- English

- عربي

A traders' week ahead playbook - Jackson Hole the focal point

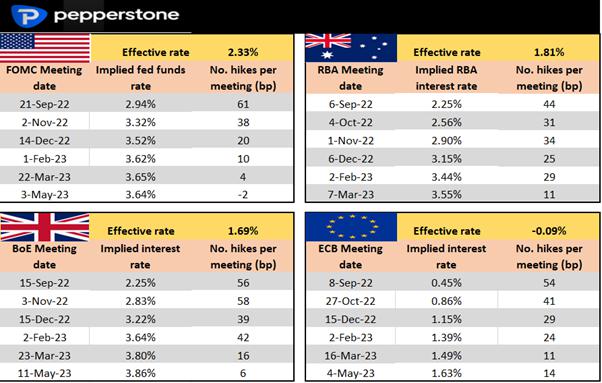

The event risk this week is really centred on Fed chair Jay Powell’s speech at the Jackson Hole forum (Sat 00:00AEST), with other global data points unlikely to promote as great a reaction – Powell should keep the option of a 75bp hike at the 21 Sept FOMC meeting firmly on the table, but offer the flexibility to go 50bp if we do see sufficient softening in the labour market in the US payrolls (NFP) report (2 Sept) and the pace of headline CPI inflation (13 Sept) falls again in the August read.

The prospect of acknowledging future triggers that could lead to the Fed cutting rates will not be present in his speech – the market would be highly surprised if they did hear this.

As it stands, the market prices 61bp of hikes from the Fed in the Sept FOMC meeting, therefore leaning closer to a 50bp hike – it would not surprise to see this pricing between 60-65bp by the end of the coming week - Powell will want to give the Fed maximum flexibility and optionality until they know the NFP and CPI prints. For this week, it's likely less about the known event risks and keeping it thematic - reacting to flows from a targeted group of markets.

5 key markets that could influence cross-asset volatility this week:

- The USD – notably USDCNH

- EU Nat Gas & German Electricity prices

- US 5 & 10-year real rates (for those on TradingView use the code - TVC:US05Y-FRED:T5YIE)

- US volatility index – the VIX index

- Fed balance sheet - A renewed belief that QT will ramp up

Specifically, EU Nat Gas (NG) prices are front of mind – EUR and EU equity index traders should watch EU energy markets closely – on Friday we saw the EU NG price trade to EUR262.78 – a new high in this bull trend and price continues to home in on EUR300. We see German ‘baseload’ electricity prices moving exponentially and again the further this rises, the worse economics in Europe will be into the next few months. News that Gazprom is to close the Nord Stream pipeline between 31 Aug and 2 Sept for maintenance has traders worried that the shutdown may be extended and is a EUR negative. Germany has done a decent job of stockpiling gas for the winter, but the market is nervous.

