How to trade USD/CAD

Trading the USD/CAD pair offers opportunities due to the unique factors influencing the Canadian dollar (CAD) and the US dollar (USD). This guide will explore the essentials of USD/CAD trading, including key influences, indicators, and strategies.

How is USD/CAD quoted?

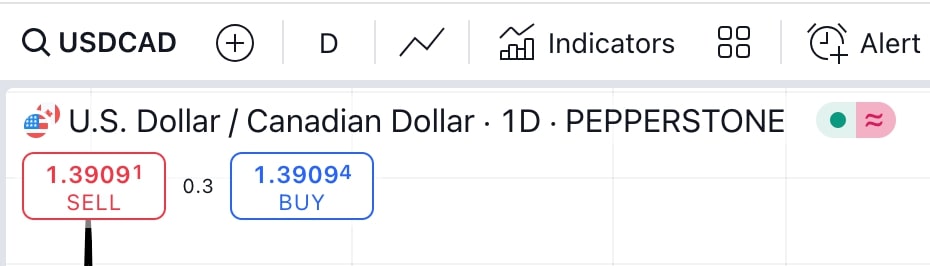

The USD/CAD currency pair is quoted as the amount of Canadian dollars (CAD) needed to purchase one US dollar (USD). For example, if the USD/CAD quote is 1.3900, it means 1 USD is equivalent to 1.39 CAD.

A rising USD/CAD indicates that the US dollar is strengthening against the Canadian dollar, so more Canadian dollars are needed to buy 1 US dollar. Conversely, a falling USD/CAD quote shows that the Canadian dollar is strengthening, so fewer Canadian dollars are required per US dollar.

Optimal trading times for USD/CAD liquidity

The USD/CAD pair is most active during the overlap between the New York and London sessions, typically from 12pm – 4pm UTC. Liquidity is highest during these hours, leading to tighter spreads and less volatile price movements. Additionally, during the North American session alone from 12pm – 9pm UTC, the pair remains active due to both the US and Canadian markets being open.

Key factors influencing USD/CAD

Several factors influence the USD/CAD exchange rate, from economic policies and global trends to commodity prices and trade balances:

Oil prices: Canada is a major oil exporter, so rising oil prices typically strengthen the CAD, while falling prices weaken it.

Interest rate differentials: Differences in interest rates between the Bank of Canada (BoC) and the US Federal Reserve affect USD/CAD. Higher US rates favour the USD, while higher Canadian rates favour the CAD.

Economic data releases:

- GDP: Strong US or Canadian GDP, a key indicator of a country’s health, impacts USD/CAD based on relative economic strength.

- Employment data: US non-farm payrolls and Canadian jobs reports influence currency values by signalling economic health.

- Inflation (CPI): Rising inflation may prompt rate hikes, strengthening the respective currency.

- Trade balance: Canada’s export reliance, especially to the US, makes trade balance data important for CAD value. While oil is a significant export, Canada also exports minerals, lumber, and agricultural products. The performance of these sectors, driven by global demand and prices, can impact the CAD.

Global market sentiment: In times of risk aversion, the USD may strengthen as a safe-haven currency, affecting the pair.

Geopolitical events: As Canada’s largest trading partner, US-Canada trade relations greatly affect the CAD. Any shifts in trade policies, tariffs, or agreements can lead to changes in demand for the CAD.

Commodity demand: Canada is a major producer of minerals and natural resources, including gold, copper, and lumber. Canada also exports agricultural products like wheat and canola. Price fluctuations in these commodities can impact the Canadian economy and, subsequently, the CAD.

Seasonal factors: The CAD can experience seasonal trends, such as strengthening during summer when tourism and seasonal employment peak, boosting demand for Canadian dollars. Seasonal demand cycles for natural resources (e.g., increased energy demand in winter or agriculture harvest cycles) can also lead to fluctuations in the currency.

Political stability and policy decisions: Government fiscal policies, including tax policies, regulatory changes, or infrastructure spending, can impact economic growth and the attractiveness of Canadian investments. Political events, such as elections, can also create short-term volatility. Stable political leadership is generally favourable for the CAD, while uncertainty or policy shifts may cause fluctuations.

