- English

- عربي

Asian equity futures suggest a mixed footing on open, but the likes of Korea and Taiwan may be encouraged by the solid rally in US tech.

Tier one news has been on the light side, with traders still dissecting the worry expressed in the Fed statement but also encouraged by the enforcement of the Fed put, with Powell committed to doing whatever it takes for as long as it takes. If you didn’t see my take yesterday do have a look as it contains a number of dates I think are key, not to mention the Fed’s focus on high-frequency data, which I feel will get more credence going forward. We’ve also seen confirmation of how bad things were in Q2, with German Q2 GDP -10.1% QoQ (vs -9% eyed) and US Q2 GDP contracting 32.9%, following the 5% drop in Q1. Consumption fell 34.6%, modestly worse-than-expected but while this is awful reading it was expected and priced, although many have attributed a 2.2% decline in crude to these readings.

We look forward not backwards in markets unless the reading is such a significant miss that it has us questioning the logic in forecasting. Recall, the consensus for Q3 is +18%, so that is what we should be questioning – will this prove to be anywhere near correct?

Staying on the data vibe, US jobless claims printed 1.43m claims, which was in line with expectations and a slight lift from last week. Perhaps more worrying was continued claims pushing up to 17.02m – not good reading with the non-farm payrolls looming on 7 August. In upcoming trade, we get US personal income/spending, employment cost index, Chicago PMI and with core PCE inflation (all at 22:30 AEST). We also get the University of Michigan survey, so plenty to fest on, but I am sceptical they move markets.

There has been some banter about moving the November US election, but I am not sure how much credence that will get, amid cries it is unconstitutional and markets have shrugged it off. We are also no closer to a resolution on US Congressional fiscal talks and it looks as though we’ll head through the expiry of employment benefits with traders expecting some sort of stop-gap solution and a focus on getting it done ahead of Summer recess.

After a risk-off EU session (the DAX closed -3.5%), US traders saw things in a more positive light, with a solid bid coming back into the NAS100 from 10,531, to close at 10715, 1.7% off the lows. The US500 closed -0.4%, but this was 1.3% off the early lows and it was pleasing to see headlines that Miami and Houston hospitalisation rates had fallen for the third and ninth consecutive day. Implied volatility has risen a touch, with the VIX index +0.66 vols to 24.76%, while in Treasuries we’ve seen good buying from 5s through 30's which tells a fairly grim picture. US real yields are down 2bp and perhaps this has helped risk recovery a touch and helped stabilise gold from $1940.

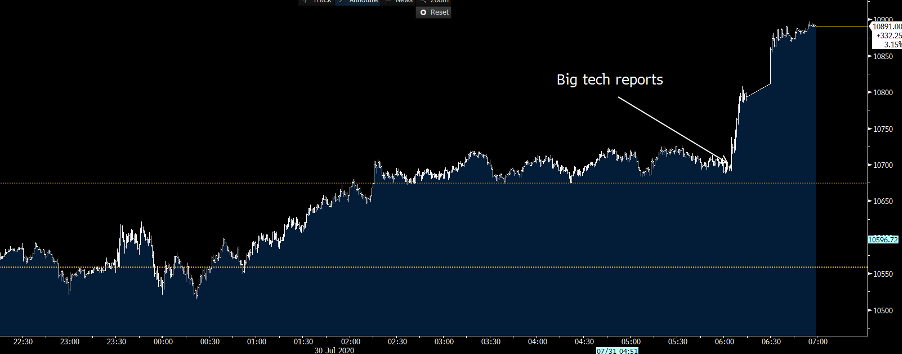

Intra-day moves in NASDAQ futures

All the action was geared to aftermarket trade though, where the biggest concentration of index weight and market ever reported. We’ve seen numbers from Apple, Amazon, Google and Facebook and the market likes what they see, with NAS futures rallying 1.8% in post-market trade. S&P 500 have pushed about 90bp higher and this will support risk through Asia.

(Source: Bloomberg)

In FX markets the GBP and EUR have worked nicely against the USD, with cable trending now and having taken out my 1.3000 target we look to the 9 March high of 1.3200. EURUSD has smashed the 1.18 level and sits 3% above the 20-day MA now, and you can see how price is hugging the upper Bollinger band all the way since mid-July. Mean reversion aside, I can’t be short EURUSD (given the trend), but this one-way move will not have gone unnoticed at the ECB, as is the case at the SNB, RBA and BOJ (and others) – but what can they do? AUDUSD will get some focus today with China releasing manufacturing and services PMI data at 11am AEST (consensus 50.8 on manufacturing) and traders eyeing a move above 72c.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.