- English

- عربي

It’s days like this that running a trend and/or momentum strategy works wonders. The USD pairs, notably USDJPY, USDCNH and USDCHF are ripping – We see the JPY as the weakest though with USDJPY spiking to 143.59 in early trade today, on what looks like a stop run through yesterday's session highs and amid thin liquidity.

The trade-weighted JPY sits at the lowest level since 2007 and some are questioning if the risks of verbal JPY jawboning from the Bank of Japan or the Ministry of Finance (MoF) have increased?

Potentially, but in this current bond driven dynamic the market will pounce on JPY weakness. Consider that we haven’t seen a sizeable lift in Japan’s inflation expectations as a consequence of Japan importing inflation (through the FX channels) and that will appease the BoJ. Commodity prices have come well off the highs, which will benefit energy importers (like Japan).

However, we are back to trading central bank divergence – FX trading in its purest form, albeit from a fundamental perspective. Don’t fight the Fed means staying long the USD, at least for now.

We can see the central bank divergence manifest in the FX forwards markets, where corporate treasurers are able to roll over USDJPY exposures for 12 months at a 600-pip discount – interest rate parity dictates this, but when you get this level of carry you know the JPY has very little safe-haven qualities, and in this current environment the JPY is simply a bond proxy. For the JPY to really head higher bond yields need to trend lower – the JPY (and perhaps gold) would become the default hedge if bond yields really started to head lower on global recession fears – not a trade for right now, but it could play out in late 2022 – recognise the signs and have the theme on the radar.

The fact we continue to watch US bond yields climb is pushing more capital into the USD – some of the recent moves can be explained by US corporates issuing a high level of corporate debt and the market having to sell out of other fixed income instruments to fund this. Some have been driven by slightly better US data (ISM services for example).