The oil market’s influence on USD/CAD

One of the most significant influences on USD/CAD is the global oil market. Canada is a major oil exporter, primarily to the US, so fluctuations in oil prices directly impact the CAD. Generally, when oil prices (WTI) rise, the Canadian dollar strengthens due to expectations of increased oil export revenue. This pushes USD/CAD lower as CAD appreciates relative to USD. Conversely, when oil prices fall, the Canadian dollar weakens, leading USD/CAD to rise.

How trade disputes impact USD/CAD trading

Understanding the role of trade disputes between the US and Canada in trading USD/CAD is important because trade relations directly influence economic outcomes. These outcomes, in turn, shape investor behaviour, and policy decisions, all of which can lead to significant fluctuations in the exchange rate. Trump's election in 2024, with the administration's protectionist trade policies, added an additional layer of uncertainty that could alter the trajectory of USD/CAD. Hence making it crucial for traders to monitor these developments closely. Here are some examples from the past 10-15 years that illustrate how USD/CAD has reacted to trade disputes:

Softwood lumber (1980s–present): The US imposed tariffs on Canadian lumber, citing unfair subsidies. While this had limited direct impact on USD/CAD, it contributed to volatility and added uncertainty to trade relations.

Dairy products (2020): Under the United States–Mexico–Canada Agreement (USMCA), US complaints about Canada’s protected dairy market resurfaced. Although this didn’t significantly impact USD/CAD, it raised concerns about potential trade retaliation, adding caution among investors.

Steel and aluminium tariffs (2018): US tariffs on Canadian steel and aluminium, citing national security, prompted Canadian retaliation. This led to a drop in the CAD, as investors feared slowed economic growth and negative effects on employment.

Energy and pipelines (2010s–2020s): Disputes over pipeline projects like Keystone XL limited Canada’s energy exports, leading to oil price discounts and weighed on the CAD due to trade balance concerns.

How does sentiment affect USD/CAD?

COT Reports: The Commitment of Traders (COT) report is published weekly on a Friday, and it is an aggregated report of the different holdings of market participants in the US futures market. The Commitment of Traders (COT) report shows institutional trading positions, which can reveal market sentiment toward USD/CAD, such as whether different trader categories are long or short overall. A high level of long positions among large speculators could indicate bullish sentiment, while a high level of shorts could suggest bearish sentiment (as per chart below).

Source: https://www.myfxbook.com/commitments-of-traders/cad

Market sentiment tools: Many brokers and platforms offer sentiment indicators (see below) that show the percentage of retail traders in long versus short positions. For example, if a large majority of retail traders are short on a currency pair, it might indicate bearish sentiment, and vice versa.

The example above shows that trader sentiment was strongly bearish in USD/CAD, with around 92% short positions and only 8% long ones. This suggests most traders hold short positions in USD/CAD, selling USD while buying CAD as they expected the USD to weaken relative to the CAD, driving the pair lower. The significant volume of short positions indicates high confidence in this downward trend*. The volume of short positions was over 14,500 lots spread across over 41,000 positions, whereas for long positions, was 1,200 lots across around 4,200 positions.

The market price (current price) was below the average entry for shorts, meaning many short trades were in profit, while long positions were posting slight losses. These positioning insights are useful for understanding market sentiment, especially when combined with other technical and fundamental analysis.

*Note: Retail sentiment data, such as the proportion of traders long or short USD/CAD, can often act as a contrarian indicator, particularly if sentiment becomes extreme. For instance, if a large majority of retail traders are short USD/CAD like in the example above, it can sometimes signal a possible exhaustion of bearish momentum, hinting a potential reversal upward if any positive news supports the USD.

Technical indicators to consider using for USD/CAD

Technical analysis plays a major role in USD/CAD trading. Some popular indicators include:

Moving averages (MA)

USD/CAD context: As USD/CAD is influenced heavily by all the factors mentioned above, moving averages help filter out these influences by focusing on price trends.

Strategy: Short-term MAs, like the 10- or 20-day, can capture quicker trend changes such as reflecting shifts in oil. For longer trends, 50- and 200-day MAs can show when macroeconomic trends, like prolonged economic growth in the US or Canada, start influencing the pair.

