FX Outlook: Will the ECB set the stage for easing?

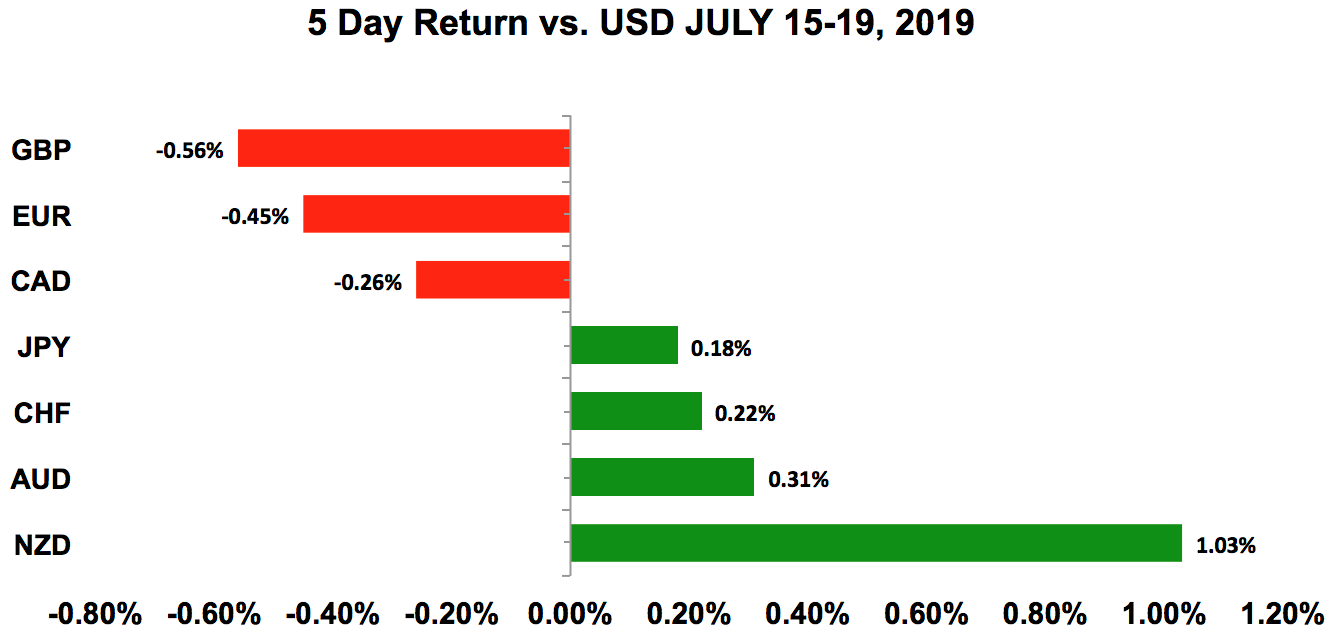

All of this occurs at a time when currencies are consolidating as they wait for new direction. The greenback is losing its influence over the market, with some currencies rising and others falling against the US dollar last week. The New Zealand dollar was the best performer thanks to stronger data. Sterling was the weakest, although GBPUSD recovered a large part of its losses towards the end of the week. Looking ahead, the focus will be on Europe, with the results of the UK Conservative Party vote and ECB monetary policy meeting due for release.

Weekly trade ideas: Don't miss these market-moving opportunities identified by BK Forex.

EURO

Data review

- Eurozone trade balance 20.2bil vs 17.8bil expected

- German ZEW survey current -1.1 vs 5 expected

- German ZEW survey expectations -24.5 vs -22 expected

- EZ ZEW survey expectations -20.3 vs -20.2 previous

- EZ CPI 0.2% vs 0.1% expected

- EZ CPI YoY 1.3% vs 1.2% expected

- German PPI MoM -0.4% vs -0.1% expected

- German PPI YoY 1.2% vs 1.5% expected

Data preview

- ECB monetary policy announcement: central bank poised to set the stage for a September rate cut

- Eurozone PMIs: potential downside surprise given global growth concerns and sharp decline in investor sentiment

- German IFO: will have to see how PMIs fare, but sentiment in the region is weak

Key levels

- Support 1.1200

- Resistance 1.1300

Will ECB set the stage for easing?

The euro is weak, but you can’t necessarily tell that from the price action of EURUSD. While the pair is hovering much closer to its May low than June high, it’s been consolidating above 1.12 for the past two weeks. During this time, the euro dropped to one-month low versus the Japanese yen; two-month low against the Australian dollar; and 22-month low versus the Canadian dollar. Its weakness is the most apparent in the crosses, because these central banks have been engaging in their current monetary policy direction for some time. The Fed, on the other hand, is at the cusp of easing for the first time since the global financial crisis, marking a major shift in policy. Before that happens, the ECB will meet next week and is widely expected to change its forward guidance.

