- English

- عربي

Talk is we're to see Q2 GDP coming in closer to -30%, but on the current tape, it does not matter - liquidity is all conquering. We can add in a monster rally in the energy sector, which is going to get further attention over the coming 24-hours ahead with reports the Trump Administration could acquire stakes or roll out measures to shore up the US oil companies. Earnings have also come in from a number of big names reporting just after the US cash close, with Microsoft, FB, Tesla and eBay ripping and keeping futures bid.

Reports on encouraging data from trials of Gilead Science drug Remdesivir came at a time when the Trump Admin was pushing out an ‘Operation Warp Speed’ program to get a vaccine to market. Again, risk feasted on this. This all seems positive, and from regardless of your position in the market this is the sort of news we want to see.

Powell keeps the gravy train alive

Risk was already strong into the Fed meeting, and there were clearly no concerns from the market that it would be a vol event. The wash-up of the meeting was that we did not really learn anything new, although expectations of big news weren’t elevated going into it - I guess if we had to assess the meeting, it was dovish at the margin. There was no tweaking of interest earned on excess reserves or changes to guidance. The market heard that they’re committed to using a full range of tools to support, and the credit policies are not subject to a USD limit. The Fed is not in a hurry to ‘lift-off’ in any way and stressed that “we are going to wait until we’re quite confident that the economy is well on the road to recovery."

In fact, Powell said they will continue to act “forcefully, proactively, and aggressively” and can do more if needed. Everything a liquidity-obsessed market wanted to hear. Baton now passed to the ECB, with Lagarde taking the podium.

The wash-up of these drivers has been the S&P 500 closing +2.7%, the NAS100 +3.5% and the Russell 2000 up 4.83% - volumes were solid, notably through the Nasdaq, although 1.6m S&P 500 futures contracts traded was a tad light. But overall, it was a move of good quality, with cyclicals easily outperforming defensives, small caps on fire and good breath.

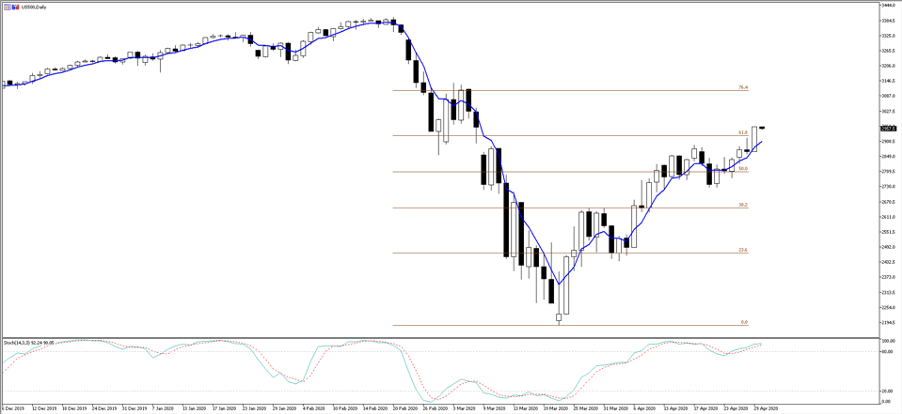

US equities offering Asia a strong platform

We also saw both the S&P 500 and futures close above the 61.8 fibo of Feb-March sell-off, with reports that the systematic hedge funds have fully covered shorts and now at levels where they are actively buying and will ramp up the notional exposures through 3000 (in the S&P futures) – I know we all say moving averages are old school and paint a picture that simply blends price action, but when trend-following funds (CTAs), with billions of USDs of capital are governed by them, we should respect them, especially when the index is in beast mode. The pain trade, it seems, remains higher.

US500 daily

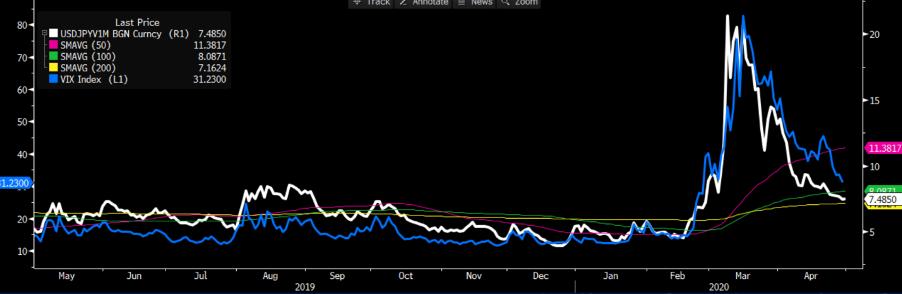

Implied volatility (vols) continue to fall, with the VIX index -2.3 vols at 31.2%, while in FX we see AUDJPY and USDJPY vols seemingly leading equity vol. Vols matter. If we see the VIX sub-20%, we will see vol-targeting hedge funds increase their weightings in equities too. So lower vols should create a new wave of capital into the markets. One to watch, but the Fed will be incredibly pleased here, as one effect they wanted from its many policy rollouts was vol suppression.

(Blue - VIX index, white - USDJPY 1-month implied vol)

"(Source: Bloomberg)"

AUDJPY 1-month implied vol

Risk FX on fire

Staying on the FX theme, and the positive feel was clearly seen here, with risk FX working well. Granted the DXY is down a mere 0.4%, but the losses were broad-based. I am holding the EURAUD short idea, although the clear consideration is whether to fully reduce EUR exposures into tonight’s ECB meeting. For those interested in the event, here’s a preview.

High beta FX is working well, although the ZAR deserves some attention after copping a ratings downgrade from S&P. The market may well shrug it off, in which case a move through 18-handle and 17.85 would compel a position.

Watching the petro-currencies given WTI and Brent crude are flying. Crude was rallying into the overnight weekly DoE inventory report, but we saw a further spike higher with traders looking at the 3.6m draw in gasoline stockpiles. As mentioned, Trump will soon announce aid to the US shale industry, which in some ways could be construed as an oil negative, as it will limit the needed reduction in production. We’ve also seen a solid flush out of the ETF selling, as the USO ETF has now re-positioned its holding through the futures curve. Norway has also stipulated the will cut production by 250k b/d in June and 134k d/d in 2H.

All-in-all, Asia will open on the front-foot with equity markets likely to unwind 1.5% to 2% higher, although once again we’re watching the Aussie banking sector with ANZ deferring its dividend and taking a $1.03b impairment charge. On the docket, and potential risk events we have China PMI (due 11:00am AEST – 51.0). We also look towards the ECB meeting (21:45 AEST) and US weekly jobless claims (3.5m new claims).

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.