- English

- عربي

December 2024 Market Insights: Key Risks, Central Bank Moves, and Trading Strategies

Setting a precedent to what lies ahead, Trump has raised his tariff game even further with his weekend post threatening 100% tariffs on BRICS nations that continue to push for a replacement for the USD. A somewhat perplexing target for tariffs, but I’m hesitant to think this rhetoric sees an immediately impact on the USD - but it certainly showcases that Trump is fine with weaponizing the USD and using tariffs liberally and at any time.

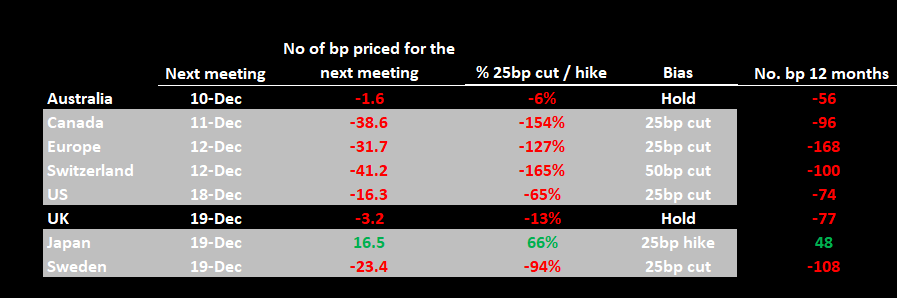

Gauging the upcoming policy shifts from G10 central banks

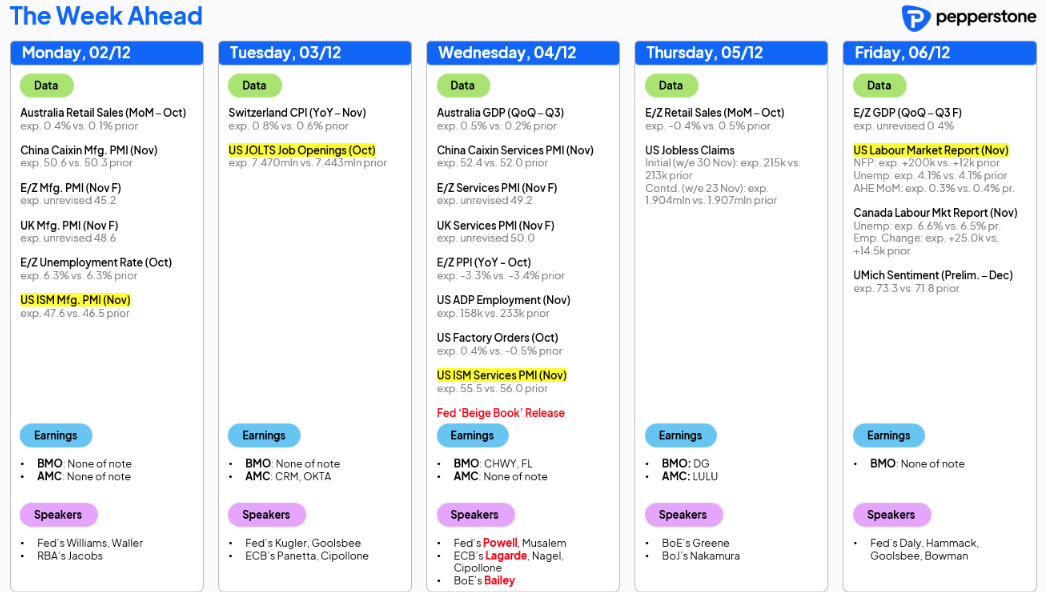

Looking at the calendar for the week ahead, we see a number of important data points that will massage market expectations around the potential policy actions from the 8 G10 central bank meetings between 11-19 December. Looking at current market pricing we see that in six of these rates/swaps traders are torn on the potential outcome for policy change. Subsequently, the market requires new data and/or central banker guidance to really increase conviction levels.

Typically, when we see the market split on an interest rate decision, it can often lead to increased volatility in the respective currency and even on a cross-asset basis.

As can we this pricing in the graphic, there is indecision as to the next move from the Fed, BoC, SNB, ECB, BoJ and Riksbank. The BoJ is offered a 66% chance of a 25bp hike 25bp on 19 December. The market is also yet to be fully convinced that the Fed cut rates at the upcoming FOMC meeting (also on 19 December), with current pricing in US interest rates swaps implying a 65% chance of a cut. The BoC, SNB and ECB meetings also interest, as we see a healthy debate between a 25bp vs 50bp cut – suggesting increasing volatility in the CAD, CHF, and EUR.

