- English

- عربي

At this stage we can key off the FX open, where the USD has weakened 0.2% against the JPY. But this isn’t the USD finding fault, as the greenback is up against the higher-beta AUD and NZD, and finding against the CNH. We watch with interest once again the CNY fix. Should the People’s Bank of China break rank and weaken the CNY by more than the street, then we could see a negative move in risk as we head into the Asia lunch session.

The move into the JPY a reflection that the 15% tariffs have kicked in on around USD $110bn of Chinese exports (to the US), and we’ve seen China come back with tariffs up on USD $75bn of US exports. One questions if there was an element of the market expecting the implementation of tariffs to be put on hold given the positive noises from both camps of late. It seems not.

The news flowing from Hong Kong wouldn’t have gone unnoticed, and we watch to see if there’s an increased response from the Chinese authorities. A Chinese manufacturing PMI print of 49.5 (versus expectations of 49.6) has also been a consideration for AUD and NZD sellers here, where we see NZDJPY and AUDJPY lower by 0.6% and 0.3%, respectively. The fact we’re seeing a broad JPY appreciation suggest we see S&P 500 and crude futures will open a touch lower, with small buyers in Treasury futures.

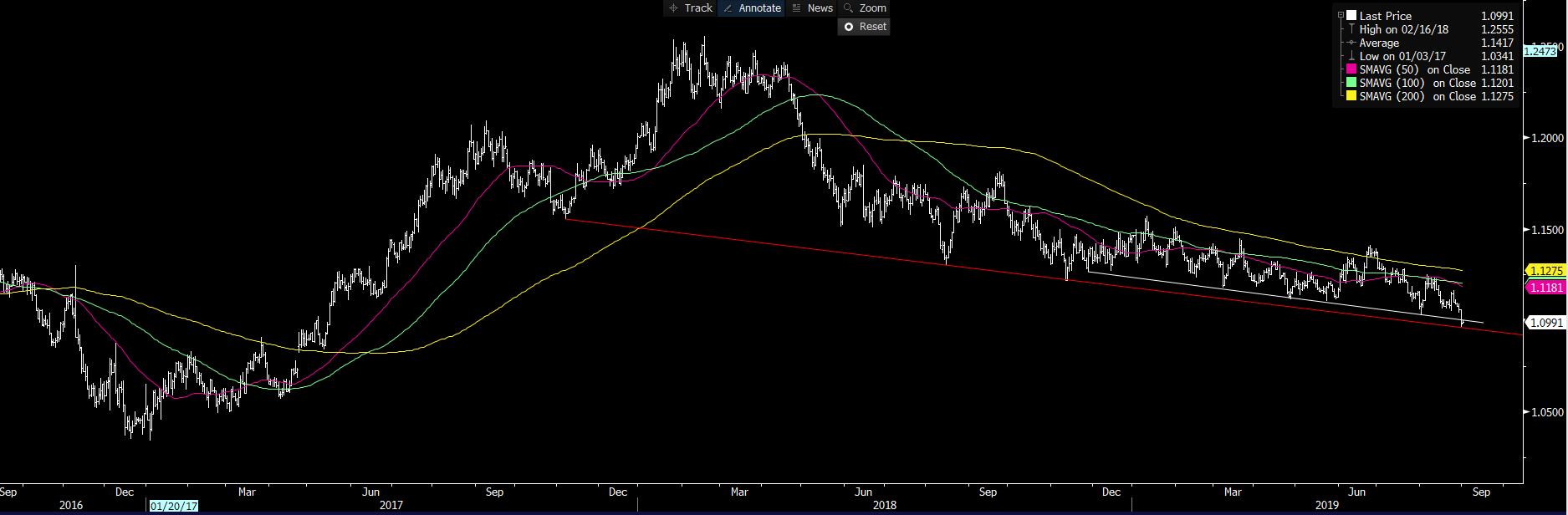

EURUSD moves in focus

Despite a whole barrage of European Central Bank speakers last week, including somewhat hawkish commentary from Klaas Knot, Sabine Lautenschläger and Jens Weidmann, which has thrown some uncertainty into the “kitchen sink” approach expected from the bank at the 12 September ECB meeting. The focus has been specifically on the break of 1.10 in EURUSD. It certainly was significant enough to garner the attention of Donald Trump, who said the EUR is dropping “like crazy, giving them a big export and manufacturing advantage.” Let’s see how things stand on Wednesday, when ECB chief economist Philip Lane speaks in London (21:00 AEST). He could really move the dial in a market that puts a 47.7% probability of the ECB’s deposit rate being taken to -60bp, as well as 52.3% to -50bp. The argument, like it’s in other nations, seems to be more about fiscal policy.

The fact Trump said the USD is the strongest in history highlights the weight he puts on the trade-weighted USD, which sits at 130.66 and resides at an all-time high. We trade the USD index (DXY), though, and whether we’re looking at the feel and structure on the daily or weekly timeframe this looks so bullish. The interesting aspect is, while we’re likely to see a better feel to this week’s US ISM manufacturing print amid robust payrolls data, we saw a huge drop off in Friday’s University of Michigan consumer sentiment report, with around a third of respondents highlighting concerns around trade tariffs. If the soft data goes lower, then the Federal Reserve will try and get ahead of the curve.

USD intervention grows a touch

