- English

- عربي

More rhetoric, no news

President Trump left markets none the wiser on trade progress overnight when speaking at the Economic Club of New York.

Investors were hoping for news on the anticipated phase one deal. Instead, Trump delivered typical rhetoric, saying a “significant phase one deal could happen, could happen soon.” He added that if no deal is raised, tariffs will be raised “very substantially.” Unsurprisingly, he took another swipe at the Federal Reserve and its chair Jerome Powell for cutting interest rates slower than Trump would've liked.

Price action didn’t respond strongly to a threat of further tariffs – perhaps because with the US election next year, an escalation of tariffs seems unlikely as it would hurt Trump’s re-election chances. Rather, markets seem to be waiting until they hear something new about trade progressions.

The backdrop continues to be a market feeling better about the trade outlook, with yields looking up. Funds are flowing out of safe havens: USDJPY is sitting around 109 after August lows of 105, and gold has fallen from the 1500 level 10 days ago to just above 1450.

XAUUSD daily chart

"Gold tested the 1400 level low in July and a 1550 high early September. November opened at 1512 and is trading today at 1457."

Gold is a recession hedge. US economic data is seeing small improvements and the trade outlook looks more positive, so the market is more upbeat. Gold has pared back and looks set to test the 1450 level. What markets want now is news of trade deal progress from Trump, which should see gold push below 1450.

Below you’ll see a chart of gold against negative yielding debt. As the outlook has become more upbeat recently, real yields have ticked up, which means a falling pool of negative yields. The risk-on mood is driving gold lower.

Gold against negative yielding debt

Add to that the S&P 500 hitting record highs day after day, the outlook for gold looks to the downside.

What this means for traders: We’re focused on trade here. If Trump is serious about raising tariffs “very substantially” if he doesn’t get his way, such a move would see gold move back up towards 1500.

What we’re watching today

G10 implied volatility is highest for the NZD this week (8.4%) ahead of the Reserve Bank of New Zealand’s (RBNZ) rate decision today at 12pm AEDT.

Market probability of a cut has moved considerably leading up to the event. A month ago, the chances of a cut were as high as 98%, yet a week ago probability had fallen to 53%. Today, markets are pricing a 76% chance of a rate cut.

ANZ’s New Zealand division have called a 25bp cut the “path of least regrets,” fearing inflation expectations could dip lower.

This is a live event. After cutting rates by a surprise 50bp in August to get ahead of the curve, markets are expecting a rate cut while the RBNZ’s peers have taken a wait-and-see approach. The outlook after today’s decision will likely be in line with the Fed and the RBA.

What this means for traders: We’ll bring you the latest as it happens. If they cut, we’ll see a small adjustment lower in NZDUSD. If the RBNZ hold just as their peers are, NZDUSD will see a bigger move up.

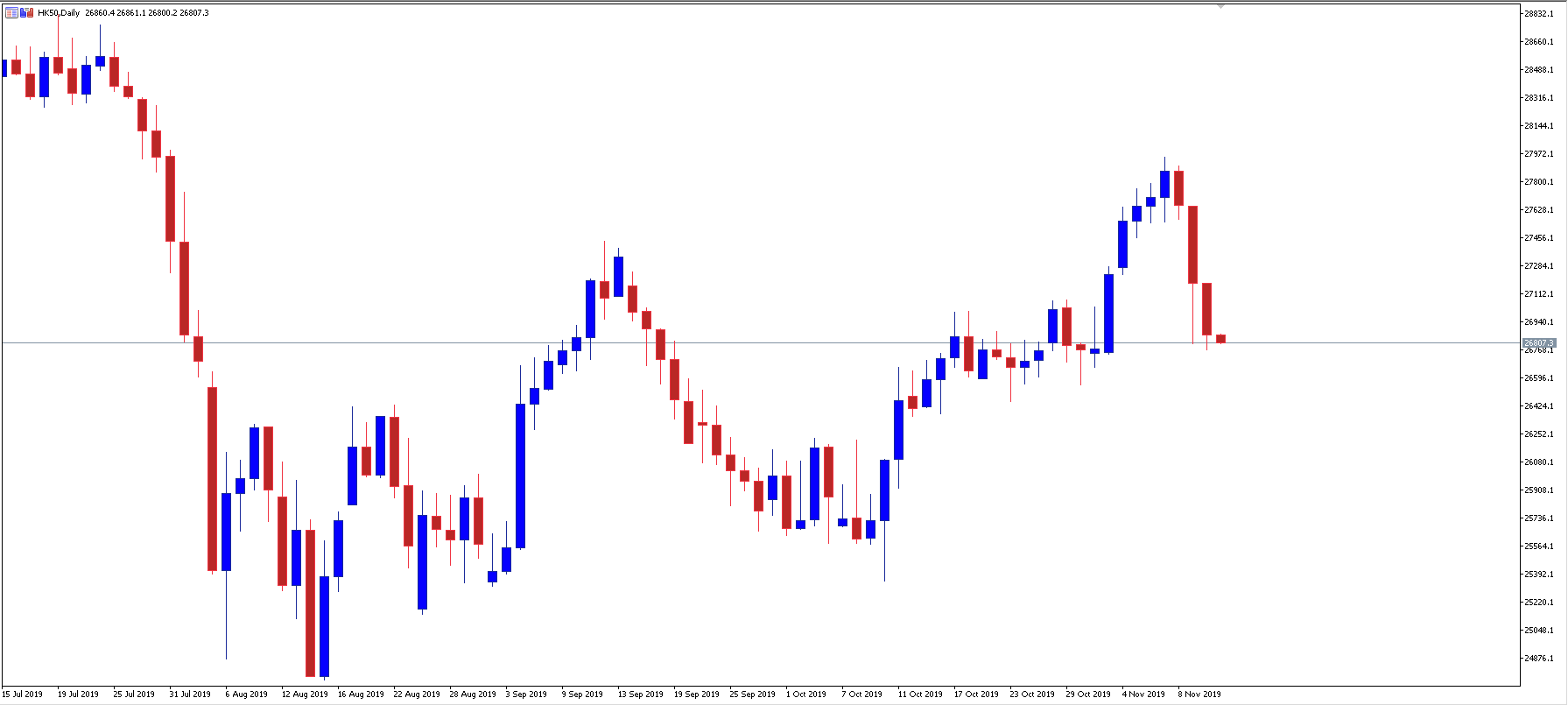

HK50 takes another hit

As protest tensions escalate again in Hong Kong this week, we’ve seen considerable losses on the Hang Seng Index, down over 1000 points since Friday. Hong Kong police say rule of law has been pushed to the “brink of total collapse.”

HK50 daily chart

"The Hang Seng Index takes another hit as protests escalate again this week. The index fell considerably to a 24376 low in August, and reached 27947 last week. Today the HK50 trades at 26807."

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.