- English

- عربي

The NAS100 closed +1.2% - printing a new all-time high. The S&P 500 +0.5%, but off the highs of 3127, with defensive sectors (REITS, utilities and Comm Services) outperforming, and the Dow fell 0.3%.

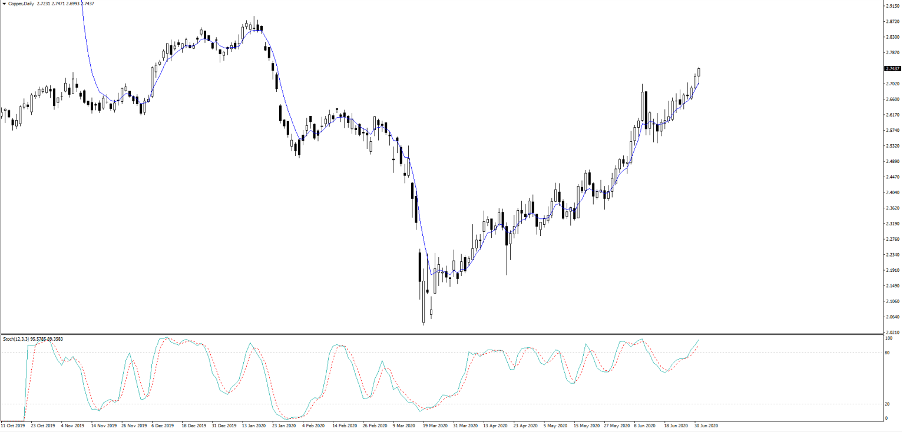

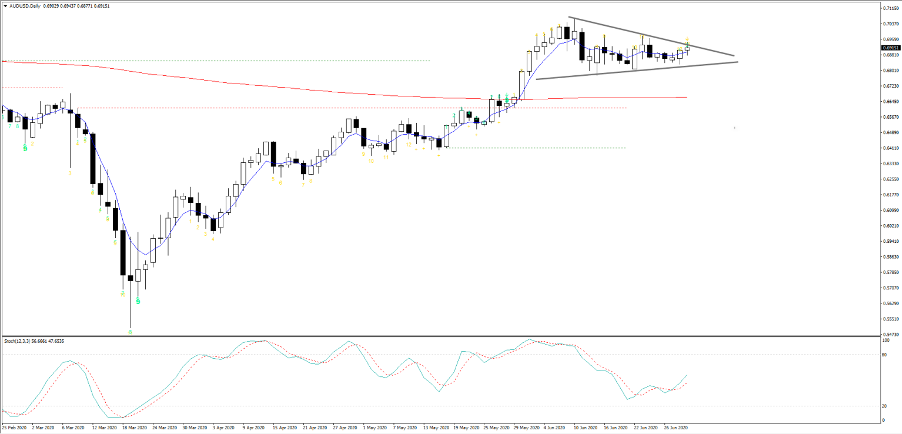

Elsewhere, the USDX is -0.3%, with risk FX working fairly well (BRL and ZAR are up 2.8% and 1.8% respectively). The AUDUSD, by way of G10 risk proxies, sits up 0.2% and in the 58th percentile of the daily range. Growth commodities are higher, with copper continuing its uber bullish run and crude once again setting a re-test of the price ceiling at $41.00. We see implied volatility broadly lower, with our VIX index eyeing a move sub-30.

There were reasons to think equities could have been lower, with US/China relations in focus, Houston ICUs exceeding capacity and big numbers out of Arizona, California and North Carolina. However, looking at the tape and the market seemingly focused on further solid US data, with ISM manufacturing growing at 52.6 (vs 49.8 consensus), with encouraging improvements in the new orders, production and employment sub-components. Good news for equities and copper and we saw the Atlanta Fed 2Q GDPNow estimate model being revised up to -36.8% (from -39.5%).

The ADP payrolls rebounded to 2.36m, just shy of consensus at 2.9m, but it should re-enforce the notion that the balance of risk for tonight’s NFP (22:30 AEST) are skewed above consensus of 3.029m jobs created in June. The unemployment rate is expected to come down to a still elevated 12.5%, while average hourly earnings should fall somewhat to 5.3%.

Consider we also get the weekly jobless claims at the same time, with the market expecting 1.35m new claims and 19m continuing claims.

(AUDUSD daily – watch exposures as price looks to break)

Lots of talk of vaccines, which is great for markets and the human race, with encouraging results seen from a joint Pfizer/BioNtech SE, who join the race to develop a drug with AstraZeneca and Moderna (among others).

It all sets us up for another positive open in Asia, with Aussie SPI futures +0.7%, with focus on HK which comes back online amid rising tensions on the streets. By way of event risk, it's all fairly minimal with Aussie trade balance (11:30 AEST) unlikely to move the dial and little else to trouble – it’s really about getting set for tonight’s NFP.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.