- English

- عربي

Enabling the next wave of growth for technology companies in Africa

The Nigerian Stock Exchange is part of the Nigerian Exchange Group. The company offers a variety of services from listing and trading securities to regulation and real estate. NGX offers trading in 45 derivatives, 161 Equities, 316 ETFs (exchange traded funds) and 145 fixed income products.

Figure 1 Nigerian Stock Exchange

The Exchange was previously known as the Lagos Stock Exchange, with the headquarters being based in Lagos, Nigeria’s largest city with a population of 21,320,000.

The NGX All Share Index

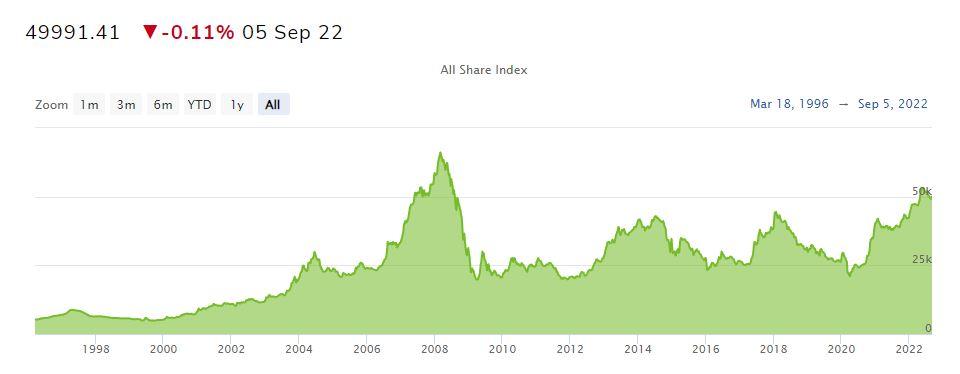

The main index is the NGX All Share Index. The market cap is approximately $28 billion. This index tracks all the listed equities on the Nigerian Exchange. Current trading close to 50,000 (as of the 06/09/2022) the index has seen steady growth from the lows of 2020

Figure 2 Nigerian Stock Exchange All Share Index 06/09/2022

The Nigerian Stock Exchange also offers indices in various sectors such as industrial, banking, consumer goods and insurance.

Actively traded companies within the Nigerian Stock Exchange

Trading Nigerian stocks is very popular. The most actively traded sector as of 06/09/2022 is the Banking Sector.

Sterling Bank, Fidelity Bank, United Bank of Africa, and Zenith Bank come in the top 5 most actively traded shares today.

Largest companies by Market Capitalization

The Big Four companies by Market Capitalization are:

- Dangote Cement PLC (DNAGCEM) with a market cap of 4.165 trillion NGN

- MTN Nigeria Communications PLC (MTNN) with a market cap of 4.071 trillion NGN

- BUA Cement PLC (BUACEMENT) with a market cap of 1.808 trillion NGN

- Nestle PLC (NESTLE) with a market cap of 1.07 trillion NGN

Trading Exchange Trading Funds (ETF’s) through the NGX

What is an Exchange Traded Fund and what is its purpose?

An ETF tracks the performance of a basket of products or securities. This could be commodities, shares, or foreign exchange. They are traded like shares and are intended to give an investor the opportunity to diversify their portfolio while keeping down the cost.

The Nigerian Stock Exchange offers the largest amount of listed ETF products in Africa.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.