A traders’ week ahead playbook – closing an incredibly eventful November

Core themes central to the narrative:

- Month-end flows – it’s always a fool’s errand attempting to trade month-end pension fund rebalancing flow and one really has little edge doing so – consider, however, the USD is -5% MTD and having its worst month since Sept 2010, with NZDUSD +7.5% to be the best performing G10 pair - the US500 is +4% MTD, while US Treasury futures are up 2.2% MTD – Chinese/HK equity indices have rallied some 20% - obviously big moves as we eye a data-heavy December

- Key technical levels being tested - With the DXY eyeing a test of its 200-day MA (105.01), USD bears will want GBPUSD to push above its 200-day (1.2183) and USDJPY below its respective average (133.96) this week – EURUSD has managed to close above its 200-day MA, with EU CPI firmly in focus this week – we question whether traders continue to sell USDs in month-end and what will be a lively December.

- China Covid case trends and lockdown measures – policy easing from the PBoC part offsets the impact of ever-more stringent lockdowns, where cities considered ‘high-risk’ areas account for just under two-thirds of China’s GDP.

- The equity ‘melt-up’…. The break of the bull flag on the US500 daily suggests a target of 4280 – a closing break of the 200-day MA (4043) would accelerate this view as active funds chase and CTAs add length

- Is bad news good news for risk? With terminal fed funds pricing at 5.02% and US 5YR real rates at 1.49%, bad US economic data this week should see both variables move lower and result in a positive performance to equities and further selling in the USD – bad news is good news in many cases for risky assets.

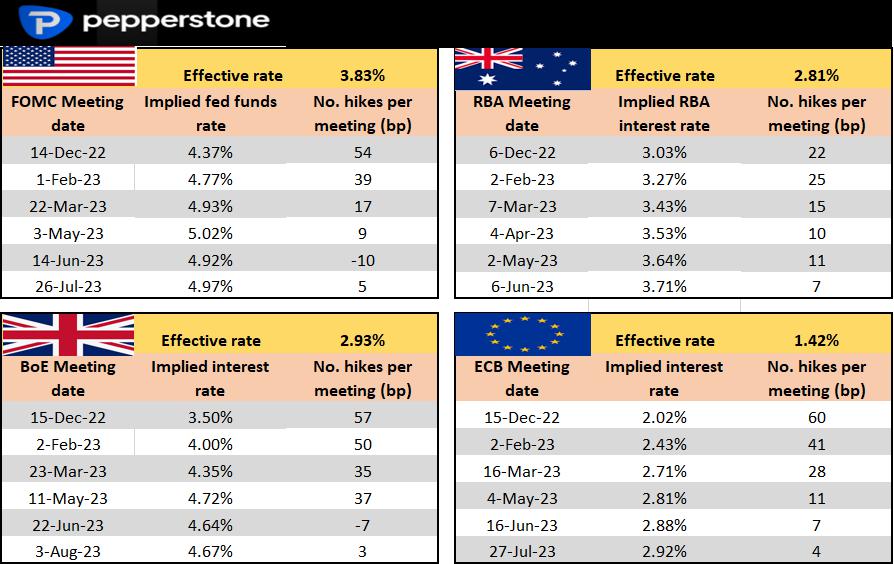

- Increased dispersions in policy from G10 central banks – as the Fed looks to step down to 50bp in the Dec FOMC, we’ve seen 75bp hikes from the RBNZ, Riksbank and the market is pricing a 40% chance of a 75bp hike from the ECB in its 15 Dec meeting.

Rates Review – we assess market pricing on the upcoming central bank meeting and the step up to the following meetings:

Assessing the event risk and potential land mines for the week ahead:

US

In the US we hear from 9 Fed speakers including Fed chair Jay Powell (Thursday 05:30 AEDT) who gets in with potential market-moving guidance just before the Fed's blackout period - the market will be watching this speech closely, so watch USD, XAU and NAS100 exposures here.

