- English

- عربي

A Traders’ Week Ahead Playbook – US CPI could cement a September Fed cut

- The French 2nd round vote throws up a big surprise

- US growth in question – US data showing a clear softening

- The USD lower for 7 days, as 2yr Treasury yields break range lows

- Gold finding form moving inversely to bond yields and the USD

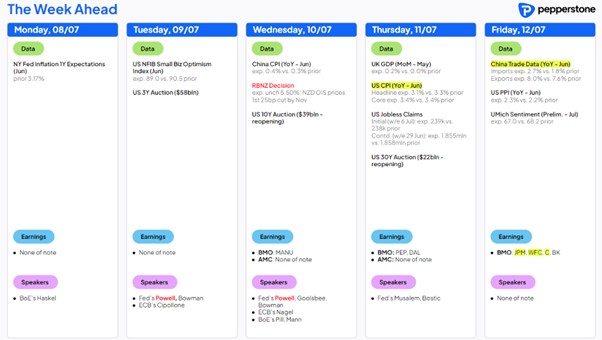

- Data to navigate ahead – US CPI is the marquee risk

- US earnings in play – The banks get the ball rolling

We move past a big week for markets, with the US labour market firmly under the spotlight, with the various readings cooling just enough to give market participants further confidence that the Fed will start its easing cycle in September.

A big surprise for the Left-wing alliance

As we look ahead, we start the week on a rather messy note, with the French 2nd-round vote throwing up a major twist, with the left-wing coalition gaining the most seats, and Le Pen’s RN party coming in third. The tactical moves made, with a significant number of candidates being pulled from the vote, married with high voter turnout, have worked incredibly well to block out the RN vote, and with Prime Minister Attal resigning, a coalition will attempt to be formed before 18 July, with negotiations taking place over the coming days.

Markets won't like a far-left government having a say, and the victorious far-left NFP leader Melenchon has already stated that he will not do any deals with Macron, and will implement his manifesto in full – however, while we are seeing the EUR modestly weaker on open (now 1.0803 or -0.4%), the fact that centrist Macron has polled better-than-expected, as well as the number of seats the Left have obtained means passing the NFPs manifesto in full will be a real challenge and while uncertainty is high once again, this should contain the fallout. Political gridlock beckons at a time when France really needs strong action to target its fiscal position.

French politics aside, the deteriorating trend in the US data flow, as well as the sustainability of Biden as the Democratic nominee, have been the central topics of conversation among macro heads, and the former debate has truly damaged the US exceptionalism trade.

We can see this dynamic through the Bloomberg US growth surprise index (below) – which essentially measures the outcome of the data relative to the consensus forecasts – where we see this at the weakest levels since May 2020. US growth Nowcast models have also been revised lower.

The good news for risk is that we are still at levels of growth, consumption and labour readings that largely say if the Fed are to ease, it's because of risk management purposes. That is, to massage the fed funds rate away from a restrictive setting and gradually to a more neutral setting, so as not to cause a more protracted downturn. It’s when the market feels the Fed need to ease beyond neutral and to stimulate the economy that earnings estimates are chopped up, and equity typically goes into prolonged drawdown.

For now, bad news on US economic data is good for bonds, equity, and gold and negative for the USD…. but one does question if there is a tipping point, where the move from a soft landing scenario, to one where the recession drums beat a lot louder – where we morph from rate cuts are good for risky assets, to one where bad news sees traders buy volatility (e.g. the VIX index), US Treasury yield curves steepen more aggressively, and importantly high yield corporate credit spreads starts to show a more alarming signal for equity.

We’re not there yet, and a ‘soft landing’ is the current market base case - so, for now, I maintain a bullish bias on risk. However, if we can identify the triggers that highlight when the market feels a greater sense of concern then we can react to changes in our market environment far more efficiently.

