Analysis

Headlines that the Hang Seng and H-Shares had entered a technical bear market – having fallen 20% since the January highs – have only increased client interest. Where the reasons for the sell-off through February and again from mid-April have been widely discussed, these factors include:

- Since mid-April, China’s economic data has consistently missed market expectations – notably, manufacturing PMIs, fixed asset investment, import demand, industrial profits, and underwhelming new home sales.

- Old-school concerns around potential defaults from property developers have resurfaced.

- Headlines on a souring of US-China relations, with China labelling Micron’s memory chip a national security risk

- The Chinese government cut the issuance of special-purpose bonds by 50% in May – much of this capital is used to fund infrastructure investment. The market sees less fiscal support.

- A weaker yuan – we see outflows from China’s markets, but funds also get paid to be long USDCNH given the attractive carry and interest rate differentials.

- Opportunity cost – while Chinese/HK stocks fell out of favour, we’ve seen US mega-cap tech and global A.I names on a blistering run. Outside the US, we’ve seen strong rallies in the JPN225 and the Kospi. International managers have repositioned holdings geographically.

- Tencent – which holds a 10% weight on the HK50 index - fell from $416 to $306. The 200-day MA is supporting the price for now.

The Heart Of The Issue

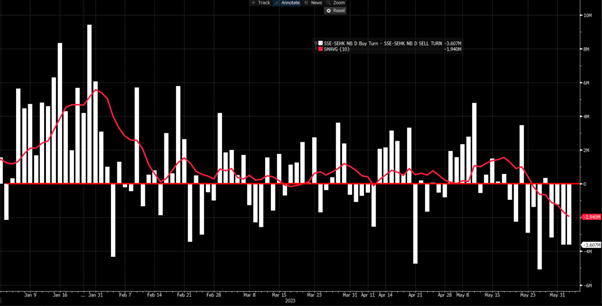

At the heart of the issue have been positioning and capital flows, where throughout January and February, we saw a record amount of foreign capital moving through the Northbound HK-Shanghai ‘connect’. International money managers were attracted to the surprisingly rapid re-opening and positioned portfolios in Chinese and HK stocks to capture the earnings lift that came from the release of pent-up demand.

For the reasons mentioned above, that investment flow has partially reversed, and we’ve seen consistent outflows through the Northbound ‘connect’, averaging $1.94b for the past ten days. These outflows have also resonated in a weaker CNH (offshore yuan), where notably, the PBOC has refrained from pushing back on the currency weakness - FX traders have therefore been only too happy to stay long this cross for the carry.

The Risk-To-Reward Trade-Off

One consideration is that Chinese/HK markets are already unloved, and we can see the market internals reaching extreme levels. On Wednesday, we saw 70% of stocks trade at a 4-week low (the most since March 2022), while only 5% of HK50 stocks were above the 50-day MA. 40% of index constituents have an RSI below 30.

Another factor that is starting to skew the risk-to-reward trade-off is potential policy support, and this may be one reason why Pepperstone clients are now currently positioned for a short-term bounce, with 3 in every 4 open positions held long.

Given the clear loss of economic momentum, there is an elevated expectation that the PBoC will ease the bank's reverse ratio requirement, allowing banks to free up capital and allow increased levels of credit into the economy. Other measures around relaxing rules on home purchases have also been talked about.

Next week's China data flow could be key to sentiment. We see May trade data, CPI/PPI, and new yuan loan data. If this comes in weak vs expectations, it may initially weigh on stocks, but it would also accelerate the need for stimulus.

We continue to focus on the daily Connect flow data as a key guide on sentiment. However, the rising risk of policy support (both fiscal and monetary) amid a market that is grossly unloved suggests a tradeable rally could be underway, and while the technicals suggest this is aggressive, longs are preferred on a tactical basis. Tencent remains critical to the HK50, and any upside moves in the HK50 to 19,600 will require Tencent to push towards $350.

The Technical Picture Suggests Caution Is Warranted

The technical setup, however, needs work, especially on the daily timeframe, and a one-day rally needs follow-through, so with the trend currently lower, my technical view remains biased short. On the higher timeframes, a simple 3 & 8-day EMA study shapes the directional bias, and I’m yet to get an exit signal from short bias. With the tactical view in mind, a bullish EMA crossover is a growing risk, and I would have a far greater conviction of sustained outperformance from the HK50 upon this development.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.