Reduced liquidity will be a factor as we roll through the month, but so could a potential performance chase from active managers (to beat their set benchmark) with end-of-year rebalancing flows also due to impact – when these dynamics reconcile with uncertainty as to various central banks next move, anyone hoping for a quiet last month of the calendar year may be disappointed.

The key event risks to navigate this week

Much of the attention will fall on the week’s US economic data flow and how it could influence the Fed’s thinking. There is a whole list of US data points that could rock markets, notably should we see an outcome that deviates significantly from the consensus, but the data points which hold the greatest possibility of moving the dial are the ISM manufacturing, ISM services, and the nonfarm payrolls print.

The prospect of negative USD returns in December have increased and given what’s priced (in the interest rates table) and the fact that there is a higher risk that the Fed cut by 25bp, as does the ECB, with the BoJ a real chance of hiking by 25bp, tactical shorts in the USD seem compelling.

USD bulls will want to see the ISM manufacturing reports push towards and even above the 50 expansionary read – they will also want to see the various US labour market reads show improvement and stave off any signs of further signs of cooling.

US nonfarm payrolls is the marquee event risk for the week

Naturally, it’s the US nonfarm payrolls (NFP) which will get the greatest level of attention. The economist’s consensus is for 200k jobs to have been created in November, with the range of estimates seen between 270k and 155k – a potentially healthy snapback after the weather and strike impacted October print (of 12k jobs).

While next week’s US CPI print will also be an important input, an NFP print above 230k-250k, with the unemployment rate unchanged at 4.1%, will have some questioning if the Fed should cut rates at all in December. A jobs report between 160k to 190k with an unchanged U/E rate of 4.1% is likely the sweet spot for risk, as it keeps a December cut in play but is also a healthy level of job creation.

The US 2-year Treasuries and the USD (notably USDJPY) are the clearest expressions of a strong/weaker NFP print. I suspect that it would take a truly weak NFP (below 100k with a higher U/E rate) to derail the US equity juggernaut, and after the S&P500 printed its 54th ATH for the year on Friday, the wind is clearly to its back.

Offering some degree of guidance, we hear from 10 different Fed speakers through the week, including the more influential Christopher Waller and Chair Jay Powell – the appetite expressed for a cut in December, and the pace of easing ongoing could move markets. Fed members Goolsbee, Hammack and Daly speak after the NFP print, with traders looking to see how the jobs report influences their call on a cut in December. There is little data of great interest in the UK, or Europe, although we do hear from 5 ECB speakers (including President Lagarde), and they will likely guide us towards a 25bp cut for the December meeting.

The BoC to cut by 25bp or 50bp on 11 December?

In Canada, we see the November employment report on Friday, which is expected to show that 25k jobs were created, with the U/E rate ticking up to 6.6%. With CAD interest rate swaps pricing a 25bp vs 50bp cut as a lineball call, the jobs report could go some way in influencing that debate, in turn, injecting increased volatility into the CAD. USDCAD looks good for a 1.4100 to 1.3930 range, and these levels that define my risk in USDCAD trades. A close below 1.3951 would certainly start interest in positioning for further downside in the pair.

