- English

- عربي

FX Outlook: Dollar wobbles, but Fed keeps traders on their toes

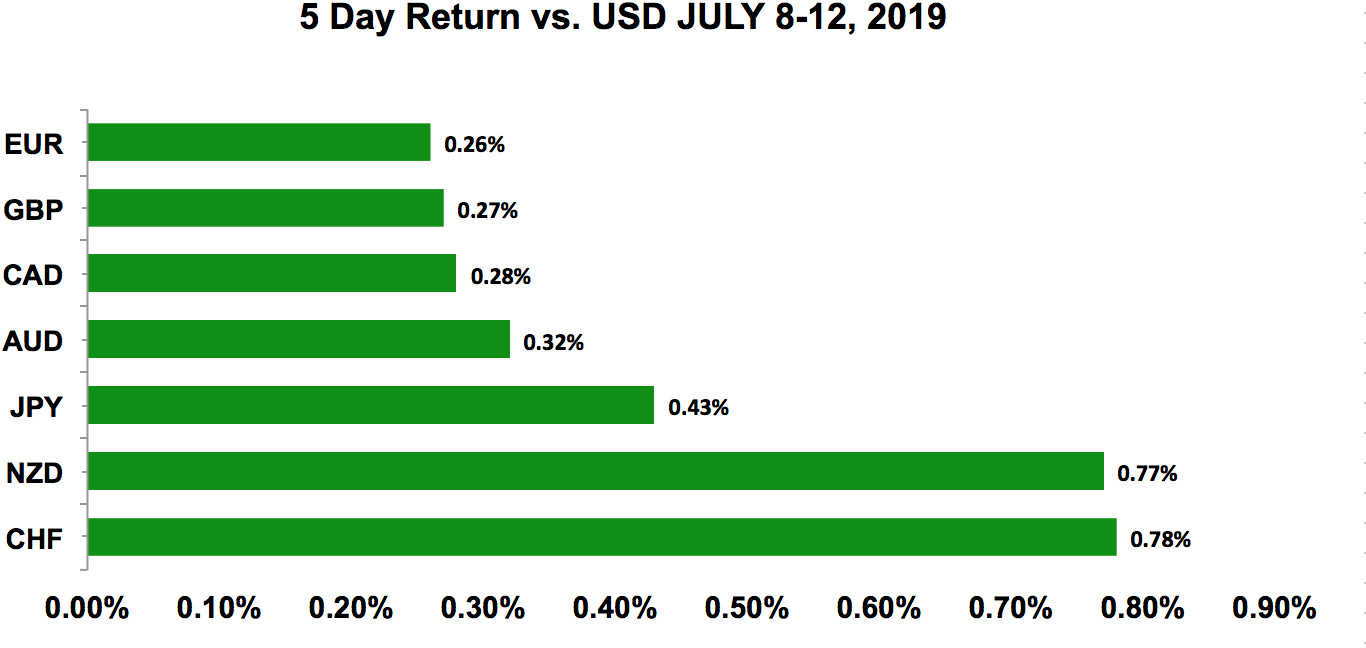

The Swiss franc and New Zealand dollar rose the most, which isn’t a surprise considering that USD/CHF is the anti-dollar trade these days, while kiwi has been exceptionally sensitive to the greenback’s movements over the past few months. EUR and GBP were the weakest performers, as political troubles continue to limit gains in these currencies. In the week ahead, investors will be looking at the US retail sales report very closely, in the hopes that it’ll help to set expectations for the 31 July FOMC meeting. In addition to US data, however, there’s also a long list of market-moving economic reports from other countries, including Chinese gross domestic product, Australian employment, New Zealand consumer price index, and Canada’s inflation and retail sales reports. The UK also has a very busy calendar that includes their retail sales, employment and inflation reports. So, the performance of the US economy and direction of US monetary policy won’t be the only driver of currency flows.

Weekly trade ideas: Don't miss these market-moving opportunities identified by BK Forex.

US DOLLAR

Data review

- Fed Chair Powell says uncertainties on trade and global growth dims the outlook.

- FOMC minutes show some members were interested in a deeper cut.

- CPI 0.1% vs 0% expected

- CPI YoY 1.6% vs 1.6% expected

- Producer price index MoM 0.1% vs 0.1% expected

- PPI YoY 1.7% vs 1.6% expected

Data preview

- Empire State manufacturing index: recovery expected after sharp drop previous month

- Retail sales: potential downward risk as wage growth slows and Redbook reports weaker spending in June

- Housing starts and permits: prospect of lower interest rates should help housing

- Beige Book: US data hasn’t been terrible, so Beige Book could show strength alongside weakness.

