- English

- عربي

The Daily Fix: The COVID-19 vaccination rollout an inspiration to markets

One aspect that has pushed up asset prices has been the roll-out of the COVID-19 vaccine, which has almost perfectly complimented the proposed new fiscal stimulus program in the US and ever accommodative stance from global central banks.

It certainly feels that the risk of upside in risk assets still outweighs the downside. That's unless we see a sharp downturn in economics which seems unlikely given the view that economics is about to turn more positive. Or we see the Fed offer a stronger signal that it's thinking about tapering its QE program, but that seems unlikely to play out for a few months.

Until we see weekly fund flows really turn more bearish, then risk assets will be supported as money managers know that a failure to be involved in the melt-up will cost them their jobs. Amid this backdrop, we should see further outperformance in US small caps (you can trade the US2000 with us), energy, materials, and financials – while bond curves steepen and pro-cyclical currencies, such as the NZD, AUD and MXN find buyers easy to come by.

The vaccine rollout is in full effect

One factor at the heart of this momentum trade is the rollout of the COVID-19 vaccine. After a few concerns, it’s now full steam ahead and we’ve seen over 131 million doses being administered across 73 counties. In the US the COVID daily case counts in on the decline, while at the same time the US is rolling out the vaccination in earnest – recent data had the US approaching an average of nearly 1.5 million doses per day last week, with this hitting 2.1m injections on Saturday alone. 10 US states have now vaccinated 10% of more residents with at least one shot and on the current trajectory. It will take around 10 months to cover 75% of the population. This equates to nearly 13 doses administered per 100 people, which lags Israel (62 doses per 100 people), UAE (39) and the UK (17).

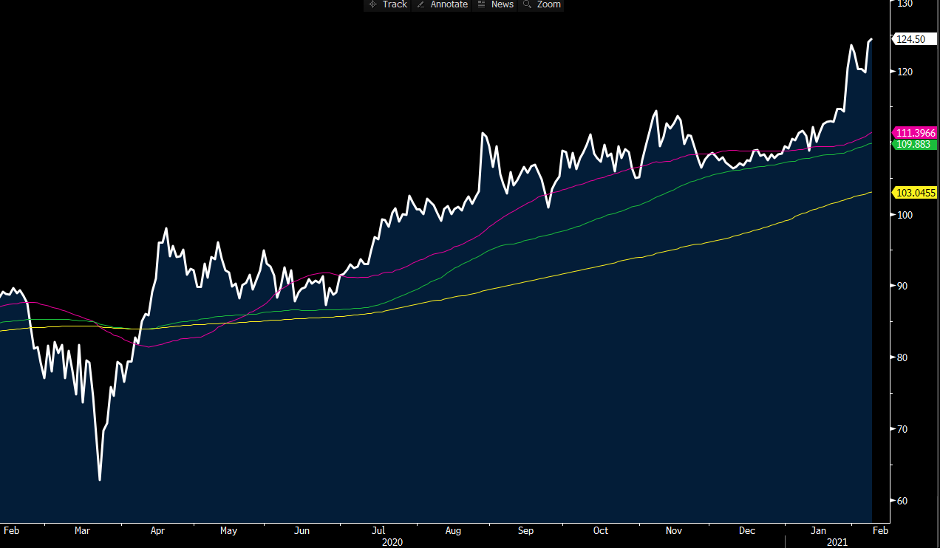

Daily chart of Abbott Labs

(Source: Bloomberg)

Bullish Abbott Labs and J&J

President Biden’s target of 100 million vaccines in 100 days is firmly on track and as Dr Fauci detailed on Sunday, the demand from US citizens is outpacing supply. It makes me question the investment case in the Pharma companies that are manufacturing these vaccines and how much is now discounted. Certainly, at this juncture Abbott Laboratories is trending strongly and on price action alone would be the pick of our equity offering. Johnson and Johnson are also looking quite upbeat, having just released its preliminary phase 3 trials for its single-shot vaccine and we await the FDA’s review in March and also 1 April when they roll out its vaccine across Europe. The single-shot aspect seems key when addressing global supply shortfall.

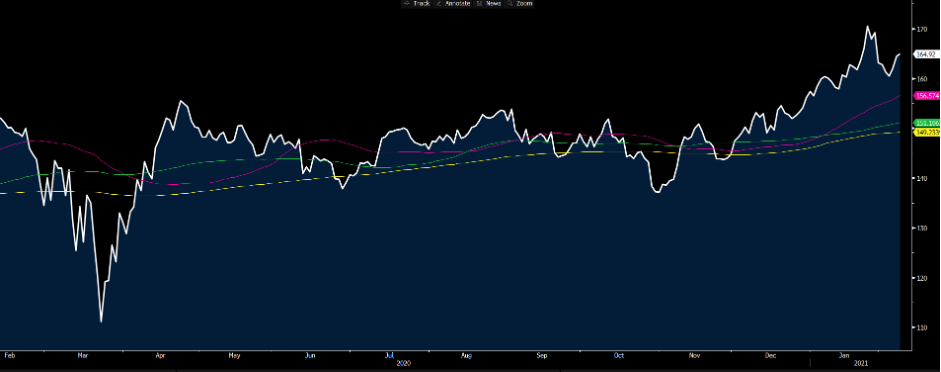

Pfizer is lagging its peers when we look at recent share price performance. However, the Pharma giant is expanding its capacity to 2 billion doses and has an agreement with the EU for 300 million doses, 200 million scheduled for this year – that can't be bad for the bottom line. Again, it also goes some way to answering the global supply question and when combined with supply from AstraZeneca, J&J, Pfizer and Novavax should meet what is required.

(Source: Bloomberg)

Predicting herd immunity

The market takes inspiration by the roll-out in the US, but also in the UK where current vaccination rates suggest 97% of the country could be vaccinated by December, with enough supply to be offered to all consenting adults by July. Europe is the clear laggard as is the case in Australia, but if we take a global view the question becomes whether the supply will be there and ultimately when do we feel we’ll see herd immunity?

The supply concerns as addressed are expected to be met by the manufacturers. By way of expectations around herd immunity, on current news flow it feels like the market is now of the view that herd immunity will be achieved in developed economies by late Q321. The rollout in emerging market nations is somewhat slower and the spread is quite vast across the nations, meaning accurately predicting herd immunity can be problematic.

For markets, the clear focus is on the US and while China is key to the global growth story, the focus there is less on COVID trends and more on the supply of credit and liquidity.

Maintaining a bullish bias for now

So, the signs are clearly encouraging and while there are concerns about mutated strains, on the whole this isn't just good for markets but the human race. The hope is this aggressive vaccine roll-out translates into re-openings and the release of pent-up demand from consumers - in turn, driving down savings rates and getting animal spirits firing up.

When combined with a huge dose of fiscal and monetary stimulus should indicate that the US, China, and global potential going to see real GDP above 6% in 2021. It seems until the Fed’s narrative turns more hawkish the vaccine rollout should keep frothy markets supported. Ready to trade the opportunity? Trade now with Pepperstone.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.