- English

- عربي

Bitcoin Price Prediction: Will BTCUSD Break Above 71,700 or Fall Toward 60,000?

High-Level Overview

• Bitcoin is coiling inside a tight range after a sharp rebound from February lows

• A break above resistance opens 80,000, a break below support exposes 60,000

• Liquidation pressure and extreme volatility mean the next move could be explosive

Bitcoin has recovered strongly from the 6 February low of 59,884, breaking the recent leg of the downtrend and rallying to a high of 72,180. However, the move has stalled, and on lower timeframes BTCUSD is now consolidating within a defined range between 71,600 and 68,400.

The key question for traders is simple: which way will Bitcoin break from this range?

Bitcoin Resistance at 71,500 to 71,700 Remains Critical

The 71,500 to 71,700 zone is acting as clear technical resistance. Price has failed multiple times in this area, with supply repeatedly dominating. A sustained breakout above this zone would increase the probability of upside continuation and open the door to an initial target near 79,000 to 80,000.

A break higher would signal renewed bullish momentum and could attract both momentum traders and systematic buyers back into the market.

Bitcoin Support at 68,400 in Focus

At the time of writing, BTCUSD is testing the lower boundary of the range near 68,400. A decisive four-hour closing break below this level would increase the risk of a deeper retracement toward 64,000, with 60,000 emerging as a secondary downside target. Range breaks following consolidation phases often lead to expansion in volatility, making this level particularly important for short-term traders.

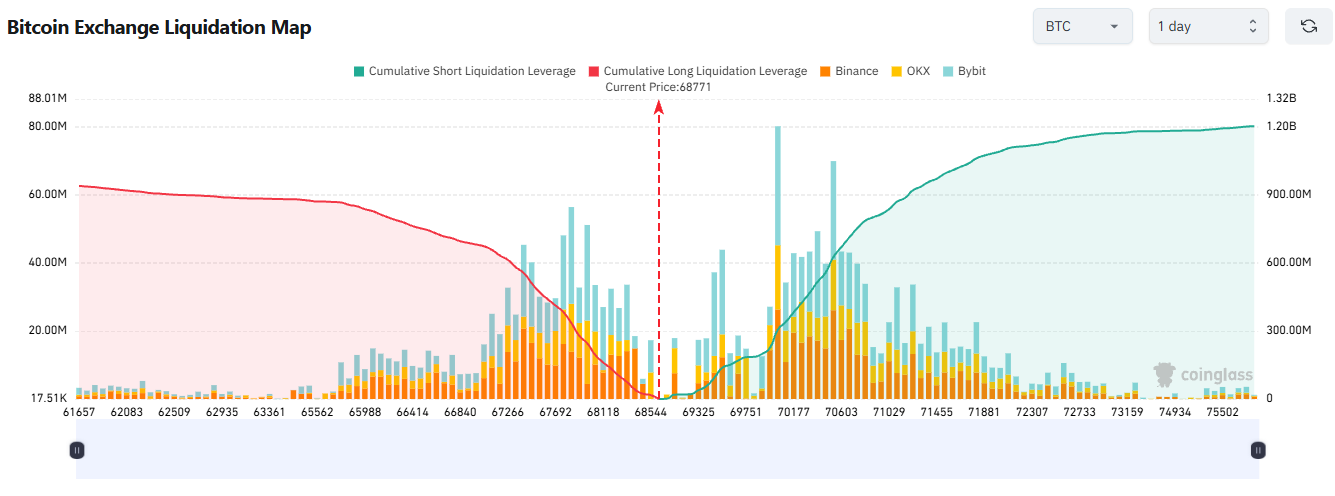

Bitcoin Liquidation Map Shows Short Squeeze Risk

Reviewing the Bitcoin liquidation map from Coinglass provides additional insight into leveraged positioning. The data shows a notable skew toward cumulative short leveraged positioning relative to longs.

There is a cluster of potential short liquidations between 70,035 and 70,532. A push above 70,000 in spot BTC could force short positions to close, accelerating upside momentum and potentially triggering a bullish breakout from the range.

By contrast, there is a relatively smaller concentration of long liquidations below current price levels. Much of the leveraged long positioning was already flushed out during the recent move toward 60,000. Traders appear hesitant to aggressively re-engage on the long side until a clearer trend emerges.

Bitcoin Volatility Remains Elevated

Bitcoin’s short-term realised volatility remains extremely elevated, with 10-day realised volatility around 106 percent. This is near the highest level seen since November 2022.

Such elevated volatility limits the appeal of Bitcoin for many institutional investors, as volatility-adjusted returns become less attractive. This may partly explain the relatively subdued and inconsistent net flows into spot Bitcoin ETFs, including the IBIT ETF, where no clear trend in sustained inflows has emerged.

A moderation in volatility toward the 60 percent range, combined with a confirmed bullish breakout, could improve institutional participation and strengthen the broader investment case.

Bitcoin Breakout Setup: What Traders Should Watch

Bitcoin is currently compressing within a clearly defined range. A break above 71,700 would increase the probability of a move toward 80,000, while a breakdown below 68,400 raises the risk of a pullback toward 64,000 and potentially 60,000.

For momentum traders and range-break strategies, this is a setup worth monitoring closely. Alert levels around key resistance and support zones could become focal points for broader crypto market participation.

The next directional move from this consolidation phase is likely to attract significant attention across the cryptocurrency trading ecosystem.

Good luck to all...

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.