Relative strength index (RSI)

USD/CAD context: Since USD/CAD often trades in ranges during stable economic periods, RSI is particularly useful for spotting overbought or oversold conditions, signalling potential turning points. Trade tensions, for example, can create overbought conditions in USD/CAD if USD strengthens as a safe-haven asset.

Strategy: Look for RSI to confirm oversold conditions (readings below 30) during times of high CAD weakness (like oil price slumps) or overbought conditions (readings above 70) if USD is strengthening from global economic concerns. Divergences are valuable in USD/CAD because they often precede reversals caused by shifts in interest rate expectations or key economic data releases.

Moving average convergence divergence (MACD)

USD/CAD context: MACD can be valuable for catching momentum-driven moves in USD/CAD, especially during periods of monetary policy divergence between the Fed and the Bank of Canada.

Strategy: Watch for bullish or bearish crossovers that align with economic data or central bank announcements, as they can confirm the strength or weakness of USD/CAD. For instance, if the Fed is hawkish while the Bank of Canada is dovish, a bullish MACD crossover would align well with a rising USD/CAD trend.

Bollinger bands

USD/CAD context: USD/CAD can experience strong breakouts or reversals around economic releases or interest rate announcements. Bollinger bands are ideal for capturing these moments by highlighting volatility and potential breakouts.

Strategy: During low-volatility periods (often when there’s no major news), look for a Bollinger band squeeze that might signal an upcoming breakout. For example, a squeeze followed by a sharp break above the upper band could indicate a strengthening USD trend, possibly from hawkish Fed expectations or softening Canadian economic data.

While each of these indicators can be powerful on its own, the best results come from using a combination to confirm signals and reduce false readings. This multi-indicator approach can help traders develop a clearer perspective on the pair’s price action, trend strength, volatility, and potential turning points.

Key support and resistance levels to monitor

Long-term support and resistance levels for USD/CAD

Long-term levels* typically reflect broader economic conditions and more significant price movements, often shaped by factors like interest rates, oil prices, and global economic events.

Long-term support levels:

1.3000 - 1.3100: This zone has historically acted as a significant support area for USD/CAD. In times of oil price declines or when Canadian economic data weakens, the pair often finds support around these levels.

1.2500: This level has acted as psychological support, with the USD/CAD pair touching or briefly dipping below it during periods of economic stability and oil price strength. For example, in early 2018, the USD/CAD dropped toward this level before rebounding.

Long-term resistance levels:

1.4000 - 1.4500: This resistance zone has historically marked significant turning points, especially when the US dollar strengthens across the board, or during periods of sustained weakness in Canadian oil prices. The 2016 oil price collapse saw USD/CAD rise to this level.

1.3700: Another significant resistance point, where the USD/CAD pair faced rejection during strong oil rallies in 2017 and 2018. This level has been important for traders to monitor when oil prices are stable or rising.

Short-term support and resistance levels for USD/CAD

Short-term support and resistance levels are more volatile and closely tied to recent market sentiment, economic reports, and geopolitical events. Hence these levels tend to shift quickly as market conditions evolve.

Short-term support levels:

1.3600: In the short term, this level has frequently been tested, especially during market corrections or when oil prices experience declines.

1.3400: A more immediate support level, this range has provided support during fluctuations in oil prices or when Canadian economic data disappoints, such as weaker-than-expected employment numbers or GDP data.

1.3200: In the recent past, USD/CAD has bounced off this range, particularly when oil prices spike or when the Bank of Canada took a more hawkish stance on interest rates.

Short-term resistance levels:

1.3800 - 1.3850: This range has been a significant short-term resistance area when the USD has rallied, especially when oil prices dip, and US economic conditions improve. This level was tested multiple times in 2022 and 2023 during periods of volatility in global markets.

1.4000: This psychological barrier can come into play in times of extreme US dollar strength or oil market turmoil, particularly during geopolitical crises (eg, supply chain disruptions or significant global tensions).

It is important to monitor these levels around major economic events or announcements. For instance, if USD/CAD is approaching a strong resistance level right before a catalyst, a break above this level could confirm a bullish trend continuation. Conversely, a strong support level during a decline may indicate where the pair could find buying interest, especially if oil prices are stabilising, which could support CAD. As these levels constantly evolve, traders must adjust their strategies based on changing market conditions, particularly those influencing oil prices and the respective central bank policies.