- Philadelphia Fed: will have to see how Empire State fares, but recovery expected

- University of Michigan consumer sentiment index: stronger numbers expected as stocks hit record highs and Fed talks rate cuts

Key levels

- Support 107.50

- Resistance 109.00

Powell confirms that a rate cut is coming

Federal Reserve Chairman Powell made it very clear last week that a rate cut is coming. As we expected, the head of the Fed was unfazed by the latest jobs report. In one of his biggest speeches of the year (i.e., the semi-annual Congressional testimony on the economy and monetary policy), he said we’ve got no evidence to call this a hot labour market. The unemployment rate is low, but wages aren’t responding. The Fed hoped that wages would move up more, but clearly the economy can sustain much lower joblessness without higher wages than previously thought. The economy is in a good place, but uncertainties on trade and global growth dim the outlook and data in general, since the June meeting has continued to disappoint. Inflation pressures remain muted, manufacturing and housing appeared to have dipped again, investment slowed, and, as a result, many policymakers saw a case for lower interest rates in June. Powell’s outlook reignited the selloff in the US dollar and confirmed that rates will be lowered in July. But the market isn’t convinced that an additional move will be needed this year.

Stocks are trading at record highs, and the upcoming rate cut could take equities even higher. US President Donald Trump appears to have softened his tone on China and, if trade relations improve, another round of easing may not be necessary. While Fed President of Atlanta Raphael Bostic said that, “Economic storm clouds aren’t actually generating the storm yet,” Fed President of New York John Williams said that, “Current picture is complex, but the economy is in a good place.” These comments aren’t particularly negative, and suggest that, at minimum, Bostic and Williams favour an insurance cut. However, if this week’s economic reports, especially retail sales, miss expectations, we expect the greenback to trend lower ahead of the July 31 monetary policy meeting.

AUD, NZD, CAD

Data review

Australia

- NAB Business Confidence 2 vs 7 previous

- NAB Business Conditions 3 vs 1 previous

- Westpac Consumer Confidence -4.1% vs -0.6% previous

- Consumer inflation expectations 3.2% vs 3.3% previous

New Zealand

- Food prices -0.7% vs 0.7% previous

- Card spending 0.1% vs 0.2% previous

- Card spending retail 0% vs -0.5% previous

- Business PMI index 51.3 vs 50.2 previous

Canada

- Bank of Canada leaves rates unchanged, lowers GDP forecasts, and says economy’s strength in Q2 driven by temporary factors

- Housing starts 245.7K vs 208.6K expected

- Building permits -13% vs -10% expected

Data preview

Australia

- RBA minutes: likely to reinforce the Reserve Bank of Australia’s dovishness

- Employment report: potential downside surprise given drop in hiring reported by manufacturing and services PMI

- Chinese Q2 GDP: potential downside surprise given trade war impact on China’s economy, but Chinese data is always hard to handicap

New Zealand

- PMI services index: Stronger manufacturing PMI signals potential upside in services.

- NZ CPI: potential upside surprise given sharp rise in food and commodity prices in Q1

Canada

- Consumer price index: potential downside surprise given lower prices, according to IVEY PMI

- Retail sales: potential upside surprise given rise in wholesale sales

Key levels

- Support AUD .6950; CAD 1.3000; NZD .6600

- Resistance AUD .7050; CAD 1.3250; NZD .6750

CAD unfazed by Bank of Canada’s worries

All three of the commodity currencies traded higher last week and, while the Australian and New Zealand dollars’ gains were consistent with risk appetite, the Canadian dollar should have bucked the trend after the Bank of Canada’s monetary policy announcement. In their latest policy statement, the BoC said they no longer believe their economy is immune to weaker global growth. They left interest rates unchanged at 1.75%, and lowered their 2020 GDP forecast on the basis of weaker export demand, sending the Canadian dollar tumbling lower. Going into the rate decision, we’d wondered if the BoC would align themselves with their peers and start talking about easing up — until the eleventh hour, some media outlets were calling for GDP upgrades. While BoC Governor Stephen Poloz refused to comment on whether the next move in rates will be higher or lower, there’s no question that the central bank took a more dovish stance last week, and that should have set a top in the Canadian dollar.