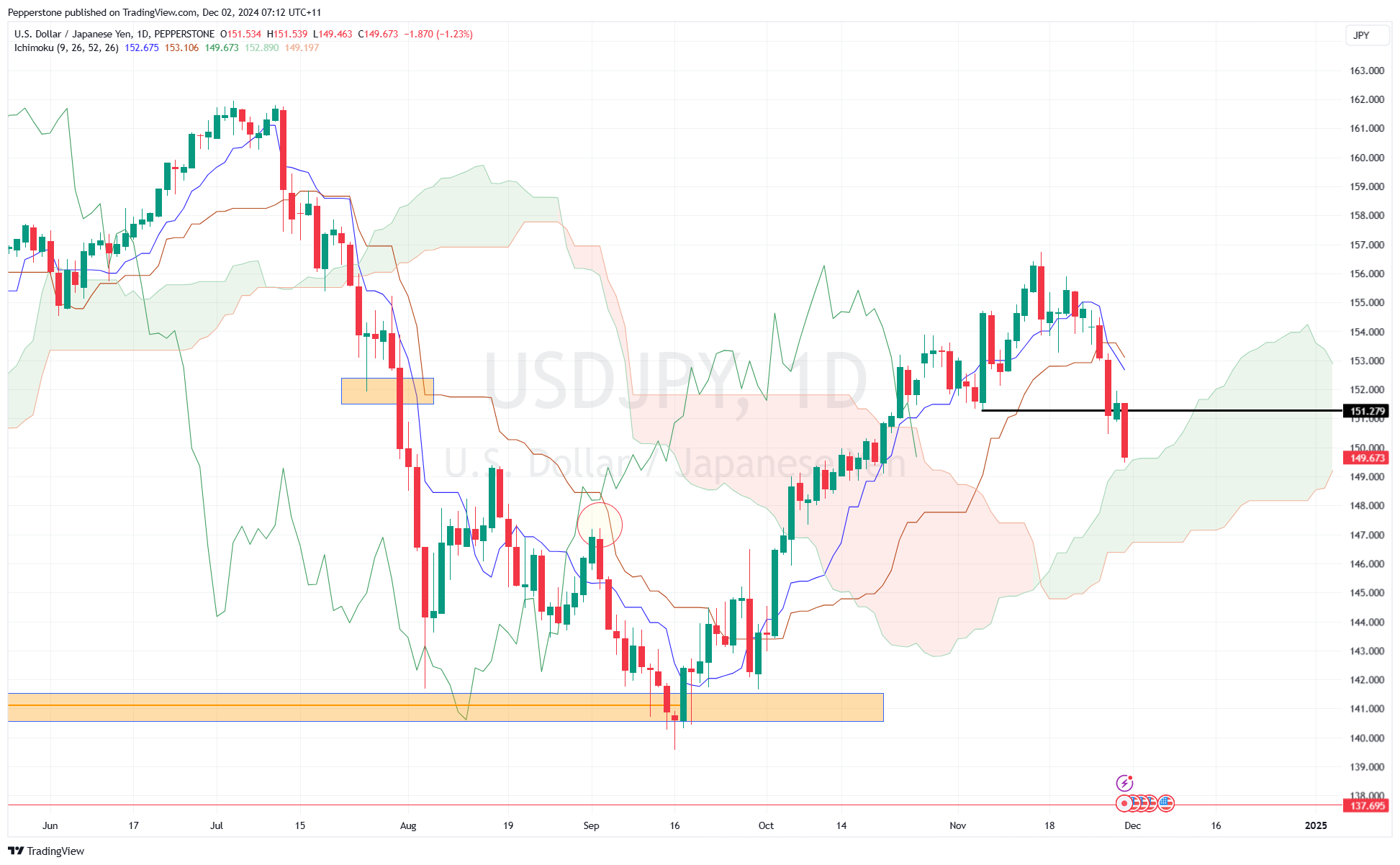

An impending BoJ hike – the JPY finding the love

Moves from the BoJ are coming in the spotlight once again – and after last week’s hotter Tokyo CPI data, we’ve seen a strong short covering rally in the JPY, with the market taking the view that on balance the BoJ are going to hike this month. The Tankan report (on 13 Dec) could also be a consideration for the BoJ, while in the week ahead capital spending, company profits and cash earnings (6 Dec) may all hold clues if the current pricing for a December 25bp hike is on the money.

USDJPY gets the attention with the pair closing below 150 with good buying on the week in the JPY cross rates. The month-end flows that impacted the USD last week have now passed and may result in would-be buyers stepping back in, although they are now fighting a short-term downtrend, and it seems more appealing to sell rallies than buy this falling knife. The top of the I-cloud kicks in at 149.22, and that may act as ST support, but a break here and JPY bulls will be pushing for 146-145.

Elsewhere, we see Switzerland and Sweden’s Nov CPI print which could cement a 50bp and 25bp cut respectively from the SNB and Riksbank. In Australia, we see Oct retail sales, and Q3 GDP, although the data this week shouldn’t affect the markets view on impending RBA action – if anything, better data should be best expressed in the equity market where the ASX200 looks to take out last week ATH of 8477, with SPI futures needing a closing break of 8509.

China released its Nov PMIs on Saturday, with manufacturing index at 50.3 vs 50.2 expected, and services at 50.0 vs 50.3 – levels that shouldn’t cause much reaction in Chinese markets. In the week ahead we see the Caixin manufacturing/services PMIs, which are both expected to show expansion in the smaller end of the Chinese business landscape. In China/HK markets, it's hard to be overly excited about equity at present, with the higher timeframes showing the CN50, CHINAH and HK50 all in consolidation mode and moving sideways. Perhaps good Caixin PMI’s can kick start a better tape,

OPEC+ meet on Thursday with the overriding consensus that the group will keep its voluntary output caps in place for several more months. We may get a surprise, but with Brent tracking a $75 to $70.70 range of late, global demand estimates falling and the Trump administration talking of increasing output by 3 Mbps, it’s understandable to think that OPEC+ delay any output increases until late Q125, and subsequently we see calm conditions in the Brent price, with traders feeling spot is at a fair value.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.