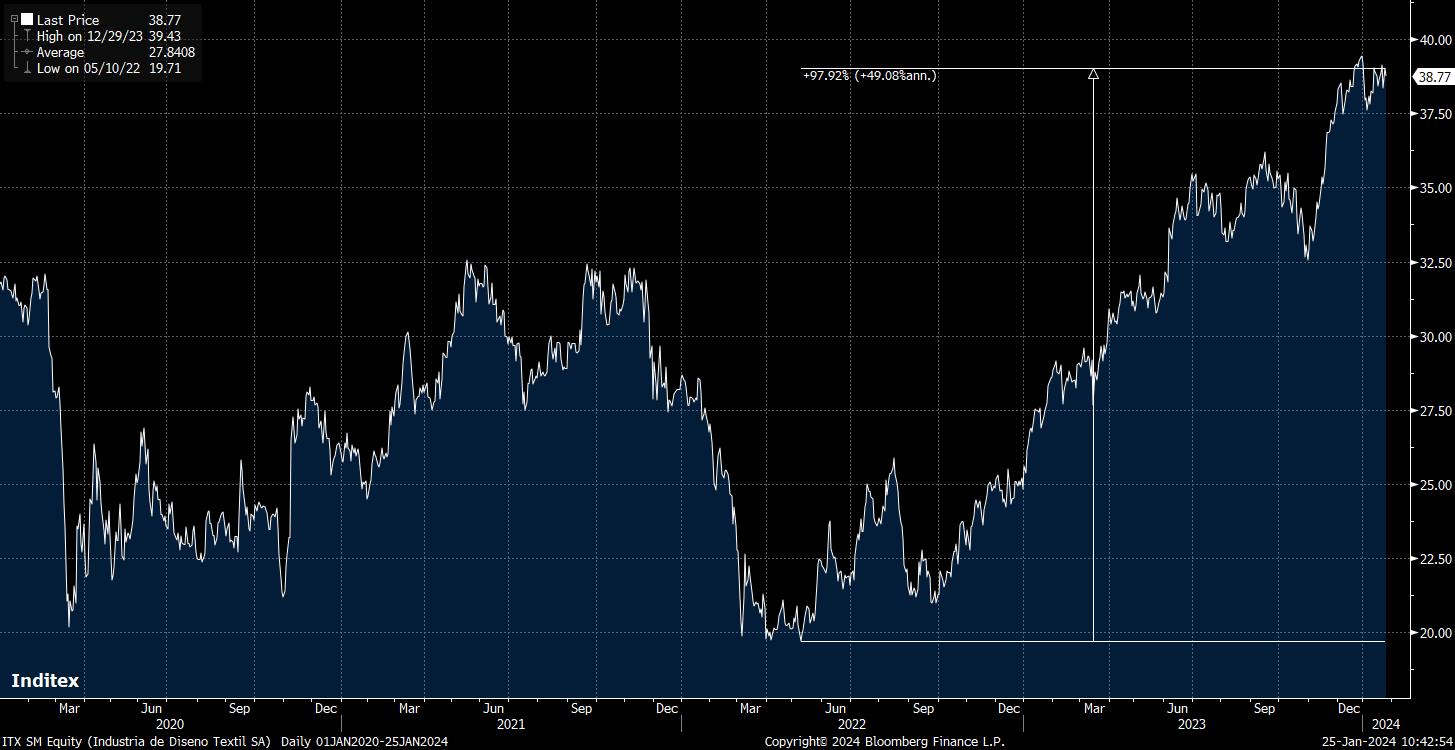

Finally, we turn to Spain. By market cap, the largest stock in Pepperstone’s new equity offering is Inditex (formally known as Industria de Diseno Textil), owner of numerous well-known fashion brands including Zara, Bershka, Stradivarius, Pull & Bear, and Massimo Dutti.

Founded in 1975, by Amancio Ortega, the stock has performed well over the last 18 months or so, rallying almost 100% from the lows printed in mid-2022, despite having reported a slowdown in sales growth in the third quarter of last year, as earnings fell short of market expectations. This flags a significant risk to the stock, and the retail sector more broadly moving into 2024, as consumer sentiment remains relatively shaky, and waning economic momentum may continue to result in an increased level of restraint in terms of discretionary spending.

Financials, meanwhile, are also well-represented among the newly available equities, including Spain’s largest bank by assets, and G-SIB, Banco Santander, in addition to the 2nd and 3rd largest banking institutions in the nation, BBVA and Caixabank.

Other intriguing equities include Telefonica, currently involved in something of a tug-of-war between the Spanish government and Saudi-based investment groups; energy and petrochemical giant Repsol, who operate across all areas of the oil & gas industry; and, last but by no means least, travel technology firm Amadeus, whose near-term fortunes will continue to be tied closely to the continued to the continued post-pandemic recovery in the travel sector.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.