Upper pane – EU NG and German ‘baseload’ electricity prices

Lower pane – EURUSD

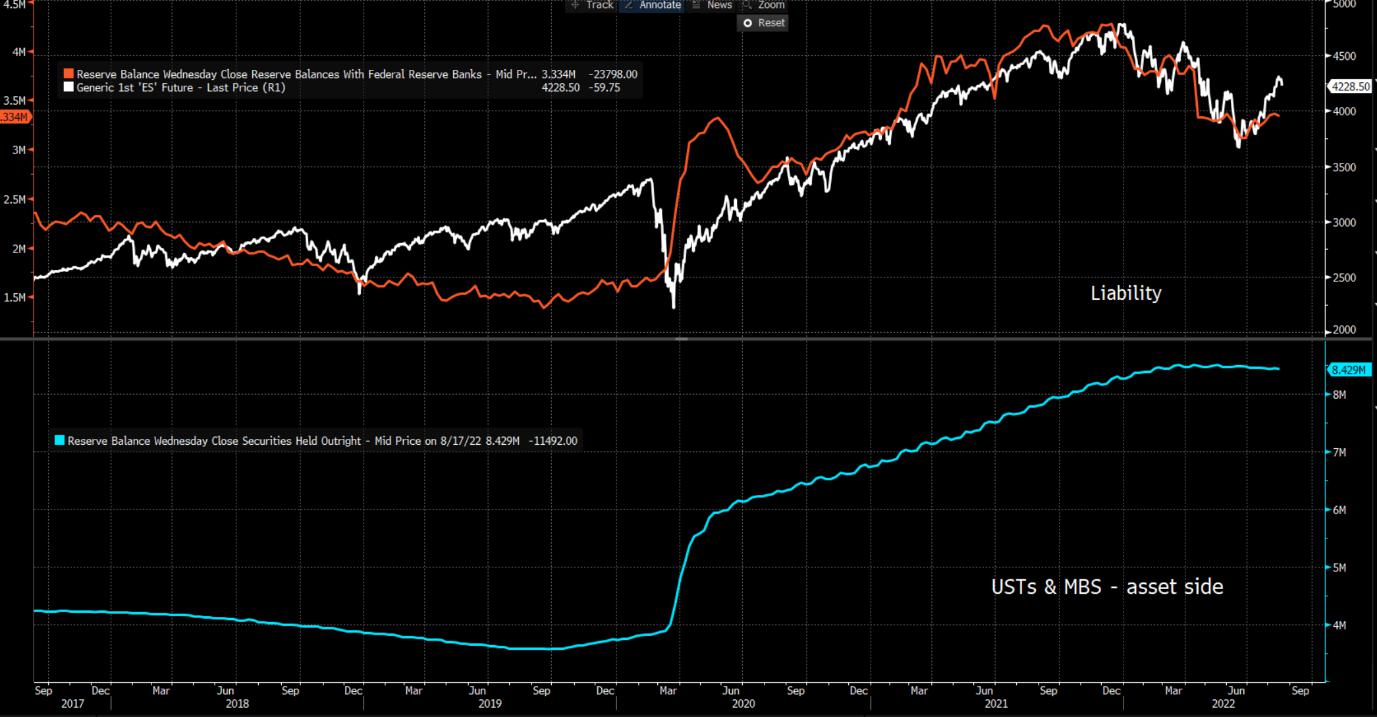

Fed balance sheet dynamics

We also watch the Fed’s balance sheet dynamic – like many, I have been focused on excess reserves passed to the Fed from US commercial banks – reserves have been on the rise, and by more than the Fed has been reducing its assets via QT - this better liquidity backdrop has been well correlated with risky assets. All the focus is on the Fed ready to ramp up the pace of reduction in the US Treasuries and potentially mortgages it holds on the asset side of the balance sheet – there is little doubt that these dynamics are boosting the USD.

Upper pane – reserves held with the Fed vs S&P500

Lower pane – assets (US Treasuries/ Mortgages) held on the balance sheet

And what a week I was for the USD – EU NG, Fed liquidity dynamics aside, a 1.4% move higher in USDCNH above 6.8300, all contributing in boosting the USD – with the PBoC likely cutting the 1- & 5-year Prime rate (11:15 AEST) by 10bp a piece, we watch USDCNH – while a cut is priced, an upside break of 6.85 would impact broad markets and should be on the radar. High beta FX was carted out last week, with USDZAR and NZDUSD leading the charge. AUDUSD gets prime time on the radar, and while 1-week implied volatility is not overly punchy (at 11.75%) and pricing the downside on the week into 0.6870 - the technicals are looking weak, with Friday close just holding the 5 August swing.

USDJPY has been a crowd favourite too, and it feels like this could squeeze into 138.00/20 before I have a greater conviction on fading the move. EURUSD sits on the 61.8% fibo of the July-Aug rally and parity is a whisker away – a fresh push higher in EU NG takes EURUSD through parity and possibly to 0.9920, and negatively impacts the GER40, with funds further shying away from EU exposure. We do get some data points in Europe to focus on – such as S&P global manufacturing PMI (Tue 18:00 AEST) and consumer confidence (Wed 00:00 AEST), but the EUR should take its cue from energy.

GBPUSD looks weak and the obvious level is the 14 July low of 1.1760 – rates markets price 56bp of further hikes from the BoE in the 15 Sept BoE meeting, and this week's data (again we see S&P global manufacturing PMI) may see traders’ massage that pricing. UK growth rates weigh on the GBP, and the market feels the UK may have crossed the Rubicon, to the point where high inflation becomes less supportive of a currency and impacts growth through the feedback loop to social channels.

If the USD is to find further form – driven by the US exceptionalism story, rising 2yr Treasuries and reduced liquidity from the Fed’s balance sheet, then other risky assets should head lower this coming week. BBBY aside, the risk ‘canary in the coalmine’ plays are looking vulnerable – ARKK, crypto, SPAC and IPO index, to name a few.

Implied vol is still sanguine, with our US volatility index making a move into 24.3% on Friday but not at levels indicative of greater S&P500 hedging demand. With options expiry now passed, we can watch (and/or trade) this index but the higher this goes the greater the opportunity to trade from the short side, as liquidity comes out of the market, the buyers stand aside, and cross-market correlations rise.

The momentum is to the downside in US500 and NAS100, although I am still waiting on a bearish MA crossover (3EMA < 8 EMA). A break of 4203 would put 4065 on the table. With so many turning bearish, a renewed push into 4340 would be the pain trade. I favour the downside tactically, but as always holding an open mind.

Rates review – looking at dynamic market pricing for the upcoming central bank meeting and the step up to the following meeting. Understanding what is priced can help with our risk management and the potential reaction to data/news.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.