- English

- عربي

- Big tech kicks back – S&P500 and NAS100 close higher

- Nvidia feels the love in the pre-market

- Asia equity opening calls suggest a mixed picture of open

- FX movers and shakers – Aussie CPI the highlight in the session ahead

- Commodities ease back after Monday's gains

The tables turn once again, and the period of position adjustment into quarter-end takes another sinister turn. We see positive closes for the NAS100 cash +1.2%, S&P500 +0.4%, while the Dow and Russell 2k close lower. The Nvidia effect strikes once again, taking tech higher on the day, while we see communication services the star performer within the S&P500 sectors – led by Alphabet and Meta. Energy holds in well after the strong showing on Monday, while materials and REITS subtract points.

Looking at the intraday tape, those trading, saw the S&P500 open on the front foot despite mild weakness in European equity markets (the CAC40 closed -0.4%), with the index trading to 5469, before rolling over to test Monday's closing levels of 5447 – this is where the buyers stepped in, and we saw a fairly solid move into the close. The bears will point to shocking breadth, with only 22% of S&P500 stocks higher on the day. When Nvidia gains +6.8% and the full suite of Mag7 names close in the green it's not hard to see why the S&P500 closed higher, with obvious outperformance seen in the NAS100.

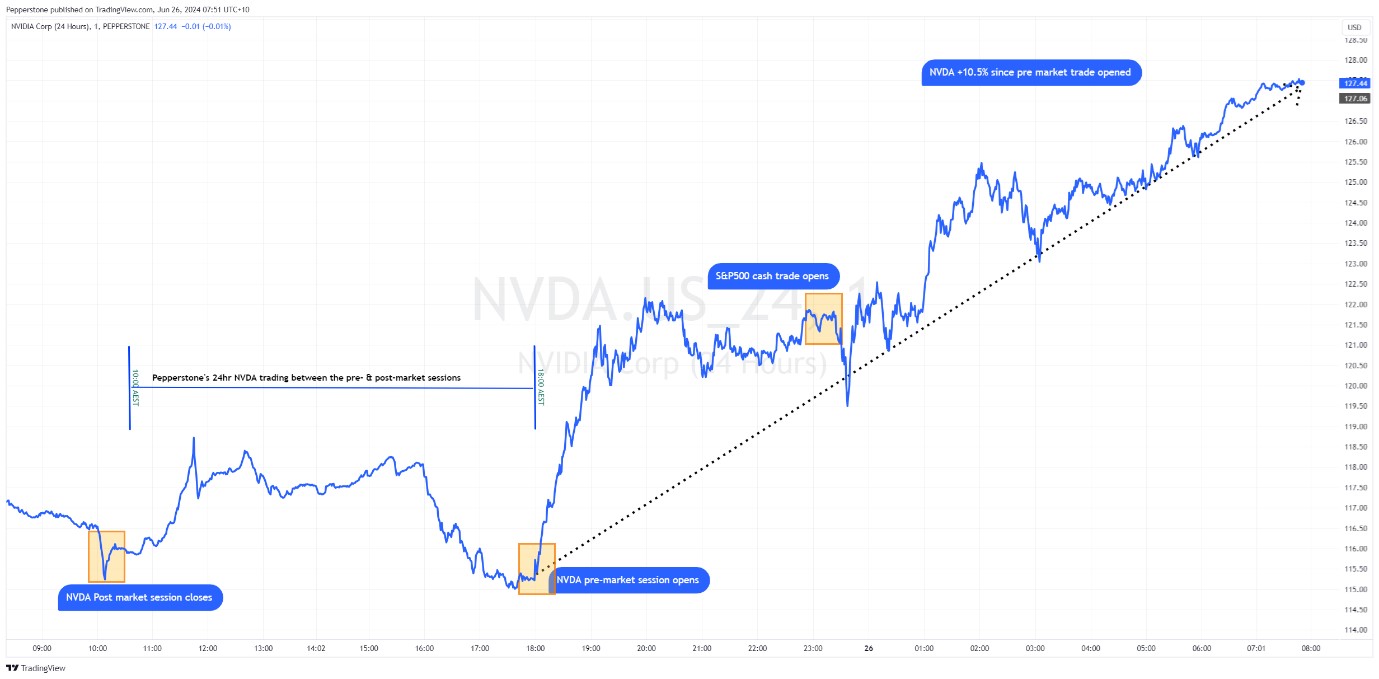

Nvidia 24-hour shares – intraday moves

We had been arguing that nothing fundamentally had changed with Nvidia (and AI-related names), and the 16% decline in Nvidia was driven by overly stretched technicals, and a saturated position, with month- and quarter-end a reason to take some length off the table. As we see from the intraday chart of our 24-hour Nvidia CFD, the buyers stepped in hard as soon as the premarket opened at 18:00 AEST, with a 10.5% rally off the lows, with some 413m shares traded. Optionality played a part, with sizeable short-dated call buying resulting in dealers hedging through buying the underlying shares – so momentum is back, but can we trust this one-day move?

I’d like to see an upside break of Friday's cash session high of $130.63 to offer a real belief this can push to new highs.

Nvidia aside, Alphabet is the large-cap play of the day, with new highs and we see that the stock is flying – long and strong, and the bulls will be gunning for $200. FedEx sit up 15% in the post-market, guiding to higher revenues for 2025 and a buyback in the works – typically a strong cyclical story, the devil is in the details, but this name should work well from here.

Crypto has also rebounded, aligning with the moves in Nvidia and we see Bitcoin testing 62k, and this just cements the idea that momentum as a thematic was the underlying driver.

