- English

- عربي

If Congress fails to pass a last-minute funding bill, non-essential agencies would close and a wide range of public services would be disrupted. For investors, the concern is not the bureaucracy itself, but the blackout of official economic data and statistical releases that serve as the compass for both policymakers and markets.

History offers useful reference points. The US has faced shutdowns before, most notably in 2013, which lasted 16 days over disputes tied to the Affordable Care Act, and the record 35-day shutdown of 2018-2019. While most standoffs end within two weeks, the 2018 episode demonstrated how prolonged deadlock can materially dent growth as the government spending freeze, with the Congressional Budget Office estimating GDP losses of roughly 11 billion dollars during that period. Equities typically weaken heading into and during shutdowns, only to rebound once funding is restored.

From Wall Street’s perspective, the most disruptive aspect of a shutdown is the absence of official data. The Bureau of Labor Statistics BLS operates on annual appropriations and has suspended its flagship NFP report in past shutdowns. Without it, investors lose a primary reference point and are forced to rely on less comprehensive alternatives such as ADP data, which do not capture the full labor market picture. Should NFP (this Friday) & CPI releases also be delayed, market participants would be left navigating through low visibility.

What this implies for markets is a likely increase in volatility, with the VIX currently at 16. Investors could rotate away from high-beta equities and toward Treasuries and gold, especially if the standoff extends beyond this week, though history suggests markets recover quickly once a resolution is reached.

Away from Washington, Saudi Arabia’s Public Investment Fund PIF has submitted a bid to acquire Electronic Arts in a leveraged buyout valued at roughly 55 billion dollars. Partnering with Silver Lake and Affinity Partners, the consortium has offered 210 dollars a share, representing a premium of nearly 25%. The structure includes 36 billion dollars in equity, leveraging PIF’s existing 9.9% stake in EA, and 20 billion dollars in debt financing led by JPMorgan Chase. While execution will take time, this stands as one of the largest gaming deals in history and underscores the fund’s ambition to shape global entertainment.

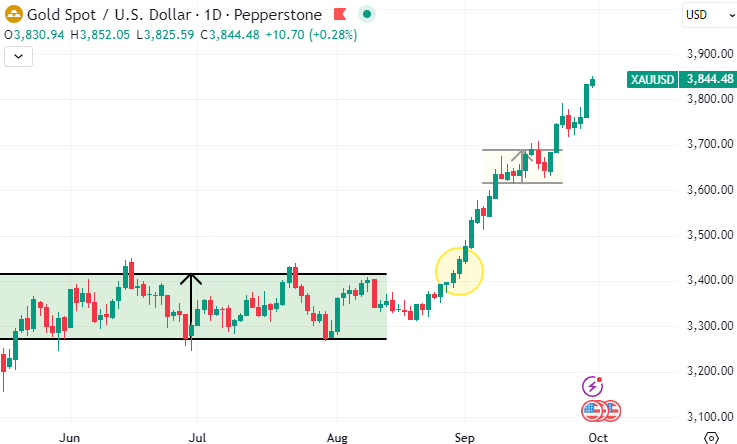

In commodities, the yellow metal surged through fresh record highs above 3,850 dollars an ounce, supported not only by speculative flows but also by structural demand. Central banks remain active buyers as part of reserve diversification, institutional portfolios have lifted allocations above the traditional 5% benchmark in an increasingly popular view, and gold’s low correlation with equities strengthens its appeal. Macro conditions add further support with the Fed remains on a path toward rate cuts, labor market indicators are softening and US equity valuations sit at stretched levels. Against this backdrop, gold stands on solid footing as both a hedge and a diversifier.

Selling gold at this juncture is proving costly, with profit-taking swiftly absorbed by demand. Short-term fatigue may emerge, but the ceiling on further gains appears fragile, reinforcing gold’s position.

The day ahead…

The Reserve Bank of Australia RBA is widely expected to keep rates unchanged at 3.60%. In the US, JOLTS job openings for August will be watched, with consensus pointing to 7.17 million versus 7.18 million previously. A modest decline would add to the narrative of a softening labor market. For most, the center of attention is the development of the government shutdown and any potential last minute resolutions.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.