The by-product of last week’s US data trend was a 15bp decline in the US 2yr Treasury on the week closing the week at 4.60% and breaking below the range it held since mid-June of 4.85% to 4.65%. We can also look at US swaps pricing and see 19bp of cuts priced for the September FOMC meeting, or an 80% probability implied for a cut. Rates traders are torn between a further 25bp cut at either the November or December FOMC meeting.

The risk, for me, especially if we get a core US CPI read (Thursday) below 0.2% m/m is that the US swaps markets look to price a 25bp cut in the September, November, and December meetings.

The USD has found sellers easy to find and followed the move in rates and US Treasuries closely, and unless we see a hotter CPI print then rallies in the USD pairs are likely to be sold, although the French political situation will now limit EUR buying. We have seen the DXY lower for 7 straight days – a rare run of poor form, as we have only seen 4 other occurrences of 7 down days since 2020. Naturally, this was largely a function of EURUSD rising to 1.0840, but we did see all other G10 currencies gain against the greenback on the week, with GBPUSD the outperformer (+1.5%) and the BRL the place to be in EM FX.

Gold is eyeing a retest of $2400

Gold has found real form in this dynamic with a push into $2391, with a close above the 7 June high of $2387. For now, gold is the anti-USD trade, but should we see greater fragility in US high-yield credit markets (the HYG ETF is a good way to view this) then gold could easily be above $2500 – that won't happen overnight though and could take weeks if not months – and by then funds could also be buying gold as a hedge against fiscal deficit blowout in the US, notably if we got a sense that the Republicans could take the House, which would give them the ability to extend the 2017 Tax Cut and Job Act in 2025, which along with other measures could see the US fiscal deficit increase by a further $1.5t+

Looking ahead to the trading week:

US CPI is the marquee risk event

Last week’s news and price moves set traders up for an interesting week ahead. For equity and US index traders, the momentum is firmly to the upside, and I am skewed to higher levels in the NAS100 and US500. I obviously have no idea if this bull trend will reverse lower this week, and flow works in mysterious and often unpredictable ways, but from a data and known event risk point of view, Thursday’s US CPI inflation print is really the only data point which could really rock the boat – the consensus is for US core CPI to come in at 0.2%m/m (3.4% y/y), so a core US CPI print that round to 0.4% m/m (i.e. above 0.35%) would have traders questioning the degree of cuts priced, US 2yr Treasury yields would spike higher – subsequently, US equity indices would find sellers.

An inline US CPI print may be good enough to justify the current rates pricing and keep equity markets headed higher. Alternatively, an outcome that comes in below 0.2% would really cement market expectations of a rate cut in September, and put further downside in the USD, and upside in equity and gold.

We also start to get the US banks and big money centre reporting on Friday and starting the ball rolling on Q2 earnings season, with Wells Fargo, JP Morgan and Citigroup all reporting pre-market open. Clients can trade these names on our 24-hour US equity CFDs and react in real time to the moves that play out from earnings.

Fed chair Powell testifies to the Senate Banking Committee on Tuesday (00:00 AEST Wednesday) – a highlight, but it would have been more insightful for markets if Powell spoke after the CPI print but his comments on developments in the US labour market could move markets.

Outside of the US, we see the RBNZ meet on Wednesday, where they will hold rates unchanged, but the move in the NZD comes from the tone of the statement relative to the 62bp of cuts priced in by February 2025. AUDNZD has been a cross I’ve been on the long side, but I would be looking to cut back into the meeting.

In Australia, we see home loan data, as well as the Westpac consumer confidence, NAB business confidence and CBA household spending – all important metrics, but unlikely to trouble the AUD.

In China, we get PPI/CPI and trade data – again, it is unlikely to move the dial too much in either Chinese or global markets, with traders looking ahead at the Third Plenum on 15 July.

For the crypto heads, the question is after last week’s big volatility, whether the overhang from Mnt Gox and the German Federal Police is done, leaving it with a far clearer structure to rally – I would be a buyer of strength, but I want to see the bulls exert themselves.

Another big week ahead, good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.