US Q3 earnings – Citi, JPM, BAC, WFC, UnitedHealth, WFC.

When we look at the companies included in the US30, there are only two banks (of the 30 constituents) - Goldman Sachs and JP Morgan. However, the US30 holds an incredibly high relationship with the XLF ETF (S&P financial sector ETF), with a 10-day correlation of 93%. So, with so many of the major financial institutions reporting, and assuming this incredibly tight relationship holds up, the US30 should take its inspiration from the movement in the US banks.

Another important risk for US30 traders this week is how the market reacts to earnings from United Health (UNH - report on 13 October). UNH commands a massive 10% weight on the US30, making it arguably the biggest weight on the index.

.png)

UNH is not a stock that CFD traders look at as closely as say a more volatile Tesla or Nvidia, given its more defensive price action. It’s one for the range traders, where buying into $460 and shorting into $520 has worked well over the past 12 months. However, given the weighting, US30 traders should be aware of the influence the stock can offer.

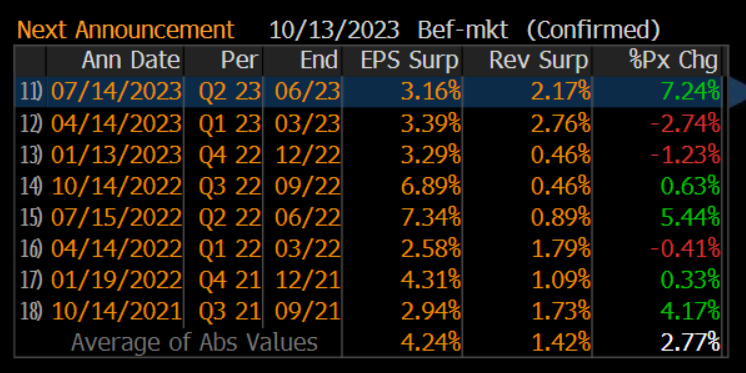

The market prices an implied move of 2.6% move on the day of UNHs reporting, which is in fitting with the average price change over the past 8 quarterly reporting periods. UNH has seen some large percentage moves over earnings and recall in the last earnings report the stock rallied 7.2% - so a sizeable rally/decline would influence the US30 given the weight.

While macro factors such as moves in bond yields, the USD and oil prices will influence the US30, one can see that earnings this week could also play a major role – time to buy the dip, or are we about to see a leg lower in the index?

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420)