- English

- عربي

Markets Whipsaw as Tariff Uncertainty and Trade War Fears Shake Global Sentiment

Through most of last week, the central view in the market was that tariffs on Mexico, Canada and China would most likely be pushed back or perhaps even staggered. That view changed on Friday with Trump’s statement that he was set to sign in an additional 25% tariff on Mexico and Canada and 10% on China, which obviously were then signed in via executive orders on Saturday, with a Tuesday (today) deadline. A subsequent defiant stance to retaliate from the Canadians and Chinese parties naturally knocked risk on the open yesterday, as the market – seemingly unprepared for the well-telegraphed punchy tariffs rates – repositioned exposures and looked to price the risk that escalation was building and a trade war that could soon also include Europe, and possibly Japan – was imminent.

In yet another turn of events, reports that China is pushing hard to get a deal before today’s deadline and will not look to aggressively devalue the CNY have resonated. Then mid-way through US trade the breakthrough came, with Mexico – the nation of the three always most likely to get a reprieve - pulled out its plan B, signaling they will put troops in the right place to see Trump delay tariff implementation here for a month.

Our attention now turns to US talks with Canada and China, where headlines will no doubt be coming in thick and fast through Asian trade today, with Trump and Trudeau speaking shortly - so we’ll see if Canada can also find a play to have the additional 25% tariffs pushed back before the deadline. Talks with China will be even more important for broad markets, and while China appears to be pulling out all the stops to get a deal, with the key personnel in Trump’s administration true China hawks, one could argue that the path for a similar resolution for China may not be as smooth and Trump will likely take this right to the wire, perhaps even past it.

Big moves going down on the dancefloor

As anyone trading markets in the past 24 hours will attest to, we’ve clearly seen some big intraday reversals playing out in the USD pairs and in risk markets – however, while we’ve certainly seen some constructive developments, until we know we know how talks with Canada and more so China evolve, and we have increased clarity on the set tariff implementation, I’d argue the coast is not yet fully clear to pile into risk with conviction, with the prospect of another tariff-related selloff still highly possible.

USDCAD traded as high as 1.4793 through Asia but was faded from this point, perhaps partly on the talk that China would not go hard on devaluing the CNY, with USDCNH offered from the open which resonated in the selling of USDs in G10 FX. Partly, because some had felt the intraday USD rally had gone a tad too far, and felt the risk to reward in chasing the USD further higher was no longer there - a factor which explains why USDCAD was already selling off hard into the Mexico tariff delay announcement. Either way, USDCAD has gone full circle and is back to unchanged on the day.

AUDUSD traded into a new Pandemic low of 0.6088 but has since rallied a big figure and looks up towards Friday’s closing levels of 0.6218 – with the deadline on China’s tariffs fast approaching news will be front and centre, and as we’ve heard from Trump if additional tariffs are to be imposed on China they will “be substantial”. If holding AUD positions be mindful that news could break at any stage and could cause sizeable intraday moves. It pays to be in front on the screens and to be able to react.

EURUSD traded to 1.0141 in early interbank trade, but now trades 1.0290, having been a high as 1.0335.

S&P500 futures were trading heavy through Asia, sitting -2.1% lower when the ASX200 and Nikkei225 closed for cash equity trade yesterday – so, while the S&P500 cash index closed 0.8% lower on the day, the falls were nowhere near as bad as what was priced by the futures into Asian markets. For context, S&P500 futures are currently 1.5% higher from the ASX200 close, so unless something significant is heard in incoming hours we should see a solid snapback, with the ASX200 likely opening 0.6% higher and NKY225 +1.0%.

