Analysis

A Traders’ Week Ahead Playbook – Time for the Fed speakers to stand up

Trump in the driving seat

The assassination attempt on Donald Trump has seen images of a defiant leader spread through social media and has seemingly galvanized his chance of reclaiming the White House. While the betting markets can be fickle, they have swung to a view that Trump in as President is almost a done deal. However one perceives the weekend images, it sets up this week’s Republican National Convention to portray a party united behind its leader, a stark contrast to the current fragile state of the Democrats.

Joe Biden and the Democratic Party must pull a rabbit out of the hat, and they need to find a spark to shift the attention back to their cause. That may be hard to do, and if any further high-profile Democrats endorse Biden to step down it could remove the taboo, and lead to Biden’s determined position having to be significantly reconsidered.

The big consideration for markets is whether the Republicans have the potential not just to take the White House and Senate, but whether they can also swing the House in their favour as well – which, if the betting markets are on the money, is where they are behind, but that gap is closing.

If the markets feel a Republican ‘Red Wave’ is on the cards, then we could see the market accelerate various election trades. Trump as President is likely a positive for risk, at least for US equity and we should see S&P500 futures and the USD push higher today – most talk up the impact of tariffs as the key point, and it certainly may help drive capital out of China and into US markets, but it’s the promises of deregulating US industries which should be the big equity kicker.

As the picture unfolds, it seems that if Trump does indeed get the gig of President, then he’ll likely do so with the Fed already easing policy and offering him a tailwind from a falling cost of capital.

A 25bp rate cut from the Fed in September is seen as a lock

With US data coming in softer than expected we’ve seen the US 2-year Treasury yield fall another 15bp w/w to 4.45%, with the US swaps market now pricing a 90% chance of a 25bp cut in the September FOMC meeting, and nearly 2.5 25bp cuts priced by year-end. Looking even further out, the swaps market price seven 25bp cuts over the coming 2 years, which seems fairly priced on current economic trends – so unless we’re looking at a far more protracted downturn and a sizeable decline in consumption then it is hard to see much more than 7 cuts eventuate.

With the USD index (DXY) pulling into big support at 104, primarily led by EURUSD rising above 1.0900, we have seen relative implied rate differentials working against the greenback.

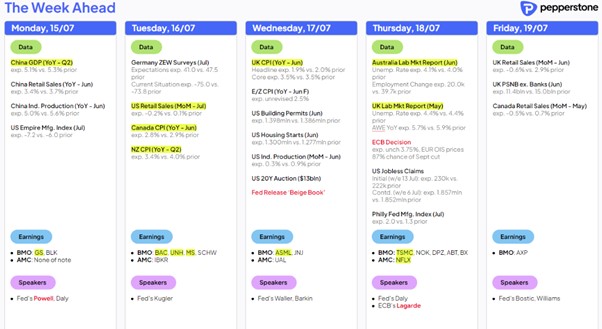

The calendar for the week ahead

By way of data to US drive this week, US retail sales (on Tuesday) is the main event, with expectations for a -0.2% decline month-on-month, an outcome which would only keep consumption estimates headed lower and keep the selling pressure on the USD. Perhaps the bigger driver of US markets will be the raft of Fed speakers due this week, and notably, guidance from Powell, Waller and Williams jump out.

The markets have largely ignored individual Fed chatter of late, but given this elevated rate cut expectations, the market will be looking for their views post CPI, and whether these individuals hold same levels of increased confidence that data is slowing that the market does.

US earnings start to roll in at a faster clip

For equity traders, we’ve already seen a handful of US banks report, but the US quarterly earnings season starts to ramp up this week with 8% of the S&P500 market cap hitting us with numbers. US financials remain front and centre, but Netflix also report, and this always kicks on equity traders' radars, given the punchy moves we often see after reporting. This time the options market implies a move of -/+8.3% on the day of reporting, so the share price could be looking at a break of $700 and new highs if the numbers and guidance please the market.

*For more information about trading Netflix and other US equity CFDs 24 hours a day, click on the link for more details

UK data in play – could GBPUSD push above 1.3000?

Away from the US, last week, a big downside surprise to Norway’s CPI jolted the NOK and resulted in the currency being the weak link in G10 FX on the week. Conversely, alongside outperformance from the JPY, the wind is to the back of the GBP, with GBPUSD eyeing a push into 1.3000. UK economic data comes in heavy this week with UK CPI (Wednesday at 16:00 AEST – consensus eyes headline CPI 1.9% / core CPI 3.5%) the big risk to GBP positions, while UK jobs and retail sales are also worth putting on the risk radar. UK swaps price an August 25bp cut from the BoE at 50%, with 2 25bp cuts priced by December - so the UK CPI data could influence that pricing (depending on the outcome) and by extension the GBP.

The ECB meeting is a marquee event but unlikely to move markets

EURGBP attracts good flow and now trades at the lowest levels since mid-2022. The EUR on a broad basis will focus on the ECB meeting (Thursday 22:15 AEST), which will be seen as a marquee event of the week for macro heads. As important as central bank meetings are for markets this should be a non-event, as the ECB will leave rates unchanged and likely detail that more data is needed to see them ease again. September seems a far more fitting date for the next ECB rate cut.

USDJPY daily

One big focal point last week was Japan’s MoF tactically intervening immediately after the weaker US CPI print, to push USDJPY into ¥157 gets close attention, and we see the pair sitting on both the 50-day MA and uptrend support (drawn from the Dec 2023 low) – this has been the line of support of late, so it is make or break for the USDJPY bull trend.

Data to move the NZD and AUD this week

On the week we also saw a dovish twist from the RBNZ, which brings a 25bp rate cut onto the table for the 14 August RBNZ meeting – this week’s NZ Q2 CPI print should influence that probability, so it is a potential volatility event for those running NZD positions.

Staying in the antipodean currencies, we’ve seen the AUDUSD rising for 8 of the last 9 trading sessions and now approaches the 68c level. Relative AUS vs US interest differentials are driving the pair and are certainly more influential on the direction of travel than Chinese equity indices or industrial metals. AUDCAD is another which has real upside momentum in play.

With that in mind, the key release to put on the radar this week is the Aus June employment report (due Thursday at 11:30 AEST), where a strong report could modestly increase the prospect of an RBA hike in August – although it’s the Q2 CPI print (due 31 July) that could really make or break that decision.

Keep the ASX200 on the radar – not only did we see the index close at a new ATH last week, but our opening call suggests we see an unwind above 8000. On the day, we question if the index can hold the big figure.

China risk – the Third Plenary session in focus

We also get a fair bit of event risk from China, with the MLF decision, new/used home sales, Q2 GDP, industrial production, retail sales and property sales all due through the week. The marquee risk though is the Third Plenum, which essentially sees more than 370 members of the Communist Party’s Central Committee come together and plan for the 10 years ahead. Third Plenum’s have been the forum to announce radical change in policy over the years, hence the market interest.

It is expected that we could get headlines from the Third Plenum from Thursday, but expectations of an announcement that causes significant volatility are low. I am turning more constructive on Chinese/HK equity, but they need work, and few are convinced of a rip higher in the HK50 and A50 and alike – the tape will tell.

Good luck to all,

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.