Staying in the US, we also receive consumer confidence, Case Shiller house price index (which caused some big market moves last month), core PCE, personal income and the ISM manufacturing report – while we still have several economists’ forecasts to be received, the current consensus sits at 49.8, which would be the first contraction in manufacturing since May 2020 – is bad manufacturing data good news for risk? I’d argue that would be the case in the NF payroll report, but a downside miss on manufacturing and the market might de-risk.

The highlight of the week will be key labour market reads, with the JOLTS job opening report and US non-farm payrolls (NFP) – the NFP is the marquee event risk for the week, where we see expectations of 200k jobs created and an unchanged U/E rate of 3.7% - average hourly earnings should pull to 4.6% - a cooling of the labour market is certainly good news for risky assets here, so a weak print and the NAS100 and gold fire up, with good sellers in the USD. USDJPY has been one for the radar and we watch for a break of 138.46.

Australia

In Aus we get the second monthly CPI read, where headline CPI is eyed at 7.6% (from 7.3%) and we get speeches from RBA gov Lowe (to the Senate) and RBA member Jonathan Kearns – it was a solid week for AUDUSD, where we see price threatening a break of clear resistance at 0.6800, ahead of the 200-day MA at 0.6934. The market is pricing 22bp of hikes from the RBA on the 6 Dec, so a 25bp hike is almost fully priced.

(AUDUSD daily)

China

The focus remains on the future with a the daily Covid case count now above 40k, a more stringent lockdown regime and rising protests and unrest – hence, the market will probably sidestep the manufacturing and services PMI (both due Wed) – While the govt looks at lockdowns, the PBoC supports with a 25bp cut to banks’ Reserve Ratio Requirements (announced Friday), injecting some RMB500b in liquidity into the economy and raising the prospect of a cut in the Prime Rate (due 20 Dec) – Monetary easing is obviously supportive of Chinese equity markets, but the uncertainty around Covid measures outweigh and offers a negative bias early this week in CHINAH, HK50, and CN50. Happy to sell weakness in HK50 on a break below 17,290 – conversely, the preference is to place buy stops orders above 18,500 as a momentum play.

We also see underlying upside momentum in USDCNH and an elevated prospect that the cross kicks above 7.20, and that may limit USD selling against other G10 pairs – let's see what we get on a monetary support level.

Europe

In Europe, while we get a raft of ECB speakers the highlight is EU CPI inflation estimate (Wed 21:00 AEDT), with French and German CPI (due 18:45 AEDT and 00:00 AEDT respectively) – for the EU estimate, the market expects a slight drop to 10.4% (from 10.7%) - given we see 60bp of hikes priced for the 15 DEC ECB meeting the CPI print could greatly influence the 50bp or 75bp debate.

EURUSD tracks above the 200-day MA but needs to kick. Long EURCAD is a trade I’ve been riding and will stay with that for 1.40+ - I said at the start of the week that the GER40 was the strongest market on the radar, and I remain skewed long, as is the case with the FRA40.

UK

Not much to watch in the UK this coming week – we get spluttering of housing data – Nationwide House prices, mortgage approvals and consumer credit – we hear from BoE economist Pill and Catherine Mann – the market prices 57bp of hikes from the BoE on 15 Dec, and again it’s hard to see this week’s UK data impacting this pricing too intently – a 50bp hike seems the most likely scenario. GBPCAD has been in beast mode, largely in line with GBP, but one to watch for the momentum traders.

Crude focus - OPEC summit

We a great trader focus on crude ahead of the weekend OPEC summit on 4 Dec – there are a lot of moving parts with China Covid dynamics, and price caps on Russian crude are the subject of increasingly intense debate, with Poland objecting to the proposed $65 p/b limit – earlier talk of output increases to be announced at this forum were later denied by the Saudis, so we’ll see how that goes – generally, WTI and Brent are both heavy and selling rallies is preferred – Last week’s 4.4% drop saw crude extended its run to 3 consecutive weeks of losses - The 26 Sept swing low of $76.61 is the big level to watch – OPEC aside, China Covid news flow likely a key driver here.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.