- English

- عربي

Global markets grappled with a dose of political risk that stole attention from data, much of which remains absent due to the ongoing US government shutdown. In France, the sudden resignation of Prime Minister, only a short time after forming his government, reignited concerns over political stability and narrowed the horizon for policy continuity. In Japan, Sanae Takaichi’s victory as leader of the Liberal Democratic Party fueled expectations of more expansionary fiscal policy. And the market reaction was instant, the Nikkei index surged over 4% to fresh record highs above the 48,000 level, supported by a simultaneous weakening in the yen.

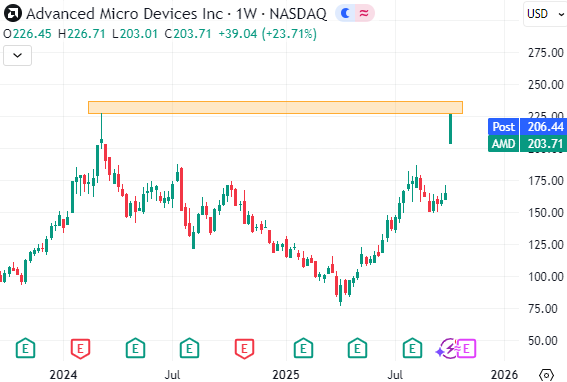

This contrast reflects the tone of the global mood. In the United States, equities showed notable upside, with the S&P 500 up 0.4% and the Nasdaq 100 climbing around 0.7%, driven by strength in technology. The tone was reinforced by the OpenAI - AMD partnership, seen as a strong vote of confidence in the sector’s future. Under the deal, OpenAI announced a strategic partnership with AMD to invest in its processors and deploy their capabilities in building massive data centers with power capacity reaching up to 6 gigawatts to run AI applications. The plan marks a healthy diversification move away from OpenAI’s near-total reliance on Nvidia, with the investment estimated at around $100 billion - a staggering figure that shows the scale of the new AI infrastructure race. The deal also gives OpenAI the option to acquire up to 10% of AMD. The stock responded sharply, soaring as much as 38% at the open.

The deal cements AMD’s position as a major player in the chip race while giving OpenAI greater flexibility to diversify its supply and expand its computing capabilities. To put it into context, one gigawatt of power equals roughly the electricity consumption of one million homes, meaning this project represents six times that scale. The market’s reaction, although intense, appears justified given the magnitude of the announcement, even if AMD remains below its March 2024 peak.

In another corner of the market, US Treasury yields edged higher, with the 10-year yield holding around 4.15% amid broad selling across the curve. Long-dated maturities appear to be entering another acceleration phase, while the 2-year yield remains just below 3.6%. Markets continue to price in a 25-basis point rate cut at the upcoming FOMC meeting later this month, a reflection of the view that the Fed is likely to continue the gradual risk-management approach to support a weakening labor market. However, rate cuts at a time when growth is re-accelerating and inflation is holding near 3% remain an unusual policy mix.

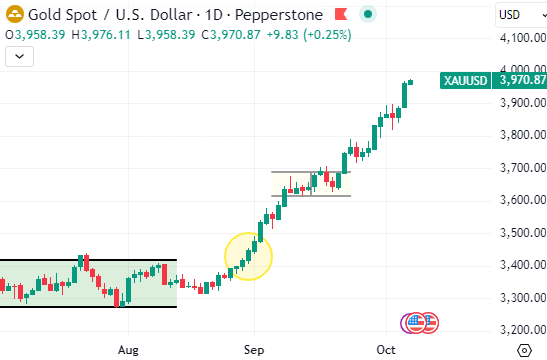

On the other side of the risk spectrum, gold extended its historic advance, with traders now eyeing the key $4,000 level. These elevated levels highlight gold’s growing strategic role as a structural component within diversified portfolios, with both institutional and retail investors increasing their exposure, unlike previous phases when central banks led the accumulation. The current bid for gold mirrors rising unease in markets, equity valuations have reached multiples near 23 times earnings, bringing the word ‘bubble’ into discussion perhaps on very research desk. Should such concerns grow large, gold stands as the most effective refuge.

The broader sticky point for markets remains in Washington, where the government shutdown has halted the release of official data, most notably the Nonfarm Payrolls report NFP. Without this key gauge, the cornerstone for assessing labor market strength and policy trajectory, investors and policymakers alike are left navigating in low visibility. As a result, markets have turned their attention to secondary and private-sector indicators, though the absence of official data deepens uncertainty and adds an element of fear.

Looking ahead, with the lack of key data releases, today’s calendar appears light. The US Treasury is set to auction $58 billion in three-year notes, a process that remains unaffected by the shutdown, as confirmed by the department last week. Meanwhile, remarks from Fed officials, including Bowman, Kashkari, Bostic and Miran, will attract increased attention, as their comments may now carry outsized market impact in the absence of data-driven catalysts.

Across assets, the broader picture remains clear. Equities continue to advance, fueled by liquidity and robust earnings, though high valuations leave markets vulnerable to surprises. The dollar holds its ground, and precious metals, led by gold, remain the most expressive indicator of current market sentiment.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.