What trading strategies may work well for USD/CAD?

Here are four strategies to consider for trading USD/CAD, with examples of how and why each strategy works:

Trend following strategy

Overview: This strategy involves identifying and following the prevailing trend. Trend-following strategies use indicators like moving averages and MACD to determine whether USD/CAD is in an uptrend or downtrend.

How: A common method is using a 50- and 200-day moving average crossover. When the 50-day moving average crosses above the 200-day (a "golden cross" indicated as green circles in the chart above), it indicates an uptrend, and traders may buy USD/CAD. Conversely, if the 50-day crosses below the 200-day (a "death cross" indicated as red circles in the chart above), it signals a downtrend, and traders may short USD/CAD.

Why: Trend-following works in USD/CAD because the pair often experiences sustained moves due to macroeconomic factors, such as interest rate cycles and oil price trends, which influence the broader trend.

Range trading strategy

Overview: USD/CAD often moves within a range during periods of market consolidation, especially when there’s no major economic news or when oil prices are stable. Range trading involves buying at support levels and selling at resistance levels within a defined price range.

How: Identify clear support and resistance levels, often by looking at previous highs and lows or pivot points. When USD/CAD approaches support, traders go long, expecting the price to bounce. When it approaches resistance, traders go short, expecting the price to pull back.

Why: This strategy is effective when USD/CAD lacks a strong directional trend and is constrained by macroeconomic factors or oil price stability, which often cause the pair to trade within a range.

Breakout strategy

Overview: The breakout strategy involves identifying and trading USD/CAD when it breaks through key support or resistance levels, often signalling the start of a new trend. This strategy is useful when economic data or news events cause sudden shifts in market sentiment.

How: Look for periods of consolidation or low volatility, where the price moves within a narrow range. Place buy orders just above resistance or sell orders just below support, anticipating a breakout. To confirm the breakout, some traders use volume indicators or wait for a candlestick close outside the range before entering.

Why: USD/CAD is sensitive to economic data releases and other key events. A breakout strategy can capture significant moves when volatility spikes, especially during major economic announcements or geopolitical events.

Oil-driven news trading strategy

Overview: Since Canada is a major oil exporter, USD/CAD is highly sensitive to changes in oil prices. An oil-driven news trading strategy involves trading USD/CAD based on oil price movements or major announcements that impact oil markets.

How: When oil prices rise significantly, the Canadian dollar usually strengthens, and USD/CAD may decline. Whereas when oil prices fall, the Canadian dollar weakens, and USD/CAD tends to rise. Traders can monitor oil-related news (like OPEC announcements or supply disruptions) and trade USD/CAD accordingly.

Why: This strategy leverages the strong correlation between oil prices and the Canadian dollar, allowing traders to anticipate USD/CAD movements based on oil market developments.

Managing risk in USD/CAD trading

Risk management is undoubtedly essential in forex trading, particularly with USD/CAD, given its sensitivity to both economic events and oil price fluctuations. Consider the following factors:

Set stop-loss orders: Always use stop-loss orders to limit potential losses. This is especially important when trading during volatile periods or around major news events.

Adjust your position sizing: You could potentially limit each trade’s risk to 1-2% of total account balance. This approach helps preserve capital, even if the market moves against a position.

Stay updated on economic events: Be aware of key events that could affect USD/CAD, such as Fed or BoC announcements. Avoid large positions right before these events, as prices can spike unpredictably.

How can I start trading USD/CAD using CFDs?

Open an account: Begin by opening an account with a CFD broker, such as Pepperstone, which offers a selection of trading platforms and access to USD/CAD prices.

- New traders can explore the trading platform and the markets by using a demo account which simulates live market conditions and trading without the need to risk any real money.

- Fund the account: Once the trading account is open, fund it by making a deposit using one of the payment methods available.

- Download the trading platform: Navigate the trading platform provided by your broker and get familiar with its features and functionality.

- Start trading: After gaining confidence in using the trading platform, start trading USD/CAD in a live account.

- Pepperstone offers 1350+ contracts for difference (CFDs) which are cash-settled and non-deliverable allowing traders to speculate on price movements. In this way traders can go long or short without worrying about the ownership or delivery of the underlying commodity.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.