- English

- عربي

Gold Surges Past $4000 as Momentum and Macro Tailwinds Collide

It’s also a clear example of why buying any market at former highs — or in markets that are already grossly technically and tactically overbought — may not feel right but can still be the right trade.

Gold is now up 52% year-to-date, marking the most impressive price rise since 1979. Even a simple moving average crossover system as an exit signal for long positions (using the 3 EMA and 8 EMA) would have kept traders in the trade — unemotional and unperturbed by sky-high technical oscillators or concerns over stretched positioning. As we can see, those signals are yet to flash a firm exit.

The recent bull trend has frustrated swing traders looking for a more pronounced pullback in which to establish longs, and many have had to simply buy at market and chase the price higher. Some have attempted to short gold on the view that the move is overdone and that the risk of mean reversion is sufficiently elevated.

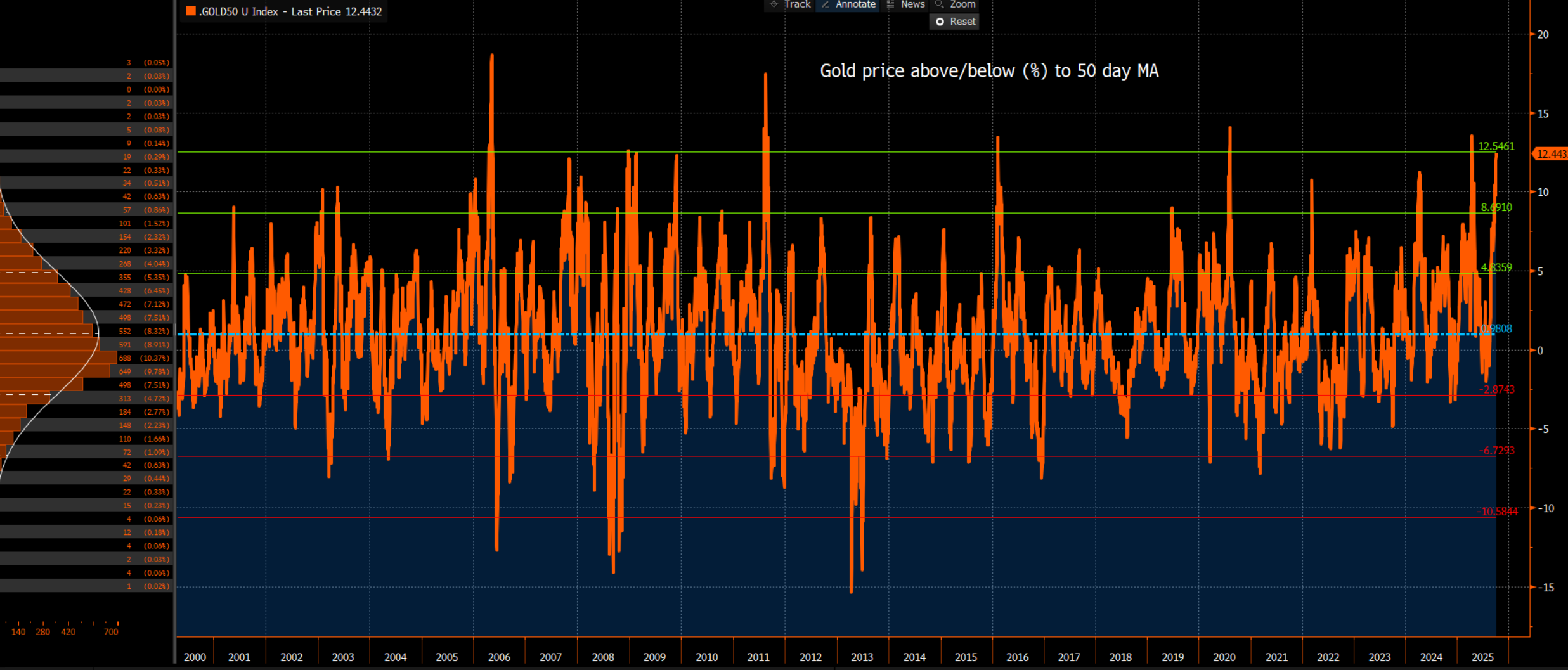

That time may soon be upon us — one reading worth noting is that XAUUSD now trades at a 12% premium above its 50-day moving average, or three standard deviations above the average premium since 2000.

However, throughout September and October, shorting gold on the higher timeframes has not worked out well, and many have been forced to cover — further fueling the rally.

Drivers Behind the Gold Rally

The reasons for gold’s relentless surge are numerous, but worth revisiting:

• China’s gold reserves: Data released Monday showed China added to its gold reserves for the 11th consecutive month. Holdings are now at their highest levels since 2015.

• US fiscal concerns: The ongoing government shutdown has reinforced fears of ballooning US debt and deficits (as a % of GDP), positioning gold as both a classic and a preeminent debasement hedge.

• Policy uncertainty: While the US fiscal position has improved through 2025, Trump’s plan to use tariff receipts to fund relief programs for farmers, welfare recipients, and households — alongside Democrat resistance to the soon-to-expire Affordable Care Act (ACA) subsidies and the $1 trillion in healthcare cuts Trump earmarked for the One Big Beautiful Bill — looks increasingly likely to push deficit projections higher.

• Loose financial conditions: The US now has its loosest broad financial conditions since 2022, yet the Fed is firmly expected to cut rates at both the October and December FOMC meetings. Inflation expectations remain well anchored — but for how long?

• Portfolio reallocation: Major institutions are rethinking the classic 60/40 equity–bond split. Morgan Stanley, for example, has proposed a 60/20/20 structure (equities/bonds/gold). While gold may be tactically and technically overbought, it remains institutionally under-owned — given that global fund managers traditionally hold just a 2% allocation. That appears to be changing, and we may already be seeing this reallocation into gold playing out.

• Huge ETF and ETP flows: Institutional flows are clearly visible in gold ETFs and ETPs, which have surged through September and October, lifting total holdings to within 100 tonnes of the 2020 record highs.

• Gold is an uncorrelated asset: Gold continues to show very low correlation with both the S&P 500 and US 10-year Treasuries — a key advantage for portfolio diversification and volatility reduction.

• Physical flows to US vaults: Gold migration to COMEX vaults in the US has supported CME pricing, with holdings now exceeding 40 million tonnes — up 9% since July.

• CTA buying: Systematic trend-following funds (CTAs) have been major buyers of gold futures. While many are now “max long,” their activity has been instrumental in driving prices higher.

• Physical scarcity fears: Growing concerns about tightening physical supply and potential increases in lease rates are adding a speculative bid.

The Bottom Line

The reasons behind the gold rally are plentiful, while the arguments to sell largely hinge on stretched positioning and technical exhaustion. But let’s remember — gold has been technically overbought since early September.

Gold, silver, and platinum are all articulating a powerful macro message, and it’s one that deserves respect. My own view is that funds and global reserve managers want a hedge — against fiscal recklessness, currency debasement, and unpredictable government policy — and gold sits squarely at the heart of that movement.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.