- English

- عربي

Market Intelligence: Six reasons October will be a big month for traders

In the UK, Prime Minister Boris Johnson’s plans for a hard Brexit are facing increasing obstacles. In the US, a formal impeachment inquiry has been launched against President Donald Trump after the Ukraine whistleblower controversy.

Meanwhile, central banks around the world are deciding whether or not to ease as they navigate an uncertain global outlook. Of course, US–China trade tensions continue to linger and should continue to be dominant driver of financial markets.

Here are the six key event risks and opportunities throughout October:

- At the October European Union Summit (17 - 18 October), the UK PM is expected to negotiate a Brexit deal. Parliament has ruled he must request an extension if no agreement is reached.

- High-level trade talks between the US and China are scheduled for 10 October. The announcement initially calmed markets, but Trump has since rubbished the possibility of an interim deal, indicating he wants a complete deal only.

- The FOMC meeting on 30 October will be “data-dependent,” according to Federal Reserve Chair Jerome Powell. Will we see a third and potentially final cut as part of the “mid-cycle adjustment”?

- The market is pricing a 15% chance of a rate hike at the 24 October European Central Bank meeting, showing ECB monetary policy is exhausted.

- Markets have brought forward expectations of an RBA rate cut from December to October after poor August employment data.

- The Bank of Japan has hinted at easing when they next meet. Previous monetary measures have failed to get inflation back on track, exacerbated by global uncertainties. The 31 October BoJ meeting will be live, and we expect changes to policy.

1 October – RBA rate decision

Not long ago it looked like the RBA would hold the cash rate steady at 1% when they meet in October, with only a 42% chance of a cut.

Expectations changed on the back of the September RBA minutes and sufficient slack in the August unemployment data, where the unemployment rate lifted to 5.3% from 5.2%. The labour market was a focus of back-to-back rate cuts in June and July. Seeing the rate tick even higher has brought forward rate cut expectations from December to October.

Then, there’s the Australian consumer who’s reluctant to spend despite recent income tax cuts — another reason to lower rates sooner than expected.

Furthermore, the RBA will be keen to keep the momentum going, and will want to offset any effect from a further Fed rate cuts here to maintain export competitiveness.

What the Australian economy really needs is fiscal stimulus to spur the consumer, as monetary policy seems to become less and less effective the lower rates go. Yet, the Morrison Government is more focused on achieving a budget surplus than any serious fiscal measure to lift a dragging economy. Without fiscal stimulus that central banks are calling for globally, the RBA will have their hand forced to move to the cash rate closer to the zero-lower bound.

Looking past the October rate decision, keep an eye on the next round of unemployment data pencilled for 17 October. Another poor result here will encourage even more easing and would see a dip lower in AUDUSD.

10 October – US-China ‘high-level’ trade talks. US Treasury has said currency issues will be a focus.

The market stopped to breathe for a moment when Trump delayed a round of tariffs on Chinese goods early September. High-level trade talks were announced after the act of goodwill leading up to the 70th anniversary of the People’s Republic of China.

But, as the pattern goes with this trade war, what goes up must come down. And down it came when Trump said he probably doesn’t need a trade deal to win a second presidential term in 2020.

He also rubbished the idea of an interim deal, saying he’s looking for a complete deal in his all-or-nothing approach to trade negotiations.

Some speculators were hoping Trump would want to have tidied up the trade war leading into the election, giving a deadline to trade uncertainties. But now with no end in sight, markets are again left feeling a little less certain, especially with the trial balloons that Trump could restrict Chinese access to US capital markets.

17 - 18 October – EU Summit

Assess your exposures to GBP here. Expect a window of volatility during the EU Summit from 17 - 18 October.

Markets will be listening closely to what comes during the EU meeting, especially after a major blow to UK PM Boris Johnson’s Brexit plans, when the Supreme Court ruled his suspension of Parliament was an unlawful attempt to quash Brexit debate.

The Prime Minister is expected to negotiate a Brexit deal at the EU Summit. The UK Parliament has even ruled an extension to Article 50 must be requested, probably on 19 October, if an agreement can’t be reached at the event. If Johnson doesn’t request an extension, then we expect a vote of no confidence and a possible caretaker government.

As the PM’s plans for a hard Brexit are increasingly thwarted, we should see more GBP buyers here as the currency ticks up.

