How To Simulate Your Trading Strategy on MT4

Developing strategies that work in theory is one thing. But in practice, its a whole different story. In order to test the effectiveness of your strategy and manage risk appropriately, you need advanced tools to backtest them on.

If you’ve dipped your toes in the water and traded forex, equities, or commodities, you’ve probably spent your fair share of time trading on demo to hone your skills and test your strategies. It’s by no means a pointless endeavor, but while it does teach you invaluable skills without risk to your capital, there may be better options for you to consider.

Why miss out on the live opportunities that markets present every day when you can develop a strategy, set it up with ease, and backtest it on real, historical prices immediately?

Well, if you’re trading on MT4 with Pepperstone, you can do just that.

Built into this powerful platform is the Strategy Tester. It uses real historical data over a range of timeframes to simulate EA and manual trading strategy performance. Simply plug in any EA or indicator and determine the logic for when a trade is placed.

It’s a great tool on its own, but in combination with Pepperstone’s Smart Trader Tool, the Trading Simulator, traders can replay historical market movements, assess their chosen indicators and place simulated trades based on the strategy’s logic before reviewing its performance in detail.

Our Head of Research, Chris Weston, gives a bit of insight into how to refine your strategy with our Trading Simulator.

How to access and use the Trading Simulator

Accessing the Strategy Tester is as easy as signing up for a Pepperstone account, downloading the MT4 platform and plugging in your account details. Then, with the Pepperstone Smart Trader Tools installed, run the Strategy Tester and select the Trading Simulator expert advisor.

See how the Trading Simulator works in our Metatrader tutorial series below.

Case Study

We often hear in the media about the death cross strategy. As the down-trending 50 day moving average (50 MA) approaches the 200 day exponential moving average (200 EMA), it's easy to believe the hype that a bearish reversal is in play.

But why blindly follow such a strategy when we can check if it’s proven its worth over time?

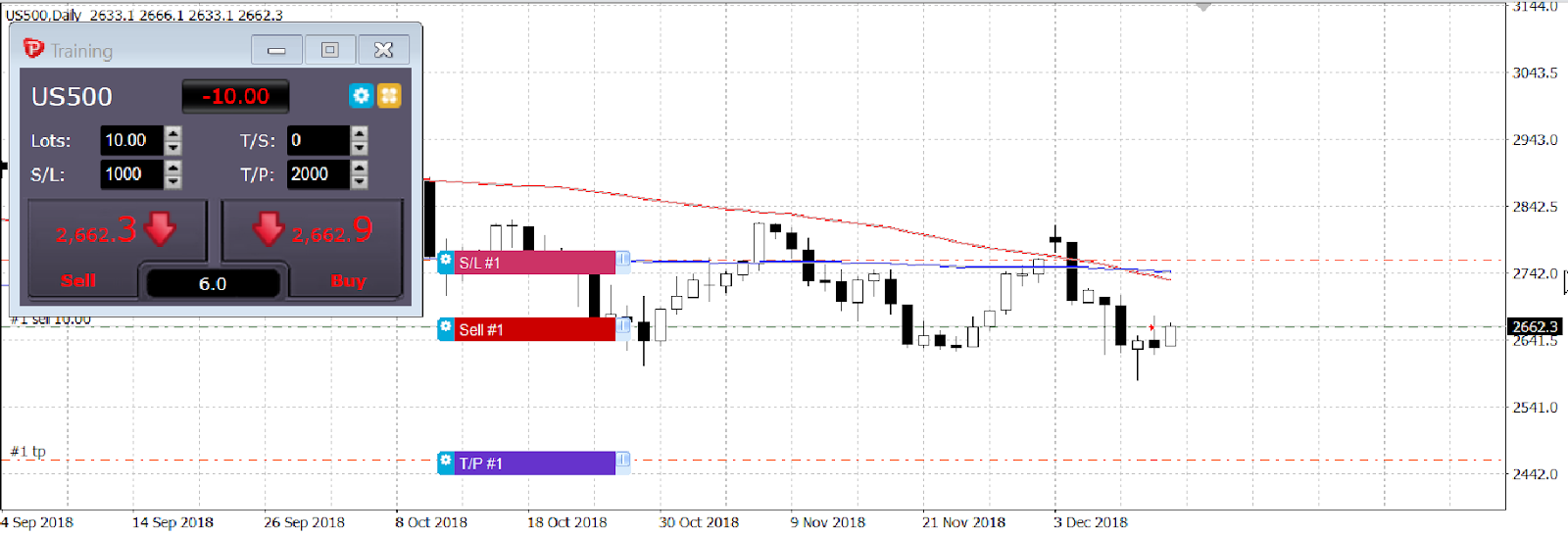

We tested this on the S&P500 (US500 on MT4) using the Trading Simulator to see if the strategy is as bearish as its name suggests.

Starting from 2018 there were only 2 death crosses using the 50 SMA and 200 EMA. These were in early December 2018 and late March 2020. We were looking to trade 10 US500 contracts, risking up to 100 points in order to let a real bearish move eventuate, and 200 points seemed a good profit to lock in. Stops and Take profits were set.

At the first cross we went short, as the strategy indicates, and watched the move play out. With a bit of patience, the take profit was triggered and 200 points of profit were locked in.

Kicking the Strategy Tester into gear, we continued on to the March 2020 death cross, and again sold into it. Our Stops were hit and the trade closed out in loss. The bearish move didn’t eventuate and the S&P500 kept on making higher highs.

The death cross had only a 50% success rate over our chosen time period, but given our risk management strategy we walked away with a profit of 9.8%.

Trade with Pepperstone And Get A Trading Edge

If you’re looking to fine-tune your strategy on real historical data, and want an efficient and effective trading edge, sign up for a Pepperstone account today. Once you’ve registered, simply contact our Support team via live chat, email or phone 24/7 for access to our suite of Pepperstone Smart Trader Tools, and simulate your strategies to see the difference it makes.