However, with the USD strong and Trump making more noises on his disdain here, the question is at what stage do we genuinely start to consider US Treasury intervention. The US really is the missing link to higher FX volatility. If the US Treasury team, perhaps alongside the Fed, intervenes, then we can start talking currency wars. This is where gold and silver go wild not just because these metals are a clear hedge against negative real or nominal rates; it’d stick out as a currency in its own right, with emerging-market FX also working well in this environment.

We aren’t there yet, and the first port of call would be US Secretary of Treasury Steven Mnuchin putting intervention on the radar to scare off speculators. But for now, we look at the trigger points and a trade-weighted USD 3% to 5% higher, with an increased rate of change or a USD index above 100.00, and eyeing a test of the January 2017 highs of 103.82 would raise FX vols. These levels would suggest we see a EURUSD into 1.0500, with USDCNY into 7.25, and that wouldn’t go down well at the White House.

EURUSD is tracking a few pips higher this morning. But for now, the pair is holding the 1.10 handle and 1 August low of 1.1027. The technical traders are focused on the 1.0960 area, representing trend support drawn from November 2017 low. A move through here would only encourage the market to increase short exposures.

Trading the range in the S&P 500

The futures open will offer insights, and the lack of any inspiring news flow over the weekend offers no real bullish catalysts in a market that saw the S&P 500 close unchanged — with the market yet again finding sellers into 2940/5 zone. The 2945-to-2822 range is clear and defined, and when this breaks it’ll get great attention.

US Treasurys found small buyers in the front end, and tens and thirties unchanged at 1.49% and 1.96%, respectively. The twos / tens curve remains inverted, and that suggests staying cautious even if we’re coming into a seasonally strong period for risk, with the S&P 500 historically working well in the period up to 19 September, where we tend to fade the strength into options exportation, with gamma sellers and corporate buyback blackout a driver.

US crude 2.8% at USD $55.10, and sits 43rd percentile of the USD $60.94-to-$50.52 range it’s established since late May. Still, the S&P 500 energy sector closed +0.08%, so it’s unclear how this lead will influence Asian energy stocks. With Aussie SPI futures -8 from the ASX 200 cash close, we’re expecting a touch of weakness on the open, with Aussie traders eyeing a whole barrage of domestic data to navigate through. Tomorrow’s RBA meeting is the clear risk, although the market puts little weight on a cut (it’s priced at 13%). But the AUD could still have a move if the bank removes “if needed” from the “ease monetary policy further if needed” in the last paragraph. A break of 67c would be big.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.