- English

- عربي

That said, much will need to go right for risk hedges to be partly unwound and risky assets to bounce – better growth-focused economic data, inflation expectations headed lower but also US real rates will need to turn lower and promote a deeper sell-off in the USD - after the moves in US 5yr real rates last week (+37bp to 1.97%), this is a big ask.

Rates volatility did pull back a touch on Thursday and Friday and we will need to see that follow through to cause a real turn in risky assets.

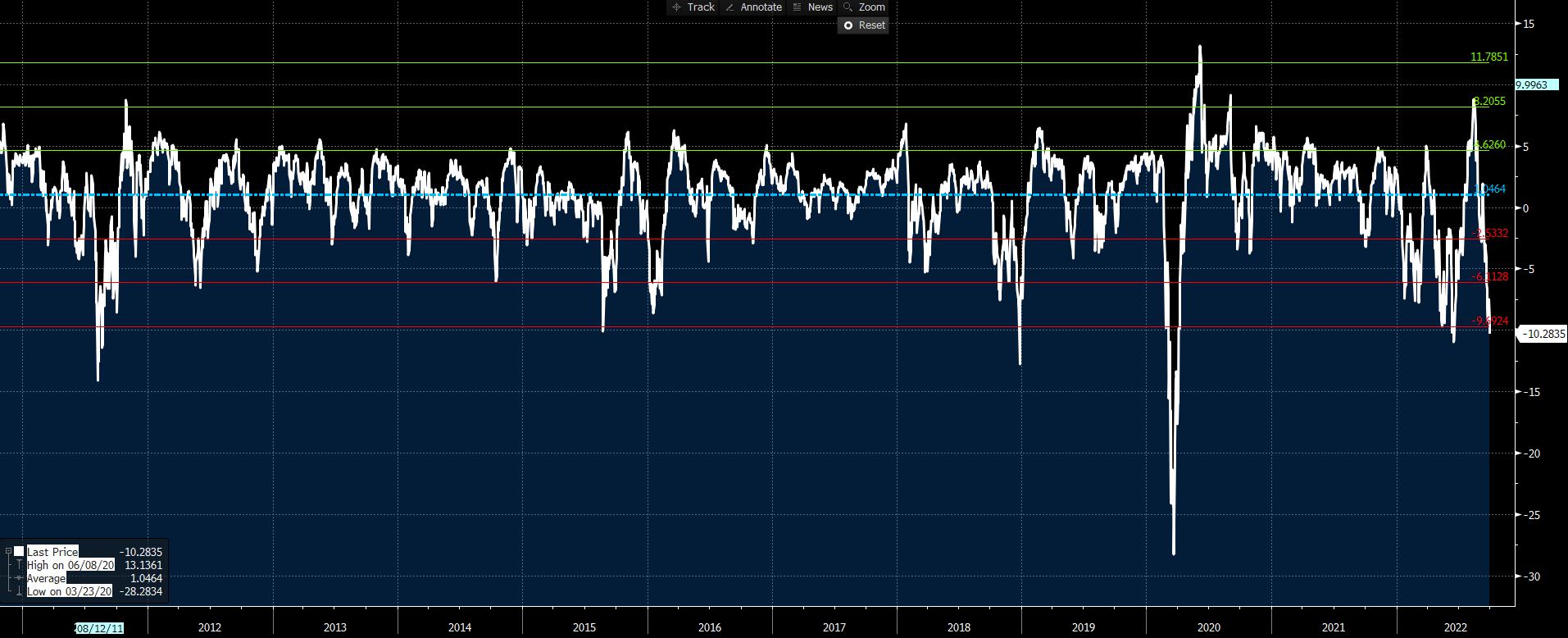

(US500 price from its 50-day MA, with standard deviation bands)

One trading consideration I see is that mean reversion may work better this week across asset classes, and we’re already seeing signs of that in FX markets – In equity indices, we see the US500 is tracking over 10% from its 50-day MA – take out the ferocious moves in March 2020 and this is over 3 standard deviations from the long-run average. Market internals is shot to pieces with 1.7% of S&P500 co’s above their 20-day MA, 32% of co’s with an RSI below 30, and 35% of co’s at new 4-week lows. This ultra-bearish sentiment plays into the risk v reward trade-off, and it suggests if we hear something remotely positive, and we see better flow, the result will be a pronounced equity counter-rally, and this may incentives funds to reduce USD longs as the default equity hedge.