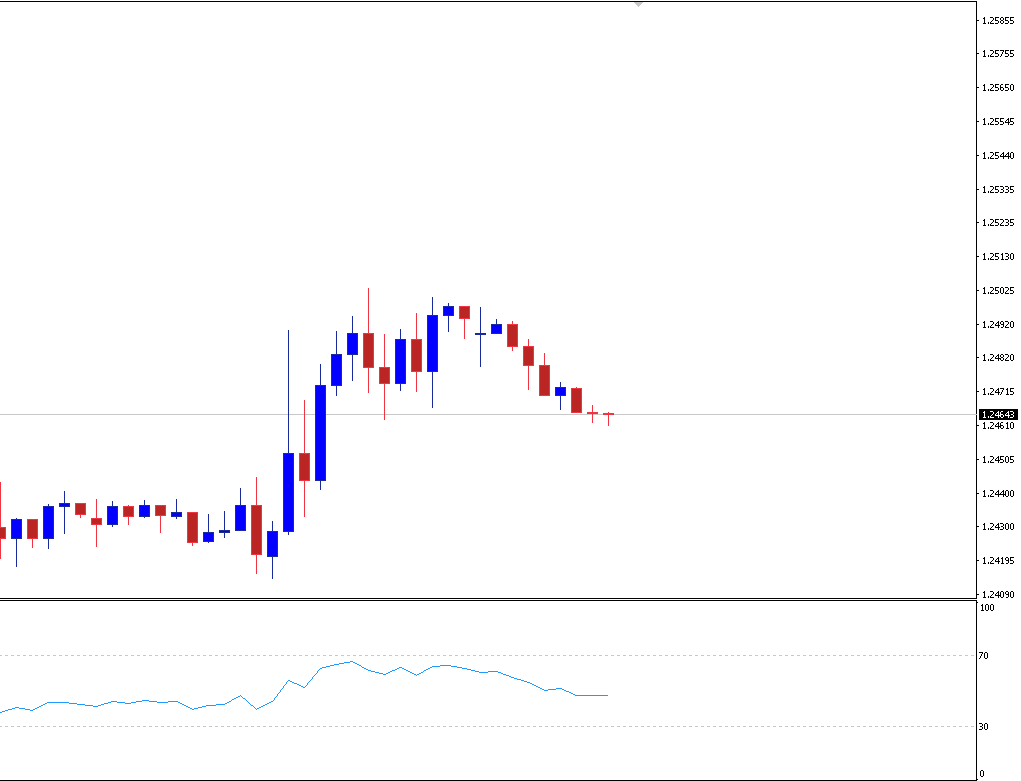

Watch GBPUSD: There’ll be buying opportunities in the selloffs, but keep exposures small during this period of high volatility. A sudden large move could see you closed out.

GBPUSD spiked on Supreme Court ruling suspension of Parliament had been unlawful.

24 October – ECB rate decision

ECB President Mario Draghi lowered its bank deposit rate a further 10bp to -0.5%, and announced a new quantitative easing (QE) plan at the September meeting — a final decision before retirement.

The announcement also came with a call for EU member governments to loosen their purse strings and spend. Rate cuts are having smaller impacts the lower they go; hence, new QE measures. Yet, governments remain hesitant to implement serious fiscal stimulus. Germany’s 54 billion euro climate change package will be budget-neutral, as it’ll be paid for by new taxes, providing no additional stimulus.

Most interesting is the market pricing a 15% change of a rate hike for the October decision. A rate hike isn’t going to happen. Rather, this shows the market sees ECB monetary policy as exhausted. Rates are unlikely to go lower for now. Instead, QE will be the ECB’s main policy tool.

The reintroduction of QE is set to purchase 20 billion euros worth of bonds per month, which, in theory, will weigh on the EUR, although consider the Fed is likely to announce its own QE program in October.

Economists have called the measure “QE infinity” due to the ECB saying the policy will occur until just before the next rate hike. With inflation currently at 1%, and forecasts as little as 1.5%, as far out as 2021, the ECB won’t be hitting its inflation target, or hiking rates, anytime soon.

29-30 October – FOMC meeting

While the FOMC’s September rate cut to the 1.75% – 2% target was widely expected, several economists are part-pricing a third cut in the October meeting as part of the “mid-cycle adjustment.”

