- English

- عربي

European equity indices saw a limited net change across the various bourses, while the S&P500 and NAS100 cash session closed +0.6% and 1% respectively. We can also see that S&P500 futures are 0.4% higher than where the ASX200 closed at 16:10 AEDT yesterday, and again that offers some tailwinds for the Asia open.

The breadth in equity appreciation across the S&P500 doesn’t give the bulls much to work with, with 61% of stock closing higher, led by communication services (namely Alphabet which closed +4.4%) Staples, consumer discretionary and tech all added points. Healthcare and REITS underperformed.

Nvidia and the broader semis space have been front of mind as we enter the highly anticipated Nvidia GTC conference - with the CEO starting proceedings a couple of hours ago. Despite Jensen Huang offering a predictably bullish backdrop for the AI scene, Nvidia’s shares trade -1% in the post-market session, likely reflecting positioning rather than anything of substance. I would note some big buyers of $800 puts for Friday’s option expiration, so someone is either hedging a sizeable portfolio holding or betting on a sell the fact playing out this week.

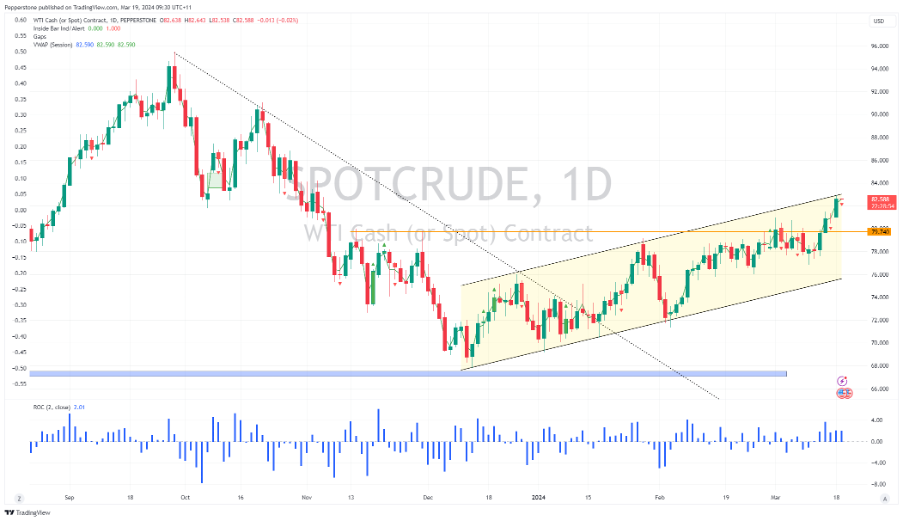

Commodities continue to see higher volumes from clients, with crude gaining 2% on the day and testing the top of the bullish channel it has held since mid-December. Gasoline continues to print new highs in a bull run that’s played out since through February, and we’ve seen price close higher for a sixth straight day. Cocoa doesn’t usually come up on the radar, but after the incredible run we’ve seen throughout 2024 this sort of parabolic run will always get the attention of derivatives traders, and while many are looking for weakness to initiate longs, we’re seeing good attention to layer into shorts too.

Gold takes a breather after a big run and slight retracement from the recent highs of $2195, and traders will be massaging positioning into the Fed meeting tomorrow.

The focus now turns to JPY and AUD exposures, with the JPN225 and AUS200 also on the radar, given BoJ and RBA meetings due in the Asia afternoon session. We also see Canadian CPI due at the start of North American trade, and we’ll see pockets of interest towards CAD exposures, notably CADCHF longs look interesting as the price is poised to break out.

The BoJ gets trader’s attention

The BoJ meeting has been the subject of a frenzy of headlines, and the sheer number of articles in the local press regarding a move away from negative rates (NIRP) does put the proposition of a 10bp hike at a real risk. Interestingly though, the JPY seems quite desensitized to increased calls for a token hike, and USDJPY traders are looking more intently at the FOMC meeting, and potential changes in the ‘dots’, as a volatility driver.

Some brave economists are even calling for a 20bp hike today which could get the JPY party started – however, the more likely scenario is a 10bp hike, an outcome Japan swaps price at 40% chance. A hike would be supportive of the JPY - however, the commentary on the outlook for policy is more important, with the market essentially discounting a further 15bp of additional hikes by year-end.

A move away from NIRP is important from a psychological perspective, but to get the Japanese yield curve pumping and USDJPY re-targeting 146.50, we need to believe this hike is not a one-and-done move. We are also on the lookout for an announcement for a formal end to YCC and changes to the purchase rate on JGB and ETF purchases.

The risk in the RBA meeting

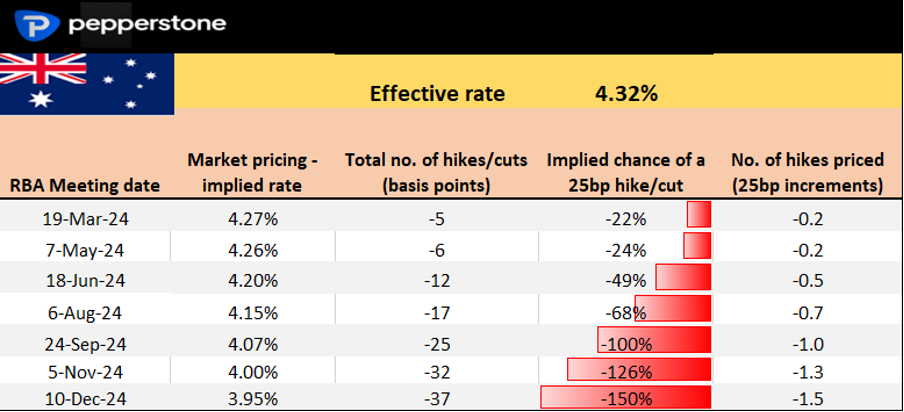

Today’s RBA meeting (at 14:30 AEDT) should – in theory – be a low-vol affair for the AUD, although there is a 20% chance of a 25bp cut priced into Aussie rate markets. Given the RBA won’t cut today, this residual pricing will need to work its way out on the outcome, which suggests a small pop in the AUD.

More importantly, we see 37bp (or 1.5 cuts) priced into Aussie interest rate futures by year-end and the statement will reconcile against that pricing. The risk of the RBA keeping the line in the statement that “a further increase in interest rates cannot be ruled out” is high, and the bank will offer few clues surrounding an appetite to cut. It’s hard to get too excited by the upcoming statement and we see AUDUSD overnight implied volatility at a lowly 10%, subsequently pricing a -/+ 30-pip move in AUDUSD spot price on the day.

Long AUDCHF and AUDNZD positions look the better trade for those betting on a modestly hawkish statement.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.