Analysis

Not because we’re seeing volatility per se – that is not the case - where Bitcoin's daily close-to-close percentage changes are seldom greater than 4%. But because of the absolute momentum and trending price action. This is not just true of Bitcoin, which has closed higher in 16 of the past 21 sessions, but in Ethereum and the broad suite of altcoins too.

The market looks at the barrage of positive news flow and adds length. There is a chase underway, as well as structural flows from market participants (and algo’s) that buy simply because the price is moving higher.

Traders look at the risk that could cause a significant liquidation and for the first time in a while see a limited number of factors that could cause significant volatility. Notably, many believe there is now significantly reduced regulatory risk, which for years has been the biggest concern with holding bullish positions.

In fact, many say the biggest risk to near-term upside is indeed profit taking, or an event outside of crypto, such as a macro event (higher inflation for example), that causes equity and risk to roll over and volatility measures to spike.

The question many are now asking is how long until we see the November 2021 all-time highs being taken out. It also begs the question of when euphoria kicks in. I don’t see it just yet, so it feels like pullbacks will be shallow and well-supported.

Let’s consider the price catalysts that appear front of mind:

- The crypto market has really been drip-fed good news stories after another – if sentiment plays a big part in the performance of this ‘high beta’ asset, then the consistency in the positive news flows has been a clear tailwind.

- The moves in the crypto scene have been in fitting with the rally we’ve seen in low-quality equity (high debt, poor balance sheet and high risk) and high short-interest equity. In fact, we can see the 20-day rolling correlation with Goldman Sachs ‘most shorted’ equity basket at 93%.

While some will say the rally is simply traders seeing the same factors pushing up high beta equity, there are some credible factors that crypto traders will point to that are specific to the crypto complex.

- Tailwinds from the $5.5b of inflows into the 9 Bitcoin spot ETFs – this is net of the $7.4b of outflows of the Grayscale Bitcoin Trust. These inflows have picked up after Chinese NY.

- An increasing belief that an Ethereum cash ETF is coming, and while the SEC will have several different considerations to what was reviewed in the Bitcoin spot ETF, many see the SEC blessing as a matter of when not if.

- Traders continue to focus on the upcoming ‘halving’ in April, which was incredibly positive for returns 6 and 12-months after the three other occurrences.

- Despite the one-way rally, Bitcoin's 30-day realised volatility stays at a lowly 30%, well below the 12-month average. This suggests Bitcoin is up there offering some of the highest risk-adjusted returns of any market.

- MicroStrategy announced purchases amounted to an additional 3000 cryptocurrency tokens over the month – paying an average price of $31,544.

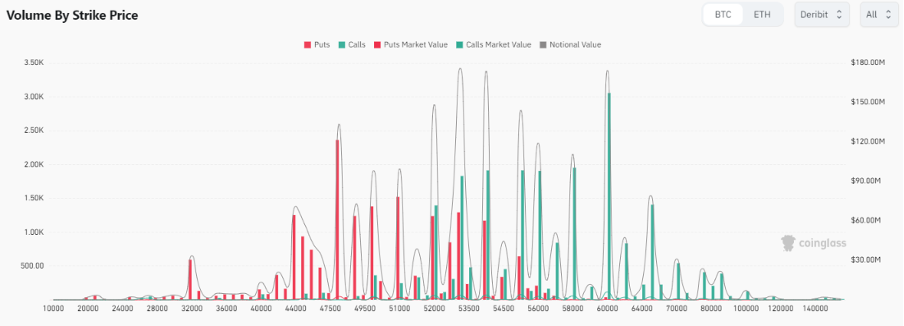

- Bitcoin options open interest sits at $17.59m and rising steadily, but still off the levels seen in December of $21b. We can see from the options data that there is increased volume in calls strikes at higher levels, notably into the $60k strike. As Bitcoin’s price moves higher market makers (who have sold the calls) must dynamically hedge their exposures to remain delta-neutral – this means buying the underlying Bitcoin, which naturally pushes prices even higher.

(Source: Coinglass)

- The higher the price goes the more leveraged shorts are being liquidated – and this will be especially true into and above $58,000.

- A small issue that is secondary in the thought process is that Donald Trump has detailed he takes a more agnostic view on crypto. No President can undermine the USD but one that is not against Bitcoin is a tailwind.

As it stands crypto is seeing a clear momentum move and getting big attention from traders –some will question how long until new all-time highs, others will start to hedge, and others feel we are getting closer to a point of euphoria – it promises to be interesting trading.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.