Certainly, the US data has come in better than feared of late, and that could influence the Fed. However, while there’s been a lot of noise, there have been no compelling signs of convergence in the trade talks or Brexit. Also, consider the problems in the repo market and the idea that the Fed’s balance sheet will expand from here to help with reserve scarcity in the banking system.

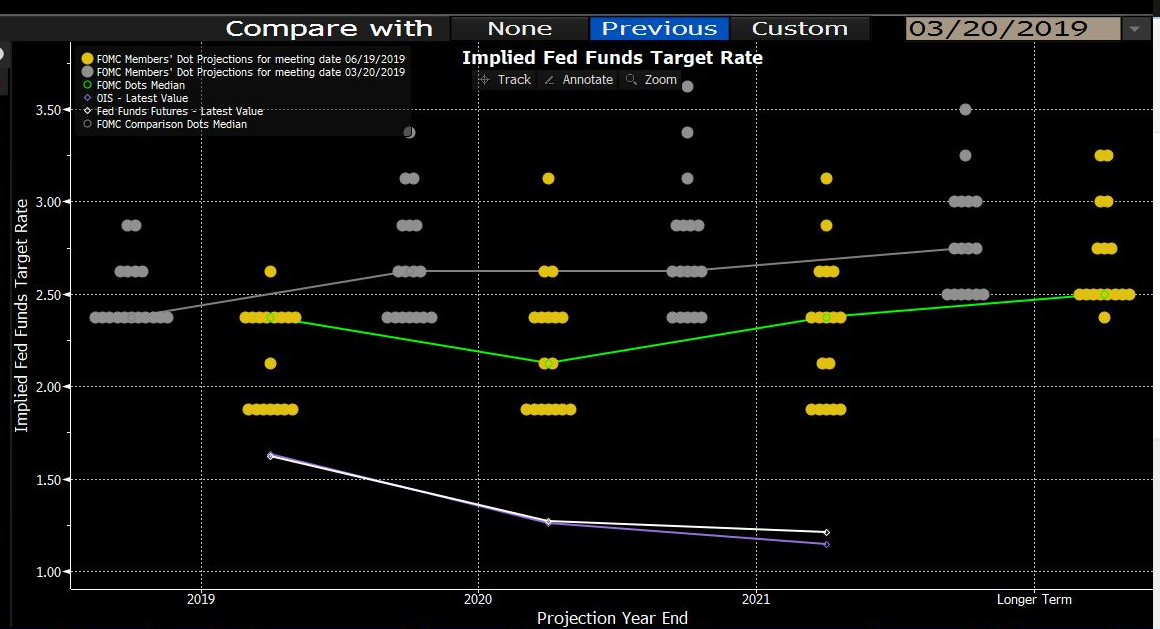

So, the Fed for now has taken a middle-of-the-road approach. The quarterly dot plot forecasts holding rates into next year, before a series of rate hikes from 2021. This contradicts markets pricing a 59.9% probability of a 25bp cut in October. But with seven members favouring a cut and five looking at holding, there’s room to adopt a more dovish stance.

Markets are expecting a considerably lower move in rates than the FOMC voting members’ median forecast.

Watch the non-farm payrolls number on 4 October. Last month’s number came in at 130K — short of the 160K expectations. We’re expecting 145K Another shortfall would be an argument for a third rate cut.

Remember that even when US data comes in poor, the USD still tends to remain strong as global data remains comparatively weaker.

31 October – Bank of Japan meeting

The BoJ meets again on the final day of October, after hinting at easing during their September meeting. For the first time in a while the meeting is “live,” and we could see higher volatility in the JPY.

It’s been six years since significant monetary easing in an attempt to lift inflation figures. Inflation has remained low throughout, with the US–China trade war and dampening global growth making the outlook increasingly uncertain. To keep its 2% inflation target on the horizon, the central bank needs to take further action.

Despite the seemingly bad news, the market was expecting a more pessimistic stance. The yen rose on the announcement.

A sales tax hike from 8% to 10% comes into effect 1 October. Similar hikes in 1997 and 2014 caused a considerable slowdown in consumption. Additional monetary stimulus may be necessary here to offset any consequences.

The market is currently pricing a 50.4% chance the rate is cut from -0.1 to -0.2.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.