I've put together a trading wrap video, with a focus on the day ahead, set-ups and ideas on the radar – I also add in a focus on the week ahead, so do take a look.

There’s been plenty of news from traders to navigate, with the BoE meeting causing ripples in FX markets and GBP getting smacked 70-pips on the statement. GBP has held Wednesday’s low of 1.3924 and the move lower reflective of a market that was long the pound into the meeting on a belief of a more confident central bank – so purely a position adjustment and for dip buyers, GBPJPY and GBPCHF are my play and certainly GBPJPY has scope here for 155.

US data was largely a sideshow, while a Biden and Pelosi bipartisan agreement on infrastructure was under in terms of size and may only really come to fruition if we see a Reconciliation Bill passed via the Senate – not enough to move the dial on the US bond market and subsequently FX markets – ex-GBP and MXN - have been quiet.

We’ve seen new highs seen in the S&P 500 and NAS100, with Tesla storming into $700 and as long as bond yields stay subdued, and economic data comes in as we’re seeing, then we should see equities continue to print higher highs – I stay bullish for now and note falling equity implied volatility, with the VIX into 14.2% at one stage which will just encourage more volatility-targeting funds into the market. Small caps are working well too, with the US2000 having the outperformance and with the US30 working well. Financials also caught a bid, with the S&P 500 financial sector +1.2% and 36bp hotter than the next best space (Energy), possibly helped by the Federal Reserve giving flying colours to the 23 banks they stressed tested – not to mention a view that this space is going to see some clear growth in share buy-back potential over the coming 12 months.

Our opening calls for Asian equity markets look constructive.

(Source: Tradingview)

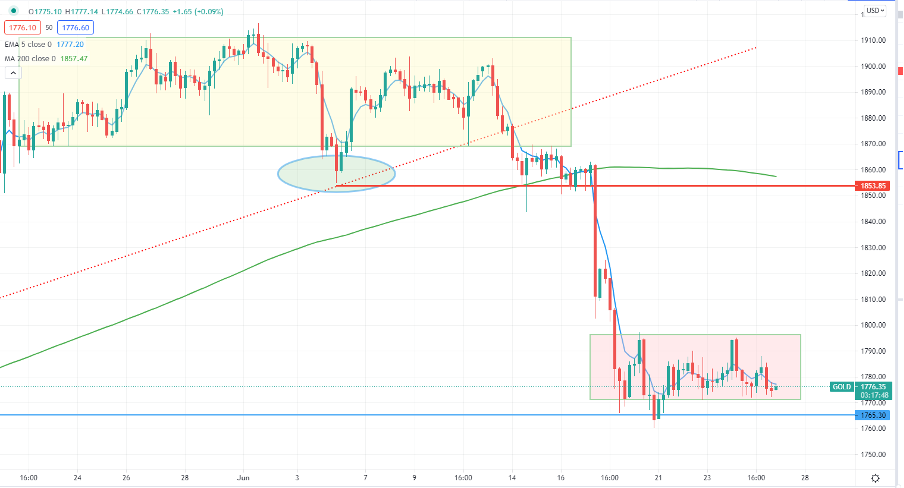

Gold has been well traded but needs to find a spark and maybe that comes in the coming 24 hours with US Core PCE and a raft of Fed speakers in the mix. Also, consider next week we get ADP payrolls, ISM manufacturing and non-farms, but the Gold price is consolidating and finding sellers too readily into 1795, while the bid is there into 1770 – I'm using these levels as a guide and when one gives way then it will shape the bias. I favour the downside, but price will guide as always. Crude, as suggested in the video yesterday is finding supply into $74 and looks destined to chop in a sideways move for the next 12 hours or so.

(Source: Tradingview)

Crypto continues to find broad-based support and our client base is skewed long of the various coins – I focus on the space in the video, but I specifically want to see if 34400 can hold in Bitcoin and if it can and the buyer’s step in so would I. Link is also on the radar. A bit more work needs to play out, but if the downtrend gives way this could have an explosive move higher.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.