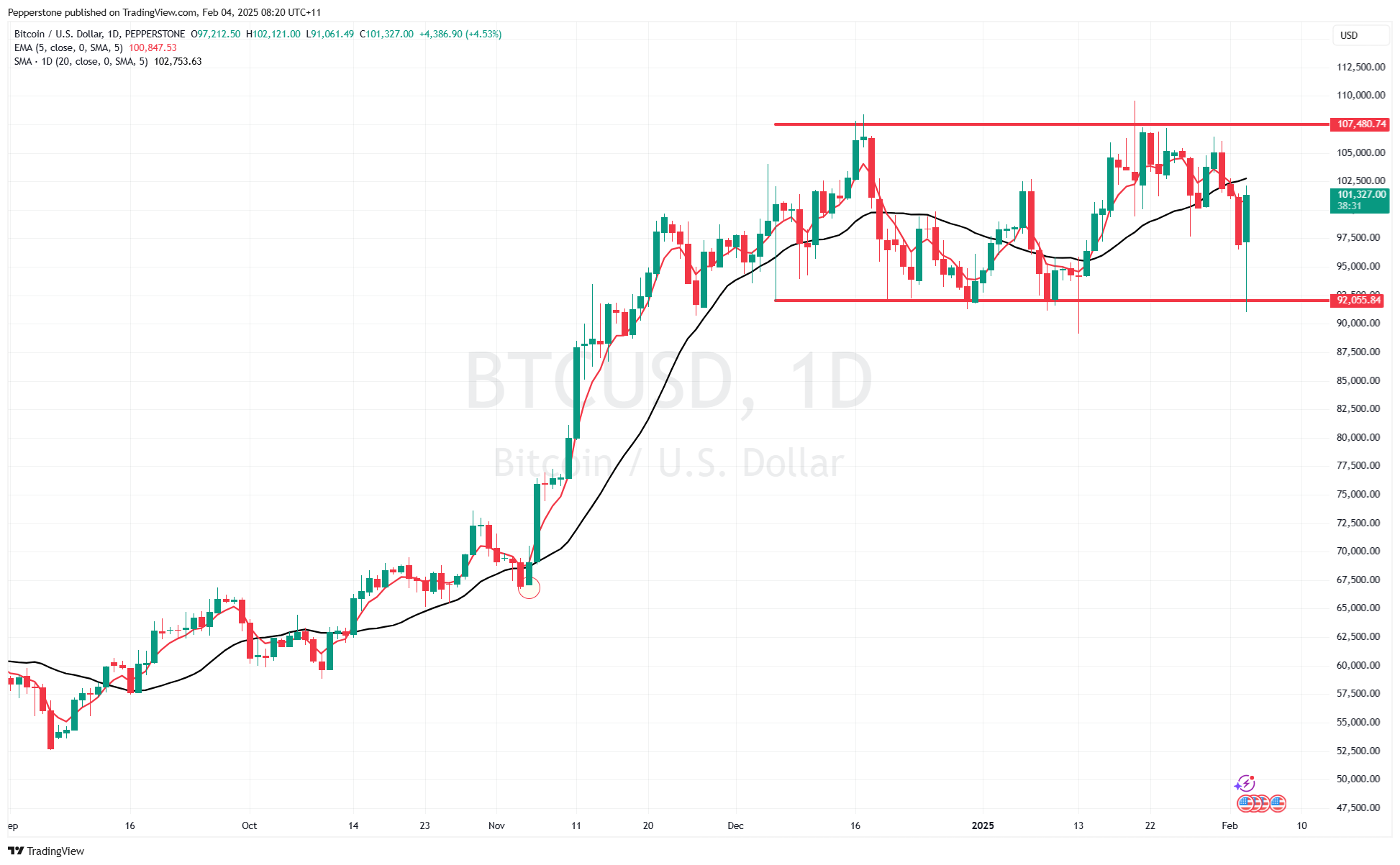

We can’t go past the moves in crypto as the intraday reversals and range expansion was wild. Ethereum – while still 7% lower on the day – has rallied a lazy 26% off the lows. Bitcoin showed once again incredible buying support into the range lows of 92,100 and those buyers who stepped in to hold the line have been rewarded with an 11% rally from the lows. Again, with the crypto scene acting as a pure risk asset, the news flow due out in the coming 24 hours matters - after a solid flush out of longs though, the market has shown its hand and we can see solid buying pressure kicking in - clearly, Bitcoin, Ethereum et al are all key buy-the-dip plays and perhaps more so than any market. Its a news driven market ahead of us, decoding what is noise and signal are key.... But the prospect of big two-way moves going down seem once again elevated.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.