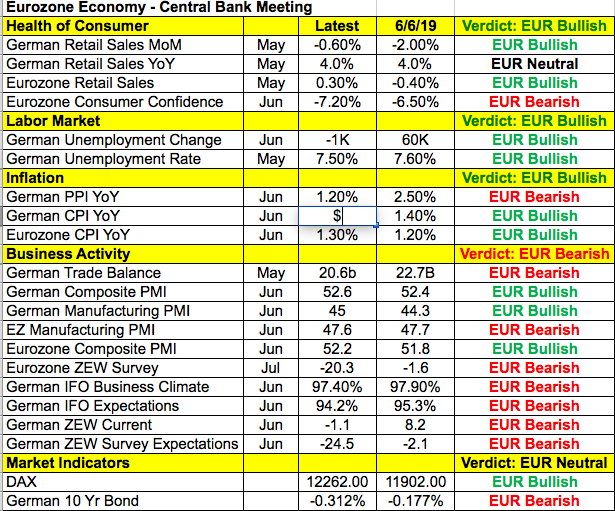

Everyone’s talking about the prospect of an interest rate cut in the US, but the ECB could also lower interest rates. Typically, the ECB likes to prepare investors for major changes, which is why it could take the major step of altering its forward guidance this week. While they could add accommodation in July, the following table highlighting the changes since their last meeting indicates that they could wait until their economic projections are updated in September. Business sentiment is down and manufacturing activity weakened, but consumer spending is up, the labour market improved and inflation ticked higher. With that in mind, the overall outlook remains grim. Low inflation is a serious problem for the central bank, with CPI hovering around 1.3% in the eurozone. Q1 GDP growth of 0.4% is also well below trend, and the threat of tariffs on Europe could dampen the outlook further. A number of economists are looking for a September rate cut, but the central bank could be more aggressive, opting for a package of accommodative measures that include asset purchases and a deposit rate cut. Considering that the ECB is expected to set the stage for these changes at its meeting next week, we expect euro to trade lower ahead of the rate decision. Technically, EURUSD is trading below all major moving averages and, while 1.12 has held as support for the past six weeks, we believe that a break is imminent.

BRITISH POUND

Data review

- Rightmove house prices -0.2% vs 0.3% previous

- Jobless claims change 38K vs 24.5K previous

- Average weekly earnings 3.4% vs 3.1% expected

- ILO unemployment rate 3.8% vs 3.8% expected

- CPI MoM 0% vs 0% expected

- CPI YoY 2% vs 2% expected

- PPI input -1.4% vs -0.5% expected

- PPI output -0.1% vs 0.1% expected

- Retail sales 1% vs -0.3% expected

- Retail sales ex auto 0.9% vs -0.2% expected

Data previews

- No major economic reports

Key levels

- Support 1.2400

- Resistance 1.2600

New PM for UK

By the end of next week, Britain will get a new prime minister. After weeks of voting, they’ve narrowed it down to two candidates: Boris Johnson and Jeremy Hunt. Johnson holds a strong lead over Hunt, so baring an unexpected upset that the former mayor of London will become the country’s new leader. He was a key voice in the Leave campaign during the 2016 referendum, and continues to push for a hardline strategy. So, while his victory is widely anticipated, his official nomination could still drive sterling lower, as it’d raise the odds of a no-deal Brexit. The most urgent and important job for the new prime minister will be to strike an agreement with the EU acceptable by the government. The deadline for a deal is 31 Oct, but there are reports that Brussels will offer an extension. Despite all the angst, the market is betting that a behind-the-scenes deal will help avoid a no-deal Brexit. This past week, the House of Commons passed a measure that would prevent the PM from proroguing (i.e., suspending) Parliament and forcing through a no-deal. All the while UK data continues to surprise to the upside, with wage growth running at the best rate in G7. Employment is steady, as well, and retail sales shows that the UK consumer is willing to spend — political turmoil be damned. All of this sets us up for very strong pop higher if the UK and EU work out some sort of compromise. At this point, the opposition to a hard Brexit looks unshakable and, regardless of the hardline rhetoric coming from the Tories, investors are optimistic that the next step will be a Brexit delay, not a no-deal exit.

US DOLLAR

Data review

- Fed beige book: districts reported a modest expansion, with little change from the previous month

- Empire State 4.3 vs 2 expected

- Retail sales 0.4% vs 0.2% expected

- Retail sales ex auto and gas 0.7% vs 0.3% expected

- Industrial production 0% vs 0.1% expected

- NAHB housing market index 65 vs 64 expected

- Housing starts 1,253K vs 1,260K expected

- Building permits 1,220K vs 1,300K expected

- Philadelphia Fed index 21.8 vs 5 expected

- University of Michigan Consumer Sentiment Index 98.4 vs 98.8 expected

- University of Michigan Consumer Sentiment Index expectations 90.1 vs 90 expected

Data preview

- Existing and new home sales: The prospect of a rate cut from the Fed could help boost housing activity.