Conversely, it could also be another brutal week, and one suspects if it is it will get truly ugly and see market chatter around coordinated policy response increase – liquidity remains a core consideration that exacerbates moves as funds try and get out of positions – spreads in the underlying market have widened in response and the cost to trade for institutional funds has increased. In this backdrop it pays to take the timeframe down, understand that markets can turn on a dime and on little news and quite often these moves make little sense – nail your position size, have an open mind, and react with intent – this will serve you well and keep you in the game.

While we watch the USD, US real rates, the Fed’s balance sheet dynamics and measures of volatility, we assess the key known event risks traders need to navigate portfolio through this week.

The week ahead:

Aussie home loan values (Tuesday 11:30 AEDT) – the data is unlikely to be too impactful on the AUS200 or AUD, but the cooling in lending is a big macro consideration – this is not just indicative of a slowdown in the demand for loans for residential property, but also business loans – The market expects home loan values to fall 3% in August, with owner-occupier loans seeing the bigger falls -3.5%.

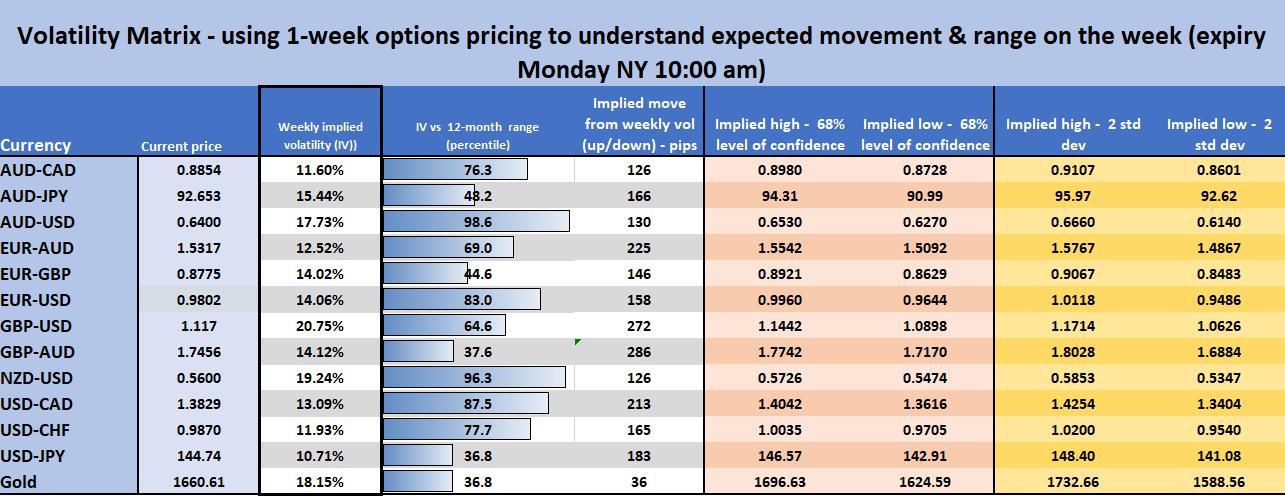

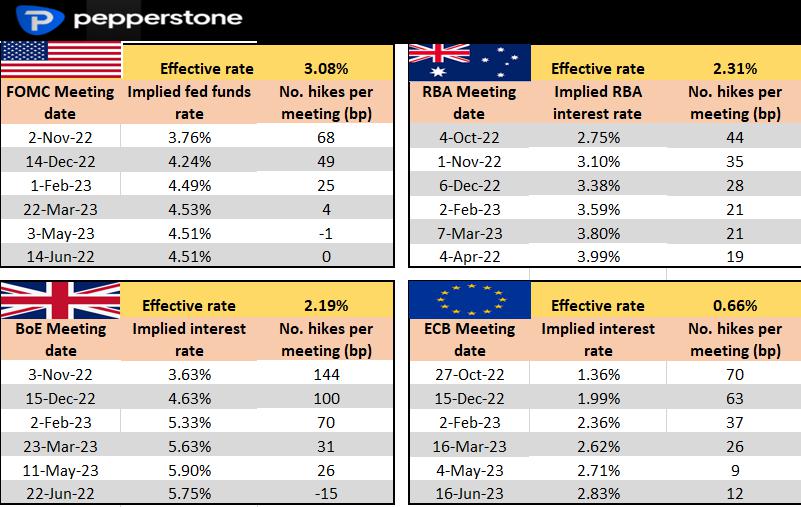

RBA meeting (Tuesday 14:30 AEDT) – the market prices a hike of 44bp, with 16/21 economists calling for the 50bp hike, so a 50bp is largely priced – We look at pricing for the November RBA meeting and see this is finely balanced at 35bp, where I lean towards a 25bp hike - we see that expectations are that the RBA cash rate pushes to 4.10% by June ‘23 – this is the ‘terminal’ pricing. AUDUSD 1-week implied volatility is close to 52-week highs, so the market looks for movement and this suggests reduced position size. Given the sky-high correlation between the AUD and equities, where the S&P500 futures trade, AUDUSD will follow.

RBNZ meeting – (Wed 12:00 AEDT) – the market prices 52bp of hikes for the meeting, with the economist’s consensus firmly aligned – NZDUSD was destroyed on Friday (-2.3%), closing below 0.5600 – similar to the AUDUSD, NZDUSD will just track the US500 – keeping an open mind on the direction of play in the US500, with sentiment shot to pieces, but it can easily get worse.

UK Tory party conference (2-5 Oct) – all eyes on chancellor Kwarteng’s speech on Monday (16:00 BST / 02:00 AEDT) – the situation in UK politics is fluid and the inability of the Truss govt to connect with the capital markets is telling – GBPUSD traded an 884-pip range last week, and the reversal from <1.0500 caught a lot of momentum driven accounts off guard. Moves from the BoE to temporarily buy 20yr+ gilts and portray a monster rate hike in Nov have reduced cable vol, but we also know the bond-buying program is supposedly a stop-gap measure – there is no easy trade here – fundamentally, the bear case in GBP looks strongest, but technically there’s a two-way risk.

