- English

- عربي

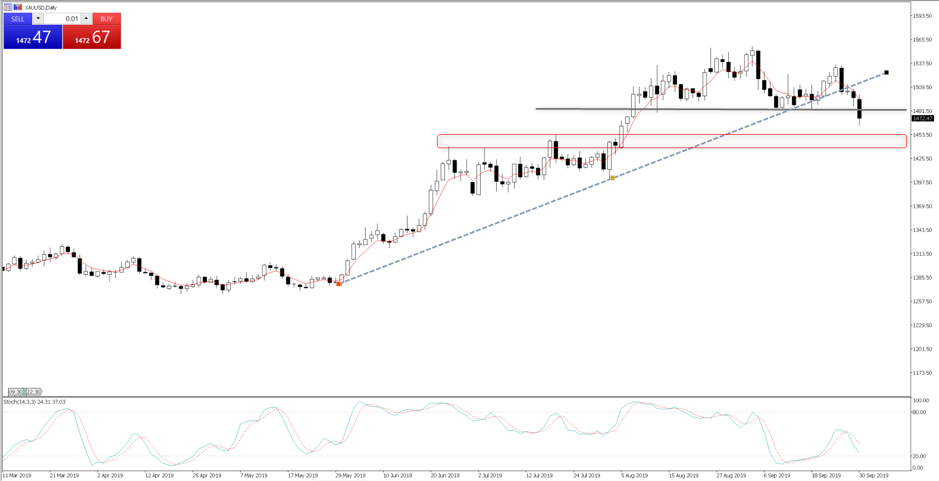

Certainly, the technical’s tell me to be defensive here, and if we hone into a lower timeframe, we can see that when we traded through the range low of $1484 that the bulls lost their dominance. The obvious support level now is seen at $1452/39 (the red shaded area), and it would not surprise me to see price gravitate here, although we watch for a re-test of the range low to confirm $1484 is now resistance.

We turn the page on Q3, and one questions how much of the overnight move has been influenced by month-end flow, certainly in the FX markets. However, with the technical developments in play, let’s examine both sides of the investment case.

Working against gold (and other precious metals)

- The USD index (USDX - see above) has broken out to the highest levels since May 2017. That said, watch price into trend resistance and signs of a rejection, which could support gold

- US 5-year ‘real’ (or inflation-adjusted) Treasury yields have moved to 19bp, from being almost negative in early September. Higher ‘real’ yields are seen as a gold negative – are yields telling us that US recession risks are falling? Watch tonight’s (00:00aest) ISM manufacturing report, where the consensus is for 50.0, which has been lowered after a poor Chicago manufacturing print.

- Expectations for a further 25bp cut to the fed funds rate has pulled back to 38% from 58% last week

- Increased talk of fiscal measures in Europe, Australia and the US are in play, while ECB President Mario Draghi was interviewed in the FT calling for a fiscal union in the Eurozone.

- Positioning: last week’s Commitment of Traders report showed a net long position of 238,000 contracts – the highest since September 2017. At the same time, holdings in gold ETF funds (see below) have increased to the highest levels in six years.

The case to own gold into $1450

- The pool (USD value) of bonds with a negative yield sits at an impressive $14.89t, representing 26% of all issued government bonds (the green line). This may have fallen from $17.03t we saw on 29 August, but there was no doubt the global bond market rally was grossly overextended at that stage. Gold had been used as a hedge against an ever growing pool of negative yielding debt.

"Top pane \u2013 gold vs total value of negative yielding bonds. Lower pane \u2013 the percentage with a negative yield."

- Implied volatility in gold held firm at 14.39% despite the sell-off, suggesting traders don’t see increased risk of outsized moves in price. The VIX index (the 30-day implied volatility in the S&P500) has reverted to its five-year average, but hasn’t collapsed – so, higher volatility should support gold

- Gold’s one-month risk reversals (or the skew of call implied volatility over put implied volatility) has come off from an extended position of 4.26 and now resides at 2.53. It tells me the options market still sees upside as its base-case (over the coming month) but has come off euphoric levels

- We have seen signs of better US and global data (lifting ‘real’ bond yields), but are we out of the woods yet?

- The chance of Trump being impeached through the House seems elevated, although it is almost certain to fail in the Senate.

- We head into high-level talks between the Chinese and US delegations from 8 October. Signs the two parties are really no closer to forging an agreement could see risk aversion rise again

- While the rates market is undecided on an October cut to the fed funds rate, the focus has moved to the Fed’s balance sheet and the likelihood of asset purchases, predominantly to keep the repo market in check. Whether there is causation and a direct link between the Fed having a bigger balance sheet, higher excess reserves and a weaker USD is the subject of increased debate. However, if the Fed is going to go down the road of ‘QE lite’ then it makes fascinating viewing and could, in theory, be a headwind for the USD and good for gold and stocks.

There are no doubt signs of better data, and future fiscal measures have seen the case for gold to diminish somewhat, especially when we consider the extremely frothy positioning and moves in the USD. That said, a good flush out should be seen as positive.

We obviously trade price, and on the daily time frame there are few reasons to buy at this point, but the fundamental picture gives me a growing belief that the better risk-to-reward trade-off is to hold off and see if the bulls support into $1450. I suspect they will, but we watch for signs the economic improvement continues, in which case the bond bulls will really question their exposures, which, in turn, will see gold head lower.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.