- English

- عربي

The implications of an ETH spot ETF – Tactical plays for ETHUSD traders

What’s important is the crypto world now sees a very high probability that an ETH spot ETF will be rolled out soon. A key question therefore for traders is exactly how much of this news is now in the price, and what is the likelihood of a “buy the rumour, sell the fact” playing out? Many are now even looking ahead at what could be the next coin to have a spot ETF launch – the front runner seems to be SOL.

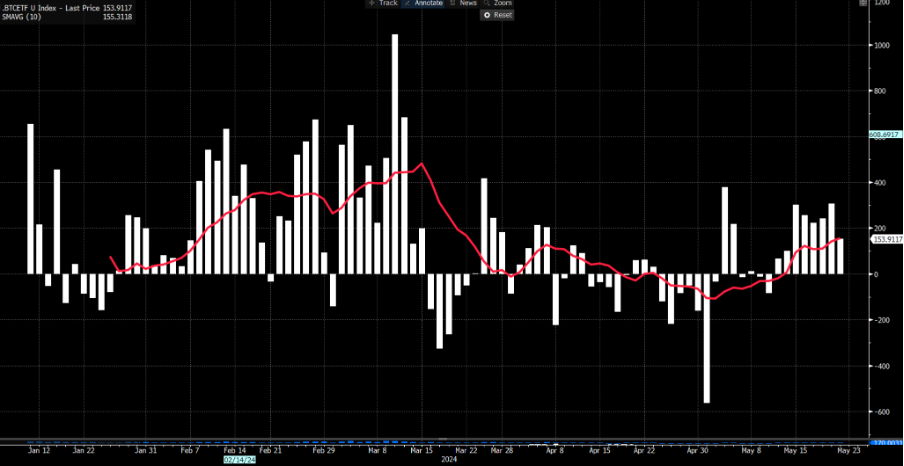

Using the BTC spot ETF as a guide, which was fully approved on 10 January, in the lead-up to the launch we saw a strong run-in the BTCUSD price into $49k and then a 21% correction into $38,500 over the ensuing 12 days. It was then that traders saw the upbeat aggregated daily inflows into the 10 BTC spot ETFs (ex-Grayscale) and aggressively bought back in, with BTCUSD ultimately rallying 90% to $73k.

Daily inflows in all BTC cash ETFs

The possibility of that same price action playing out in ETHUSD is an obvious risk, but when everyone is expecting something like this to happen, it rarely does, or at least the retracement should be far shallower. Plus, with expectations of solid inflows from investors into the ETH spot ETF, and the understanding of how influential these inflows have been on the BTC price, this understanding may even mitigate a ‘sell on fact’ altogether.

Price action portrays strong anticipation of the ETF launch

Looking at the rally in ETHUSD since 20 May, with price gaining 30% and pushing 3900, we can see the market has seen the potential ETF blessing as a big positive for ETH. We can also see the outperformance of ETH through the ETHUSD/BTCUSD (top pane) or ETHUSD/SOLUSD ratio.

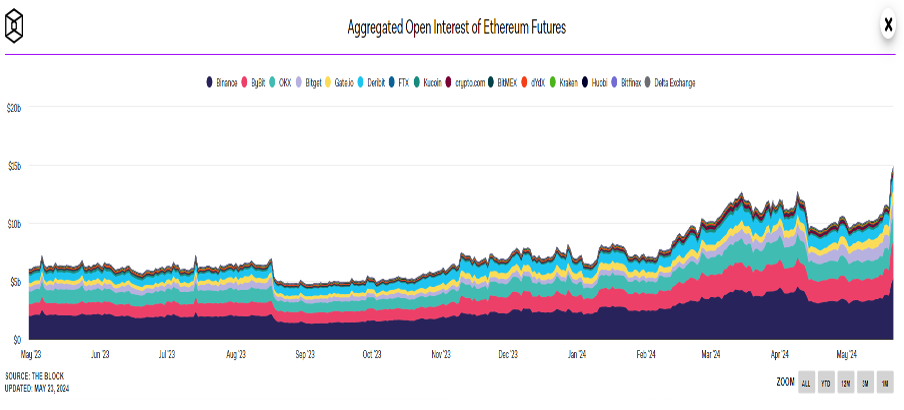

We can also open interest in ETF futures, across the various platforms, has been steadily rising, where the notional value of all outstanding contracts sits close to a record $15b. If we then look at funding rates charged on ETH perpetual futures these have been falling consistently since March, showing that despite the move higher in the underlying price, the leverage held by market participants is still very low – a sign that we are nowhere near the euphoria stage and that price could kick higher and traders may chase.

(Source: The Block)

Choosing between the ETH and BTC spot ETF – the implications

For potential investors in the new ETH spot ETF (assuming it does come) they would now have a choice. For many US financial advisors, who could look to suggest a crypto spot ETF to clients, it isn’t just a case of having BTC or ETH in the portfolio for diversification purposes – where due to its higher volatility and often low correlation with other asset classes, crypto can help spread portfolio variance. These advisors will now have to educate themselves fully on the key differences between BTC and ETH, and which is the better ETF to choose from.

On one hand, ETH has a lower market cap and differing liquidity conditions, so inflows into the ETH spot ETF could have an even greater influence on the underlying price.

Bitcoin does have a scarcity factor, which many would be aware of after the recent ‘halving’, but with reduced supply and good demand, this dynamic is supportive of the BTC price over time, with some saying BTC is a ‘store of value’ – a mantra I would currently dispute given its propensity to follow the S&P500 on big down days.

Bitcoin is not a great medium of exchange though, and ETH is far better in this regard so the adoption thematic, as well as potential use case, are more supportive over the longer term for ETH than BTC.

Either way, the market has seen how influential the BTC spot ETF has been in driving prices higher, so are ready to trade ETH should we see big inflows into the ETH spot ETF.

Of course, we could feasibly see outflows from the BTC spot ETF and rotation into the ETH spot ETF and that may raise the prospect of sustained downside in the BTCUSD/ETHUSD ratio (traders can play this by going short of BTCUSD and long ETHUSD).

What’s the play?

But for those whose focus is trading ETHUSD in isolation, the question – assuming full sign-off from the SEC – is whether ETHUSD can power through 4000 and the March highs of 4092.55, or whether we see long positions reduced quickly and a 'sell on fact' playing out – I favour the former scenario, but as long as the S&P500 can stay at elevated levels, market volatility remains subdued and US bond yields don’t start to move sharply higher, then any 15% pullback on a ‘sell on fact’ should offer a compelling entry for tactical buyers.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.