Given the moves we’ve seen and the three sectors working in the S&P500, our calls for Asia equity indices are once again mixed. The ASX200 looks to kick back some of the solid gains we saw yesterday, with the index expected to open -0.4%. When value (as a factor) has taken a backseat to growth, the king of the global value indices will underperform. BHP’s ADR suggests the miner will open -1%, so this is indicative of the broader materials space, subsequently, we can expect the Aussie banks to open on a flat note to counter the weakness in the materials names. Tech will likely find some love, but given the low sector weights on the ASX200, tech won’t be the index bulls saviour today.

We see the HK50 eyed to open -0.6%, while the NKY225 should open +0.4% higher – further chop in these indices, and I remain skewed to trade ranges.

In FX markets the USD has found a bid, following the small moves higher in US Treasury yields (US 2yr closed +2bp at 4.74%), where the USD gains were most pronounced vs the MXN, ZAR, and NOK. EURUSD found sellers into 1.0691 but has found support below 1.0700 yet again – the French election remains a clear focus for EUR traders, and while we have some calming of nerves towards this risk, the threat of the unknown is keeping activity light.

USDCAD has been well traded post Canadian CPI, which was above consensus at 2.9% y/y (vs 2.6% consensus), with Canadian rates markets now pricing 8bp of cuts for the next BoC meeting on 24 July. The CAD has seen its best work vs the crosses.

We’ve seen several Fed speakers, and various US tier 2 economic data releases, with consumer confidence coming in line with expectations at 100.4, while the Philly Fed manufacturing index improved a touch to -15.1.

AUDUSD takes focus today with the monthly CPI read due at 11:30 AEST, with expectations headline CPI rises 20bp to 3.8%. Aussie interest rates markets price 4bp of hikes for the August RBA meeting, so today's CPI data could influence that pricing, notably if we get an upside surprise above 4%, with troubling services inflation, and then we could be looking at rates pricing closer to 10bp of implied hikes - although it’s the Q2 CPI print on 31 July that will really matter to the August hike debate. Conversely, a CPI number closer to 3.5% would see any pricing of hikes coming out of the market and we’d be back to thinking the next move is firmly down for the cash rate, but not until late 2024, and more likely 2025.

AUDUSD sits at 0.6640 and continues to trade in a sideways range on the higher timeframes. On the day, I’d see the moves capped into 0.6675 and 0.6615 and would look to fade the moves here accordingly, but that depends on the CPI data. AUDNZD grinds lower, and big CPI numbers could set this higher – I am a buyer of strength in this cross.

Commodities have found sellers – after seeing upside potential in crude given the bullish price action, the bulls have failed to push on and we see price -1%. Gold closed -0.6% at $2319 and remains a frustrating one for those trading on the higher timeframes. Silver is -2.2%, with copper -1.2% at $4.37 p/lb.

Good luck to all,

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.