- English

- عربي

From a fundamental perspective, we can see how various economic data points offer important intel towards key market debates and themes. For example, strong US labour data accelerates the timeline for the Federal Reserve to taper its bond-buying program with the Fed having a checklist to see “substantial progress” in the US economy. This may prove to be an equity negative and a USD positive.

With that in mind, I’ve laid out some pivotal dates which I feel the market will trade towards and that could hold major volatility risks for traders of all asset classes. But, certainly the sleepy conditions seen in FX should change and offer real opportunity for traders.

From a psychological perspective, when the market becomes fixated on an event risk and a specific date, which we see as offering new key information, then in many cases we see powerful trends develop in price as the collective start to price a consensus outcome.

It’s a great time to trade the opportunity and potential impending volatility with Pepperstone, with our reduced cost to trade and liquidity advantage – read more here.

US

At the time of writing, the USD index has a barrier on the daily at 91.31. While conversely, EURUSD has solid support at 1.1985. USDJPY has found a barrier at the 61.8% Fibo (of the 31 March – 23 April low) of 109.66.

DXY – daily chart

(Source: Tradingview)

EURUSD – daily chart

(Source: Tradingview)

However, as we roll through Q2 and certain models suggest US Q2 GDP could be in excess of 13%, the key debate is the timeline for a reduction in the monthly pace (currently $120b) of QE. The Fed need certain economic metrics (notably the labour market) to meet its substantial progress test. So, while we can look at higher frequency data (such as weekly jobless claims), here are the tier one event risks that could really provide insights into the Fed’s timeline and ultimately move markets.

7 May – US April payrolls - 978k jobs are expected with unemployment rate eyed at 5.8%

12 May – April CPI – the consensus is that core inflation rises to 2.3% and headline 3.6%

4 June – US May payrolls – expect a consensus close to 1m jobs created.

10 June – May CPI – could we see inflation push towards 4%?

17 June – FOMC meeting – we get new economic fed funds projections, could this be the stage to lay the groundwork for tapering?

13 July – June CPI inflation – another inflation print well north of 2% beckons.

Late August. The Jackson Hole Symposium. If the data holds up, the demand for the vaccine holds up and the trajectory of the labour market is towards full employment, Jackson Hole could be the stage for Powell to announce that the pace of the bond purchase program (QE) is to be reduced. While this should be well discounted and in the lead up to the fact, we could see heightened volatility.

Australia

The AUD price is being heavily influenced by the iron ore and copper price. But will domestic policy settings start to matter more? I suspect they will and the market is gunning for a major decision from the RBA on the future of its policy settings in July.

6 July – RBA meeting. The RBA have explicitly told us they plan to make a decision at this meeting and it will be a major event risk. The RBA will detail their decision with regards to potentially making adjustments to the pace of bond purchases (QE). Its commitment to its 3-year bond target through Yield Curve Control (YCC) - whether they communicate that it’s to be phased it out or roll the bond purchases from the April 2024 maturity to target the November 2024 maturity.

The market is split on the RBA’s actions here, with some expecting A$100b of additional QE to be announced, while others expect them to announce a reduction in bond purchases, running the risk of tapering before the Fed – a clear AUD positive.

Of course, with Jobkeepers having rolled off the economic data will guide the RBA here. We get two Aussie employment reports before the July RBA meeting (released 20 May and 17 June). Importantly we don’t get the Q2 CPI print until 28 July, so that may influence as the RBA will want to see a material improvement from the Q1 print.

Europe

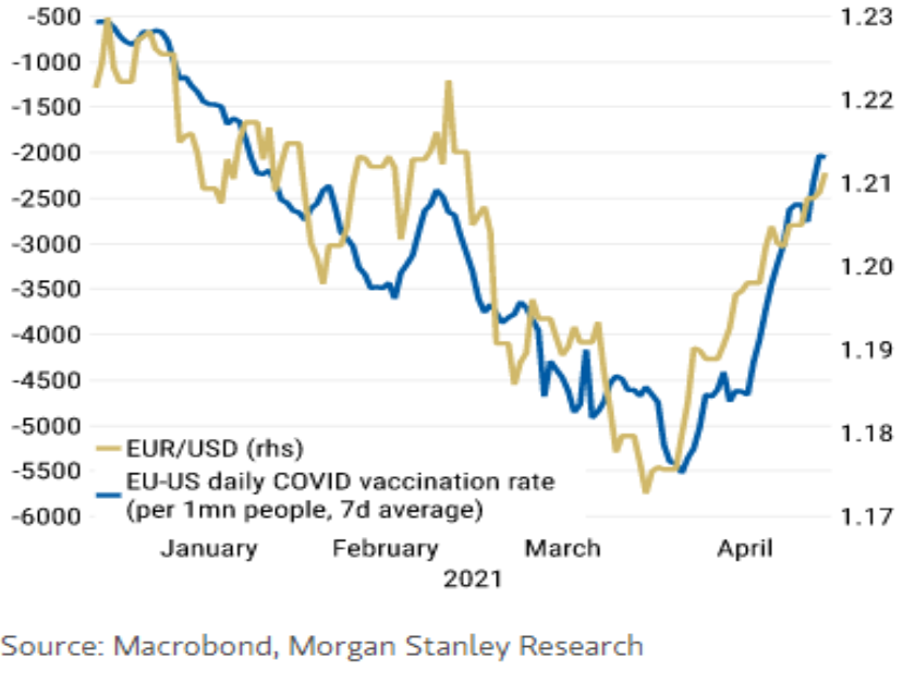

As the chart from Morgan Stanley shows, perhaps the key driver we should be looking at with EURUSD is relative vaccination rates. This makes sense given the impact vaccination rates will have on re-openings and the flow of spending and economics.

However, aside from this dynamic trader’s will be trading towards:

10 June – ECB meeting. ECB President Christine Lagarde detailed at the last central bank meeting that they would assess the pace of its own bond-buying program at the June meeting. This would be accompanied by new economic projections. There will be strong focus on the ECB’s plans here, but the bank will need to separate the idea that a slower pace of bond purchases is in no way a precursor to future rate hikes - with the first hike priced for Q1 2024.

26 September – German elections. A little further out and while it won’t get anywhere near the same publicity as the November US election, the German elections mark the end of Angela Merkel’s 16 years as chancellor. It seems the prospect of a strong involvement from the Greens is growing – either as a junior coalition partner with the CDU/CSU or in a tie-up with the SPD party. The Greens want to spend big, which means we could see Germany’s surplus swing to a deficit – this could see the DAX outperform, but it could hold negative implication for the EUR. Ready to trade the opportunity?

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420)