The S&P 500 closed +0.7%, with all sectors bar real estate gaining on the day and 73% of stocks higher on volumes smack bang in line with the 30-day average. The all-time high of 3027 is a whisker away, and the fact the index closed on the session highs details that the bulls are in charge. It also isn’t farfetched to feel we get new highs here this week or next. What’s more, small caps are flying; we see the Russell 2000 closing +2.1%. Does that tell us that the US economy has in fact turned a corner or just that investors were far too underweight this space?

We’ve seen high beta outperform low-volatility sectors — a sign of risk-taking in the market — although this is in line with the recent selling in the US 10-year treasury (closing +2bp at 1.73%). It's all correlated. Implied volatility has come off a touch, with the VIX index -0.59 vols settling at 14.61%, although with the Federal Reserve meeting next week it's hard to think we’ll get into 11% to 12% anytime soon. That’d suggest we pile back into carry trades and income strategies.

Yellow: S&P 500 high beta / low vol sector ratio. White: US 10-year treasury.

"Source: Bloomberg"

By way of leads for Asia, we can see S&P 500 futures +0.7% from the ASX 200 cash close (16:10 AEST), tracking above 3000 and now a mere 0.9% from the ATH. Aussie SPI futures are 23 points from the cash close, so we expect the ASX 200 to open in line with this move. What's also interesting here is valuation. Since 2 August we’ve seen consensus 12-month EPS taken down from $4.11 to $3.99, which, along with a move higher in the index, has seen the index command a valuation to 16.6x — the highest since 2016. One questions what’ll promote an earnings re-rating. And we’re getting to levels where the upside should be capped and will be far more attractive to short-sellers.

Nikkei futures are sitting up 0.4% in the overnight session, rallying for the eighth straight day. This market is fairly hot right now. Expect small gains in the Nikkei 225, then, as we should in Hong Kong.

Outside of equities, we’ve seen crude close down 2.9% at $55.75, with sellers sensing a loosening of restrictions on Iran, easily offsetting any goodwill from a 6.9m barrel draw in US crude inventories. Copper closed -0.5% at $2.59 p/lb, while iron ore futures have gone the opposite direction, tracking +1.6% from the ASX 200 close.

FX and fixed income take centre stage for me, though, with the highlighted anticipated European Central Bank meeting (due 21:45 AEST) ahead of the August US CPI print (22:30 AEST). The US CPI print is expected to see core come in at 2.3% YoY and headline of 1.8%. While this is traditionally a vol event, if we look at the rates markets, we can see September pricing for a cut in next week’s FOMC meeting is well anchored, and a 25bp is pretty much assured in the eyes of the market.

Trading US CPI

We need to see this inflation print through the eyes of the Fed, and question with all we’ve seen in the data flow and market moves: what number here would really alter their view on a September cut. Clearly, it’d have to be a big miss / beat to alter a 25bp cut, although the USD will still be sensitive to what’s priced through the rates curve through the coming six to 12 months.

We watch USDJPY most closely, though. And while higher prices will be driven by a further sell-off in US Treasury yields, there’s scope for a move into 108.70 (the bottom of the I-cloud), where I’d be a far more willing seller. This would coincide with my view of a potential reversal in equities and bonds.

ECB needs to force a steeper curve

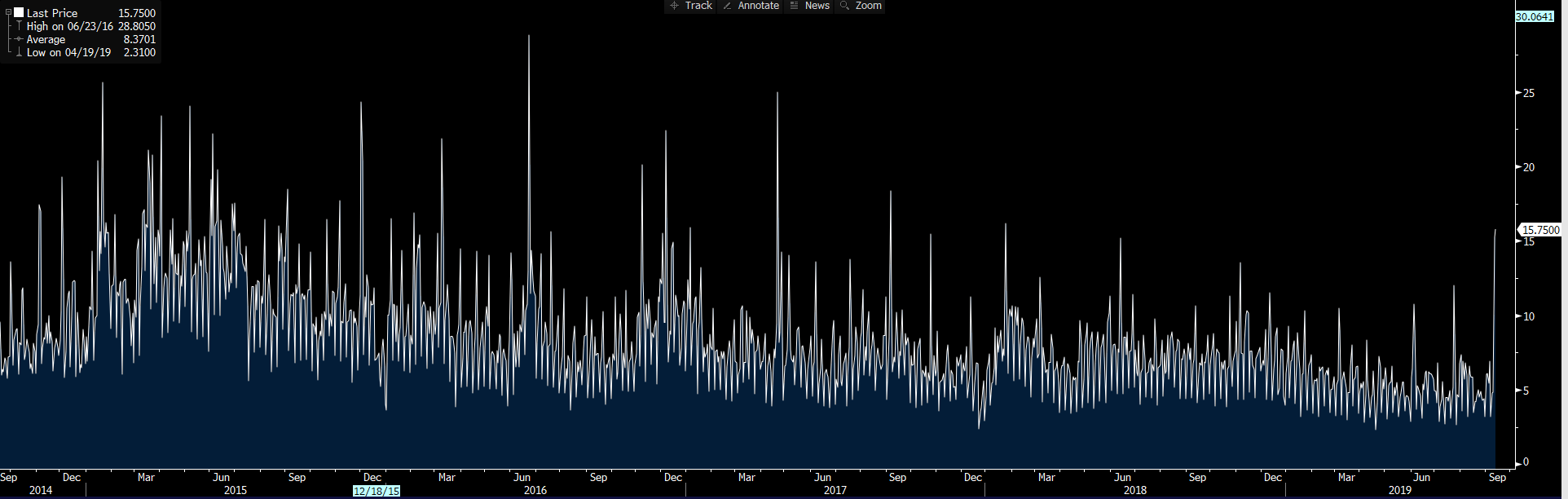

The USD index closed up 0.3% largely as a function of EURUSD pulling back a touch through trade. The EUR is front of mind, with the ECB meeting the highlight, and we can see EURUSD overnight implied volatility ratcheting up as you’d expect. We see vols sitting at 15.75%, which is the 100th percentile of the past 12 months, although vols have been so low this year that if we take the timeframe out to five years, we can get a better perspective. To put context on this, the market sees a 79-pip move on the session (with a 68.2% level of confidence). So, work that into your risk management if holding EUR exposures, which way does EURUSD or do the EUR crosses head?

Of course, volatility doesn’t predict direction but just the extent of the move. The EUR will likely take its direction from the German yield curve, as will the EU banking sector. It seems that a steeper curve is in everyone’s interest (except EUR shorts), so how does the ECB engineer this? Go hard on the deposit rate, offer a tiering structure for financial institutions excess reserves held with the ECB, lay off from any punchy QE program — all the while offering strong forward guidance about how they’ll unwind the policies, as well as pushing the emphasis onto the EU governments to pump out a fiscal response to complement already loose monetary policy concurrently. Of course, this is where the next ECB president Christine Lagarde will earn her keep.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.