- English

- عربي

A Traders’ Playbook – Defence remains the best form of attack

The geopolitical backdrop in the Middle East remains a dominant market consideration with the collective still debating whether we see other players stepping into the conflict on a more intense basis, resulting in supply disruptions to energy production and flow.

Potentially another bout of weekend hedging flow, a near 3% rally in Brent crude on Friday testament to those worries, with the move above $90 seeing traders bid up gold to $2006, with gold's role as the preeminent portfolio hedge once again confirmed. A move into the April/May supply area of $2050 seems perfectly feasible, and the bullish momentum in the price, and the ease by which we’ve seen gold push through well-watched resistance levels, suggests the path of least resistance remains higher and pullbacks should be well supported.

The BoJ meeting could be a real curveball and while the odds are we see it proving to be a low-volatility event, if the BoJ does tweak the YCC cap to 1.5% it could trigger a wave of selling through global long-end bonds (yields higher). This would likely see sizeable gyrations play through all markets, with the JPY – which has stolen the crown from the CHF as the no.1 geopolitical FX hedge – likely to rally hard. Gov Ueda has aimed to be more predictable than former gov Kuroda, so with recent press suggesting a tweak to YCC could be on the cards, the prospect of change to policy is 50:50.

We also get the US Treasury Quarterly Refunding activity throughout the week. To those who aren’t fixed-income traders, this can be an event that isn’t too well-known. As we saw in August, when the Treasury Department detailed increased auction size in its financing plans, it proved to be a key driver behind US Treasury yields rising sharply from 4%. Once again, this event does have the potential to create some big vol in bonds, which could spill over into FX and equity markets. This time around, could we see lower increases in supply, which in turn supports USTs?

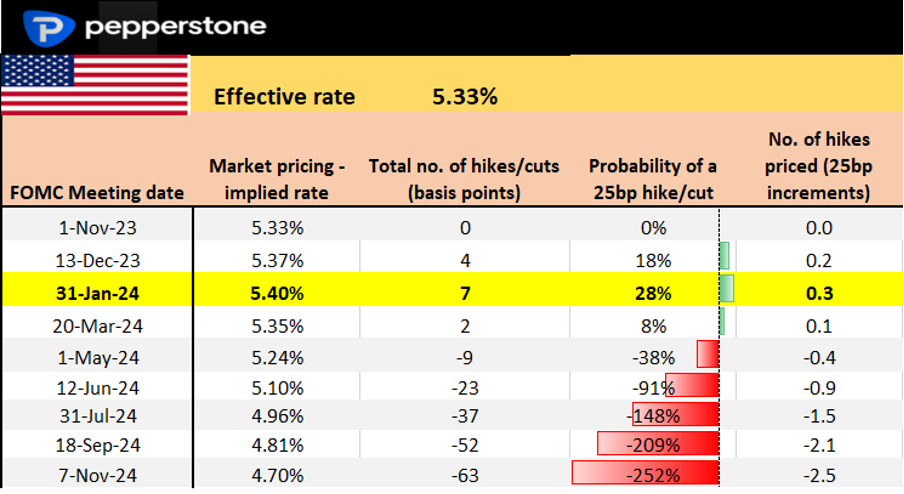

Staying in the US, while the FOMC meeting can never be ignored, traders get a thorough read on the US labour market and wages/earnings. On the docket, we get ADP payrolls, the Employment Cost Index, JOLTS job openings, Unit Labour Costs, jobless claims, and nonfarm payrolls. US swaps pricing sees very little chance of a hike this week, and a 20% chance for December, so big numbers in this report could see that probability rise, which would likely see the USD break out of the current sideways consolidation.

Corporate earnings get another run past traders, with 24% of the S&P500 market cap reporting. Apple is the marquee name to report, with the options market pricing a move on the day at 3.7% - the market focused on iPhone demand and consumer trends in China. Rallies have been sold of late, with price now below the 200-day MA for the first time since 2 March 2022.

It promises to be another lively week – good luck to all.

The marquee event risks for the week ahead:

Month-end flows – talk is pension funds and other asset managers rebalancing in favour of selling of USDs.

China manufacturing and services PMI (31 Oct 12:30 AEDT) – the market sees the manufacturing index at 50.2 (unchanged) and services index at 51.8.

EU CPI (31 Oct 21:00 AEDT) – while EU growth data seems the more important factor, we could see some volatility in the EUR on this data point. The market consensus is for headline CPI to come in at 3.1% and core CPI at 4.2%. EURCAD is trending higher, and I like it into 1.4750.

BoJ meeting Japan (31 Oct – no set time) – the BoJ should increase their inflation estimates, but the focus will fall on whether there is an adjustment or even full removal of Yield Curve Control (YCC). This is where the BoJ currently cap 10-yr JGB yields (Japan Govt bonds) at 1%. The consensus sees no change to YCC at this meeting, but there is a 50:50 chance we see the cap lifted to 1.5% - an action which could see JGBs sell off (higher yields) and see global bond yields higher in symphony. It could also see the JPY rally strongly.

US consumer confidence (1 Nov 01:00 AEDT) – The market expects the index to pull back to 100.0 (from 103.0) – unlikely to cause to much of a reaction across markets unless it’s a big miss.

US Treasury November Refunding (30 Nov at 06:00 & 1 Nov 12:30 AEDT) – the US Treasury Department (UST) will offer its gross financing estimates for Q42023 (currently $850b) and end-of-quarter targets for its cash balances. It is likely that the gross borrowing estimate will be lowered to $800b, perhaps even lower. The lower the outcome the more USTs should rally and vice versa.

On 1 Nov we will see the UST announce the size of upcoming bond auctions across the 2-, 3-, 5-, 7-, 10- and 30-year bond maturities. The market expects auction sizes to increase across ‘the curve’ by around $1-2b for each maturity. As we saw in August, the higher we see these taken the greater the likely reaction in US Treasuries and subsequently the USD.

FOMC meeting (2 Nov 05:00 AEDT) – The market ascribes no chance of a hike, so guidance from the statement and Powell’s press conference is key. One can never overlook a Fed meeting, but in theory, we shouldn’t learn too much new information and this should be a low-drama event. Here is our FOMC preview.

BoE meeting (2 Nov 23:00 AEDT) – UK swaps price a 4% chance of a 25bp hike at this meeting, and around a 1 in 3 chance of a 25bp hike by Feb 24. The split in the voting could also be important, with most economists leaning on a 6:3 split. The market feels like the BoE are done hiking, with cuts starting to be priced by June.

US ISM manufacturing (2 Nov 01:00) – The consensus is for the index to come in at 49.0 (unchanged). Consider that the diffusion index has been below 50 since October 2022, so a reading above 50.0 could be modestly USD positive.

US JOLTS job openings (2 Nov 01:00) – Last month we saw a big increase in job openings and further evidence the US labour market is tight. The consensus this time around is for 9.265m job openings (from 9.61m) – risky assets will want to see this turn lower again with reduced job openings.

US nonfarm payrolls (3 Nov 23:30 AEDT) – With so many labour market and wage/earnings data point due out this week, the US NFP report is the highlight. After last month’s blowout 336k jobs print, the current consensus is for 190k jobs, the U/E rate at 3.8% and average hourly earnings at 4%.

Brazil Central Bank meeting (2 Nov 08:30 AEDT) – The BCB should cut by 50bp.

Earnings – This week we see earnings from UK, EU and US listed names coming in thick and fast - 24% of the S&P500 market cap report this week. Numbers from HSBC (Monday), Caterpillar (Tuesday) AMD (Tuesday), Qualcomm (Wednesday), Apple (Thursday) should get the attention.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.