OPEC meeting (Wed) – the first in-person meeting since March 2020, it could be lively and one for crude trade to put on the radar - talk of output cuts to the tune of 0.5-1.0 million BPD is making waves, with Russia pushing for a 1m barrel cut – as always we react to news flow here – I like a re-test of the Sept lows of $76.22, but the bigger the output cut, the less likely the lows will be hit.

US ISM manufacturing (Tue 01:00 AEDT) – the market looks for the diffusion index to print 52.1 (from 52.8), where we look into the sub-components for real context, notably the ‘prices paid’ and ‘supplier delivery’ sub-surveys – however, unless we see the headline index below 50.0 it shouldn’t cause any major ripples, but with sentiment so shot the unexpected can easily rip.

US JOLTS report (Wed 01:00 AEDT) – with the US labour market such a hot topic, we go into the labour report expecting 11.075M jobs openings. This would be a modest decline from the 11.239m job openings we saw in July – risky assets would find relief buying/short covering on a below consensus number, although we’d need a dramatic downside miss to really get the party started. A hotter number would be a USD positive and see fresh lows in the US500/NAS100.

ISM services – not typically a market mover, but we are watching to see if the service sector shows any clearer signs of fragility – the consensus expects a read of 56.0 in September (from 56.9), which if comes to fruition is still solid expansion and supportive of risky assets.

US Non-farm payrolls (Fri 23:30 AEDT) – the marquee (known) event risk of the week – the consensus expects 250k jobs to be created, with the economists forecast range seen between +389k to 200k – perversely, a number below 200k would likely be taken as a positive for risky assets and would pull the USD lower. We also consider the unemployment rate with the consensus expecting this to remain at 3.7% - with inflation still top of mind, average hourly wages are expected at 5.1% (from 5.2%), so ahead of the Sept CPI print (13 Oct – expecting headline CPI to print 8.1%), the wage data could be influential. Risky assets (like equities) would find buyers on a sub-5% print.

14 Fed speakers – hard to see too much change from the recent Fed chatter but there has been some cooling of inflation expectations, amid the tighter financial conditions, so any acknowledgement of these moves could be positive for risk. Rates markets are signaling we are closer to a top if rate hikes.

ECB president Lagarde speaks (Tue 2 am) – we price 70bp of hikes for the ECB’s Oct meeting, so we question if Christine Lagarde alters this pricing.

1-week G10 and XAU implied vol matrix

Rates review - what's priced into markets for the next central bank meeting and the step up (in basis points) to the following meetings

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.