- English

- عربي

Tactical trades and market outcomes: who will win the 2024 US election?

Traders also need to consider:

- Quantifying the level of Trump tariff risk premium already priced in the USD and other markets.

- Who becomes president but also which party controls the House and the Senate (Congress) and the make-up of Congress. If one party were to get a sweep this could have significant implications for markets, and the extent of the potential moves in price.

- The timing of the results – with the polls so close, it seems likely that recounts will occur in some of the 7 battleground states, which could delay the result.

- Changes in underlying liquidity conditions – reduced liquidity conditions in the order book as we head towards 5 November would exacerbate movement, increase volatility and potentially result in wider bid-offer spreads.

- Whether the numbers used in the respective campaigns are realistic or simply campaign rhetoric designed to get votes.

- Whether the one-off rise in import prices from tariffs has any bearing on the Fed’s thinking on future rate cuts.

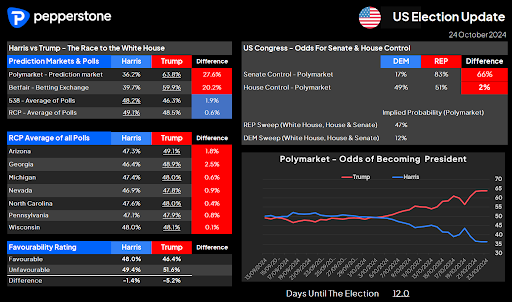

The current state of the race

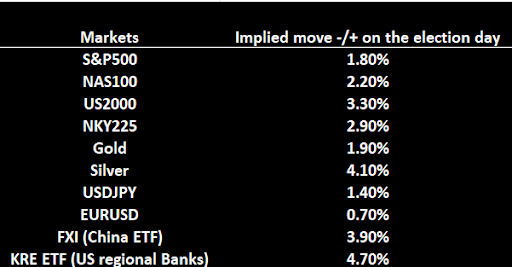

Current expectations of movement on election day in key markets

Using options pricing, we can assess the implied move on the day of the election in some of Pepperstone’s core markets, and many other election expressions. These implied moves change dynamically on the demand for volatility – we highlight a snapshot of the current implied movement for the day of the election.

Scenario 1 - Trump president / Split Congress (DEMs control the House / REP the Senate)

Key policies to focus on – Trump has campaigned heavily on raising tariffs on countries that run a sizeable trade surplus with the US. Notably, Trump has pledged to raise tariffs on Chinese imports by 35ppt to 60%, with a minimum 10% blanket tariff on all imports. While Trump would find it hard to pass many of the more prominent fiscal measures through the House, he can raise the tariff rate through orders without the blessing of Congress.

So in this scenario, tariff risk, international relations, and the subsequent countermeasures from the countries affected will immediately become the central focus.

Trading expressions that align with this election outcome and rising tariff risk:

- Long USDMXN & USDCAD

- Short MXNJPY

- Long USDCNH

- Long USDBRL

- Long USDKRW

- Short EURUSD & EURCHF

- Long US30 / short US500 (as a pairs trade)

- Long US2000 / short HK50 (as a pairs trade)

- Long Solano, Bitcoin or Ethereum

- Short Global Clean Energy ETF (ICLN.US)

Scenario 2 - The ‘Red Sweep’ - Trump president / REP controlled Congress (House & Senate)

A ‘Red Wave’ scenario, where the GOP party controls both chambers of Congress, opens the prospect of Trump going even harder on tariffs, initiating new tariffs on a far wider range of goods – the question then becomes whether uses tariffs as a negotiation tool (like we saw in 2018), or to raise revenues.

Trump would also have a smoother passage to push for the deregulation of industry, tax changes, and a wider range of fiscal measures. Given these fiscal measures would significantly increase the deficit in the years ahead, one suspects they would need to be offset and funded by tariffs. This suggests in this scenario tariffs would need to be a significant revenue raiser, or the bond market could express clear disappointment, resulting in a trend higher in Treasury yields.

While traders have bought volatility through optionality, a ‘Red sweep’ outcome is far from priced into FX, equity or bond markets.

The key policies that could move markets:

- Increased scope and scale of trade tariffs

- A 1ppt cut to the corporate tax rate to 20%

- The full rollover of the 2017 Tax Cuts and Jobs Act in late 2025

- Reduced regulatory oversight

- Reduced immigration

Trading expressions that align with a ‘Red Sweep’ scenario

- ‘Buy US-focused risk assets’

- Short US 10-Treasury futures (USTN10YR) or the TLT ETF – US bonds would likely be sold on higher US growth expectations and expectations of increased future Treasury supply to fund the increasing deficit.

- Long USDs on a broad basis:

- USDJPY and USDCHF – Where both FX pairs benefit from higher US Treasury yields

- Long USDCNH – as we saw in 2018, the PBoC may offset higher tariffs by depreciating the yuan.

- Short EURUSD – A move below 1.0500 seems likely.

- Long AUDJPY – a risk on trade that should follow US equity indices higher

- Long Solano, Bitcoin or Ethereum

- Long US2000 either as a straight directional trade or tactically vs short US30 or HK50

- Long KRE ETF (US regional bank ETF)

- Long US companies with low import exposure and high domestic sales

- Long XOP ETC (S&P Oil and Gas Exploration and Production) – Trump has suggested the US would produce a further 3 mbd of crude production.

Scenario 3 – Harris president / Split Congress (DEMs control the House / REP the Senate)

The status quo scenario, with Harris unlikely to pass her proposed market-moving fiscal measures through the Senate. Here we see markets rapidly remove and reprice Trump tariff premium and revert to looking at the macro factors which were in play pre-election – the health of the US economy, nonfarm payrolls, and relative growth and interest rate settings.

Trading expressions that align with a Harris win and a split Congress scenario

- The USD initially trades lower across the board as any legacy tariff risk is removed.

- US equity (all indices) initially trades lower but finds support as the status quo remains supportive of risk.

- Long US 10-Treasury futures (USTN10YR) or the TLT ETF – while Harris’s key policies won’t pass through Congress, a divided Congress and a president who favours tax hikes is a bond-friendly outcome, at least for the long-end of the Treasury curve.

Keep up to date with our research, daily market outlooks and videos on the Pepperstone US Election hub – good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.