Just over a month ago, the BoC saw their slowdown in growth as temporary. But in July, they did a 180 and described Q2 strength as driven by temporary factors. “Trade tensions are having a ‘material effect’ on the global growth outlook, with exports being the ‘biggest wildcard,’” according to Deputy Governor Carolyn Wilkins. The contribution of export to GDP was cut from 0.4% to 0.1% in 2020, but don’t be mistaken — the Canadian central bank still feels good about the domestic economy, because they doubled their forecast for domestic demand contribution to GDP. Poloz also felt that the strong Canadian dollar is a problem; he said a rising CAD mechanically reduces Canada’s competitiveness. This, combined with trade headwinds, gives the central bank the confidence that the accommodation provided by the current level of interest rates is appropriate. Yet, even though the BoC made it very clear that they have no plans to change interest rates anytime soon, US dollar weakness drove USD/CAD lower. We only see CAD weakness through the crosses like AUD/CAD and NZD/CAD. Keep an eye on the loonie, because Canadian inflation and consumer spending numbers are scheduled for release this week.

Meanwhile, the Australian and New Zealand dollars trended higher despite softer Australian business and consumer confidence. While the US hit the “pause” button on the next round of tariffs, the current penalties have cut into growth and prompted speculation of an interest rate by China. The Kiwi outperformed the Aussie thanks to an unexpected improvement in manufacturing activity. Between China’s Q2 GDP, Australian employment and NZ CPI, it should be another lively week for commodity currencies.

EURO

Data review

- German industrial production 0.3% vs 0.4% expected

- German trade balance 18.7bil vs 17bil expected

- German current account 16.5bil vs 12.5bil expected

- German consumer prices no revisions at 0.3%

- Eurozone industrial production 0.9% vs 0.2% expected

Data preview

- Eurozone trade balance: potential for upside surprise given stronger German and French trade balance

- ZEW: potential for upside surprise as sentiment should be stronger given rise in stocks in G20 outcome

- EZ consumer price index should be stronger given rise in French and German CPI

Key levels

- Support 1.1150

- Resistance 1.1300

Euro rallies, but Trump could turn his focus to Europe

The lack of major economic reports and the possibility of political troubles limited the rally in euro this past week. EUR/USD found support around the 1.12 level many times this past year, and Fed Chair Powell’s assurance of a July rate cut gave investors the perfect excuse to bid up the currency. The few reports released weren’t terrible, as Germany’s trade and current account balances moved higher. The market also appears to have come to terms with IMF head Christine Lagarde’s nomination as European Central Bank president. As we previously mentioned, she comes with vast experience, name recognition and respect from her peers. A current member of the central bank would have been preferable, but she’s a solid choice. However, as the market moves on to bigger issues, the EU-US trade war could become the focus. Now that the Trump Administration has settled for a temporality truce with China, it’ll turn its focus to Europe. News wire services are reporting that the administration will launch an investigation into a new French law aimed at taxing technology companies, and could impose tariffs against France. The Section 301 investigation is the same type that served as the starting point for US tariffs on China, and could open a new and ugly front in trade relations with the biggest market in the world. This week’s ZEW surveys and EZ inflation reports should pale in comparison to more important releases from other parts of the world.

BRITISH POUND

Data review

- BRC retail sales 1.6% vs -1.5% expected

- June GDP 0.3% vs 0.3% expected

- Industrial production 1.4% vs 1.5% expected

- Manufacturing production 1.4% vs 2.2% expected

- Trade balance -11.5bil vs -12.5bil expected

Data previews

- Labour market report: potential downside surprise, as manufacturing sector sees third straight month of job losses, but services see sharp improvement

- Consumer and producer prices: Prices mixed, according to services and manufacturing PMI. Input prices are strong, but output prices weaker.

- Retail sales: downside risk given drop in consumer confidence, BRC retail sales and shop prices

Key levels

- Support 1.2450

- Resistance 1.2600

Big week ahead of GBP

It’ll be a very busy week for sterling, as well, with labour, inflation and consumer spending reports scheduled for release. But, unlike some other countries where this week’s data could play an important role in near-term policy changes, the Bank of England has made it very clear that unless the economy starts spiraling lower, they don’t plan to change interest rates until Britain’s course for Brexit is determined. So, even though we believe that job growth, inflation and retail sales softened in the month of June, the negative impact on sterling could be limited. The bigger story is that Boris Johnson now appears to be a shoe-in for prime minister. He’s an advocate for sticking to the 31 Oct Brexit deadline, and prefers to leave with no deal than remain a hostage to the European Union. He’s been criticised for looking for ways to placate US President Trump, in the hopes of securing a beneficial trade deal with the US after Brexit. Voting for new PM began last week, and will last until the week of 21 July. The winner should be announced 23 July. If Johnson is selected as prime minister, the fear of an unruly Brexit could trigger a broad-based decline in sterling. Until then, the impact of data could be limited.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.