- English

- عربي

Our SpotCrude and SpotBrent flow has clearly ticked up and the fact we recently cut to as low as two pips on US and Brent crude spreads is presumable enthusing, as well as the general movement.

The crude futures curve has flattened with the two front-month contracts in contango, which is rarely positive in short-term trading as it portrays a lack of tightness in the market. Price (SpotCrude) has moved through the 50-day MA for the first time since November and traders are talking $50 as the big number in view, although, there is solid horizontal support into $53.88 – so lets assess price action here if it gets there. Lockdowns and broad COVID-19 newsflow in Europe have attracted the blame, while some have talked about China buying more crude from Iran. Next Thursday OPEC meets, so it will be interesting to see if there are moves to increase supply into this drawdown after the last meeting saw the Saudi’s unexpectedly hold fire.

In equities, small caps have been hit, with the US2000 -3.6%, while tech has outperformed with the NAS100 -0.5%, as US Treasuries have found solid buyers – UST 10s are -7bp, where real 10yr yields are down 5bp – gold has found some support from this dynamic, but the fact it sits -0.7% is a function of the USD finding buyers (USDX +0.7%) in a flight to quality. It’s a day where the gold bulls have been best off buying our AUD-dominated gold product, with XAUAUD +0.9%. Taking shorts in XAU in JPY has worked best, with the JPY the star performer in G10 FX.

The S&P 500 sits at session lows -0.8% with materials taking out the points, backed by a weak tape in industrials, financials and energy. There's been a preference for defensive sectors of the market and those companies with very predictable cash flow. Volatility has pushed modestly higher, with the cash VIX back above 20% and gaining 1.4 vols on the day.

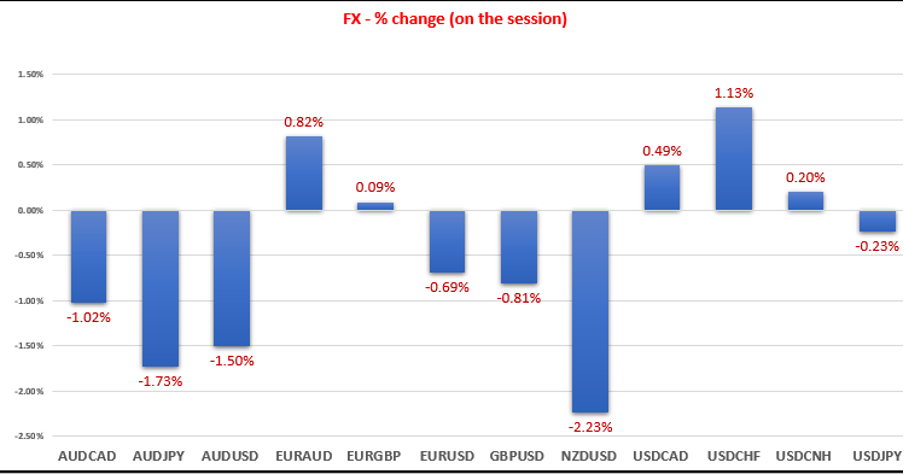

The FX markets are alive, with a broad risk-off vibe impacting. The NZD has been taken to the woodshed and is having it's biggest sell-off since March 2020. NZ 5-year bonds fell just 4bp, but should see further buying when cash bonds resume trade, as traders continue to reprice rate expectations in the wake of moves to unlock new land for development and changes to tax deductions for housing speculators. NZDUSD is currently pushing 70c. AUDUSD has also attracted sellers, with the pair trading through the neckline of the head and shoulders pattern at 0.7642 – the target here is sub-73c although instinctively this seems a stretch. AUDNZD offers a lower beta move and has broken out to the strongest levels since September 2020 – quite like this cross from the short side, for a re-test of the 5-day EMA and break out levels at 1.0840.

EURUSD is pushing the bottom of the range, with the 200-day MA in play. The CAD has outperformed other commodity currencies with the Bank of Canada announcing an unwind to its emergency crisis programs. AUDCAD shorts have been on the radar, with price pushing the 200-day MA now at 0.9598.

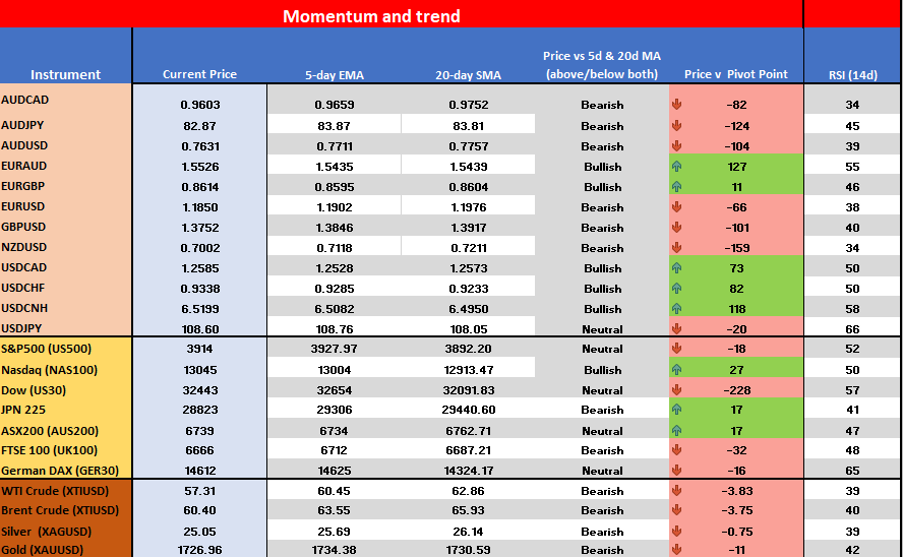

My momentum model is certainly looking a little shaky and I'm seeing a number of markets trading below the 5-day EMA and 20-day MA and the pivot point. Risk, it seems, is on the back foot ahead of month and quarter-end, where I'd expect a reversal of fortunes and a renewed interest in reflation assets like commodities.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420)