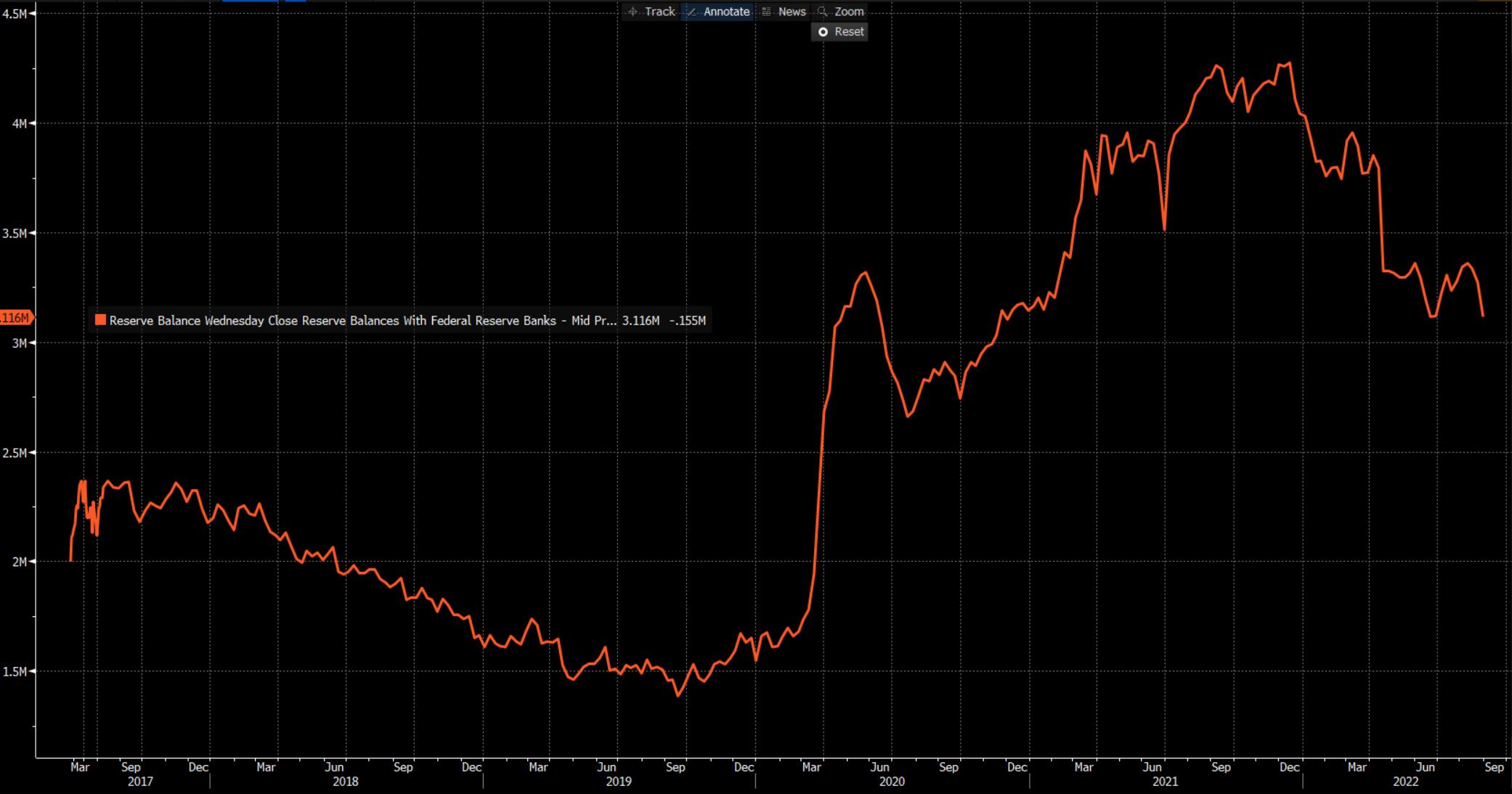

US ‘real’ rates (US Treasuries adjusted for expected inflation) are moving higher and higher. It also feels like the USD market is front-running Fed Quantitative Tightening (QT), which ramps up to the incredible pace of $95b this month - we have seen a strong relationship between falling Fed reserve liabilities and the USD and if this relationship is maintained then USDJPY could be headed for Y150+ over time.

(Fed reserve balances – USDJPY has an inverse relationship)

The trade-weighted JPY sits at the lowest level since 2007 and some are questioning if the risks of verbal JPY jawboning from the Bank of Japan or the Ministry of Finance (MoF) have increased?

Potentially, but in this current bond driven dynamic the market will pounce on JPY weakness. Consider that we haven’t seen a sizeable lift in Japan’s inflation expectations as a consequence of Japan importing inflation (through the FX channels) and that will appease the BoJ. Commodity prices have come well off the highs, which will benefit energy importers (like Japan).

However, we are back to trading central bank divergence – FX trading in its purest form, albeit from a fundamental perspective. Don’t fight the Fed means staying long the USD, at least for now.

We can see the central bank divergence manifest in the FX forwards markets, where corporate treasurers are able to roll over USDJPY exposures for 12 months at a 600-pip discount – interest rate parity dictates this, but when you get this level of carry you know the JPY has very little safe-haven qualities, and in this current environment the JPY is simply a bond proxy. For the JPY to really head higher bond yields need to trend lower – the JPY (and perhaps gold) would become the default hedge if bond yields really started to head lower on global recession fears – not a trade for right now, but it could play out in late 2022 – recognise the signs and have the theme on the radar.

The fact we continue to watch US bond yields climb is pushing more capital into the USD – some of the recent moves can be explained by US corporates issuing a high level of corporate debt and the market having to sell out of other fixed income instruments to fund this. Some have been driven by slightly better US data (ISM services for example).

US ‘real’ rates (US Treasuries adjusted for expected inflation) are moving higher and higher. It also feels like the USD market is front-running Fed Quantitative Tightening (QT), which ramps up to the incredible pace of $95b this month - we have seen a strong relationship between falling Fed reserve liabilities and the USD and if this relationship is maintained then USDJPY could be headed for Y150+ over time.

(Fed reserve balances – USDJPY has an inverse relationship)

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.