- Q2 GDP: potential weakness given softer spending and trade balance in second quarter

Key levels

- Support 107.00

- Resistance 109.00

Five reasons traders are selling US dollar

The greenback will struggle to rise with the Fed looking to lower interest rates this month. The big question for the dollar is the magnitude of easing. Will the cut in July be a one-off “preventative” move described by St Louis Fed President James Bullard, or the first of a series of cuts? Many policymakers seem to favour a 25bp move July, but they’re undecided on whether a half-point reduction this year is needed. Even Bullard admitted that the central bank “may need to do more later.” According to New York Fed President John Williams, “It’s better to take a preventative approach than to wait for disaster.” These comments suggest that US policymakers have only committed to one move this year, and the decision on a follow-up would be made if the economy weakens further. So, while the US central bank may only grant one rate cut in 2019, the mere fact that they’re easing at all after raising interest rates in December marks a significant shift in their outlook for the economy and monetary policy. Investors are also worried about tensions in the Middle East, after Iran seized a foreign oil-tanker. If you recall, the US was close to striking Iran in June, after an American drone was shot down over the Strait of Hormuz. On Thursday, US Treasury Secretary Steven Mnuchin teased the possibility of a change in dollar policy. He said there was no change in the country’s currency policy “for now.” These two simple words imply that they could alter the government’s support for a strong dollar in the future as a way to tip the trade scales in their favour. Trade talks with China have gone nowhere. On Tuesday, US President Donald Trump said there’s a long way to go on trade talks before an agreement can be reached, and, if China isn’t serious, he could unfreeze the final round of tariffs. Earnings season is also in full swing, and the results have been mediocre. On a technical basis, USDJPY is hovering near one-month lows and, despite Friday’s reversal, could slip below 107 in the week ahead. Q2 GDP is the most important piece of US data on this week’s calendar, and, given the Fed’s dovishness and lower spending in the second quarter, the risk is to the downside for this report.

In a nutshell, here are the five reasons why traders are selling US dollars:

- Preventative or not, the Fed is set to cut rates this month.

- Iran seized a foreign tanker, escalating Middle East tensions.

- Mnuchin teases possible change in dollar policy,

- US-China trade talks are going nowhere.

- Earnings disappointments drive stocks lower.

AUD, NZD, CAD

Data review

Australia

- RBA minutes reaffirm dovishness

- Employment change 0.5K vs 9K expected

- Full-time employment 21K vs 3.1K previous

- Unemployment rate 5.2% vs 5.2% expected

- NAB Business Confidence Q2 6 vs -1 previous

- China Q2 GDP 1.6% vs 1.5% expected

- Chinese retail sales 9.8% vs 8.5% expected

- Chinese industrial production 6.3% vs 5.2% expected

New Zealand

- PMI services 52.7 vs 53.6 previous

- Q2 CPI 0.6% vs 0.6% expected

Canada

- Existing home sales -0.2% vs 0.1% expected

- Manufacturing sales 1.6% vs 2% expected

- CPI MoM -0.2% vs -0.3% expected

- CPI YoY 2% vs 2% expected

- Retail sales -0.1% vs 0.3% expected

- Retail sales ex autos -0.3% vs 0.4% expected

Data preview

Australia

- No major data releases

New Zealand

- Trade balance: rise in manufacturing PMI signals potential upside surprise

Canada

- No major data releases

Key levels

- Support AUD .7000; NZD .6700; CAD 1.3000

- Resistance AUD. 7100; NZD .6800; CAD 1.3150

AUD hits two-month highs, NZD hits three-month highs

The Australian and New Zealand dollars rose to their strongest levels in more than two months versus the greenback. While there’s been no progress on US-China trade relations, data in the region is steady. Australian labour market numbers were released last week, and investors were unfazed by the lack of job growth in June. Only 500 jobs were created, but that weakness was due to lower part-time work. Full-time jobs rose more than 21K — a strong number in line with the average trend. The tight labour market supports the central bank’s decision to pause after lowering interest rates in June and July. Chinese data was also better than expected, with GDP growth rising in the second quarter on the back of stronger retail sales and industrial production. Unfortunately, even with the 1.6% quarterly increase, year-over-year growth in China hit 6.2% — its lowest level ever.

Softer-than-expected service sector activity in New Zealand failed to hurt the currency, because inflationary pressures accelerated in the second quarter, diminishing the need for additional easing from the RBNZ. Data in general has been better than expected, with housing, spending and manufacturing activity improving. This helped NZD outperform all of the major currencies, including the Australian dollar. The AUD/NZD cross fell to a three-month low, and, while the pair has been weaker before, the strong NZD relative to AUD will start to erode the improvements in the economy. There’s no Australian data on the calendar this week, but New Zealand’s trade balance could be firmer thanks to the uptick in manufacturing activity.

USD/CAD, on the other hand, is trying to find a bottom, and we’re surprised that it hasn’t already, especially after last week’s contraction in spending and drop in prices. Retail sales fell -0.1% against a forecasted increase of 0.3%. This was a big miss that was driven by weaker demand for food and alcohol. Consumer prices also dropped -0.2% — the first decline this year. The year-over-year rate was pushed down to 2% from 2.4%. Lower inflation is one of the central bank’s main concerns and, when combined with the pullback in spending, we can understand why the Bank of Canada turned dovish this month. The Canadian dollar is strong only because the US dollar is weak. With oil prices falling six out of the last seven trading days, it should only be a matter of time before USD/CAD bottoms.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.