- English

- عربي

U.S. Senate Crypto Market Structure Bill Vote: Why It Matters for Ethereum, Solana and the Crypto Market

A Critical Vote for Crypto Markets On Thursday, the 23-member U.S. Senate Banking Committee (13 Republicans, 10 Democrats) is set to vote on the Market Structure Bill, formally known as the Responsible Financial Innovation Act. With the crypto market in need of a clear upside catalyst, this vote could prove pivotal if the bill passes with enough Democratic support to be viewed as non-partisan.

Why Democratic Support Matters

While the legislation would still require full Senate approval, with a House vote expected to be relatively straightforward, sufficient Democratic backing at the committee level could provide the spark needed to reinvigorate the bullish case for the crypto market.

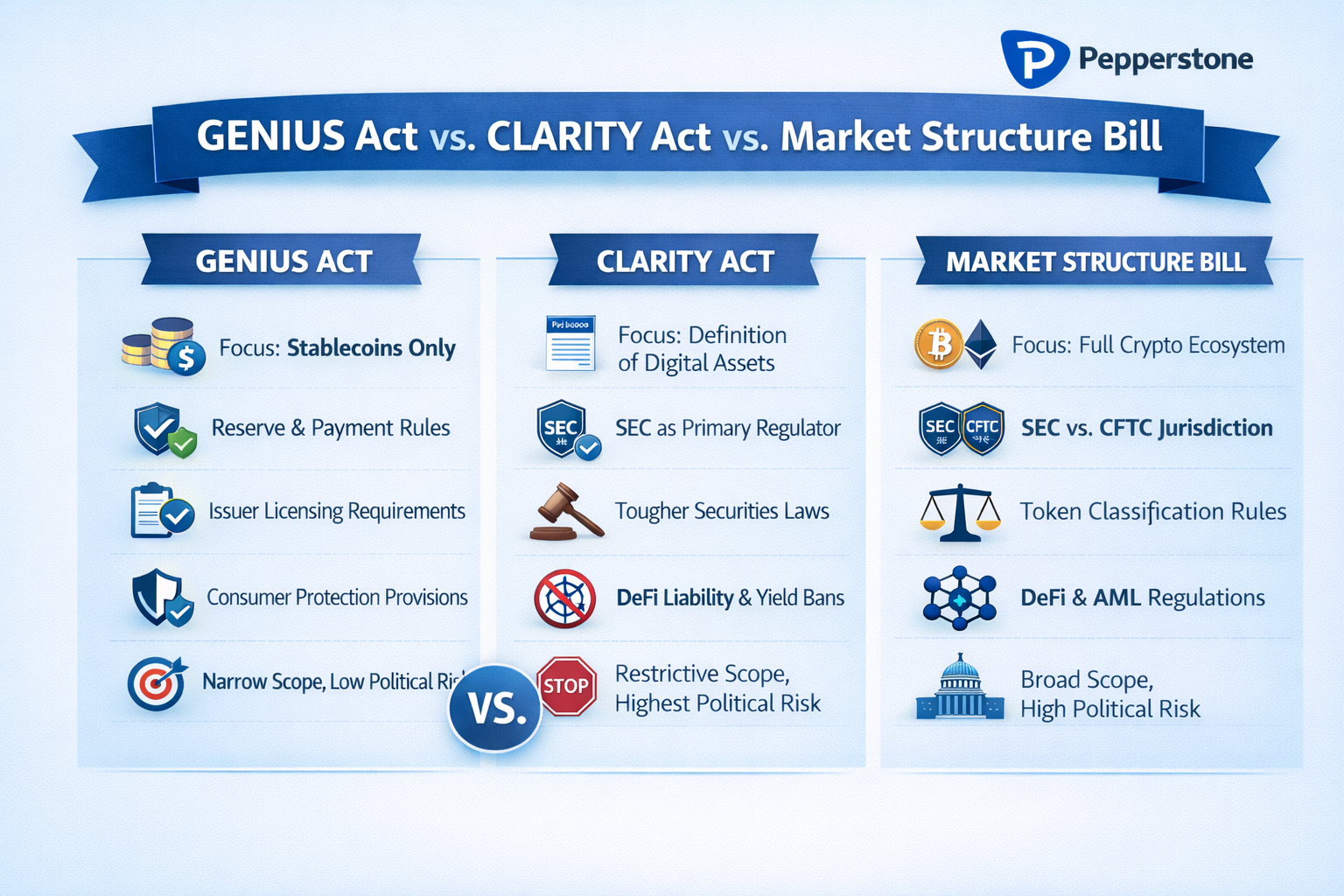

Lessons from GENIUS and CLARITY

The Market Structure Bill represents a more comprehensive evolution of the GENIUS and CLARITY Acts, which were passed in July 2025. Those bills triggered a 60% rally in Ethereum, with strong upside across the broader crypto market over the following 39 days.

What the Market Structure Bill Actually Contains

At its core, the Market Structure Bill seeks to establish the first comprehensive U.S. legal framework for cryptocurrency. It defines what digital tokens are, clarifies regulatory oversight, outlines how crypto assets can be issued and traded, and sets parameters for how decentralised systems are treated. The legislation aims to balance innovation, consumer protection, and national security. While GENIUS focused on stablecoins, this bill attempts to define the entire crypto ecosystem.

Why the Bill Has Faced Resistance

Given its scope and complexity, the bill has faced resistance from Senate Democrats, leading to multiple revisions. A reworked version will now be presented to the Senate Banking Committee and is widely expected to pass, as all 13 Republican members are likely to vote in favour, delivering a simple majority.

Why This Vote Is Only the First Test

However, that outcome alone is not the market’s primary focus. This committee vote is best viewed as a signal of whether the bill has sufficient momentum to advance to a full Senate vote, which, unless fast-tracked, would likely take place in April.

The Democratic Vote Count Matters

Crypto traders will be watching closely how many of the 10 Democratic committee members vote “yes,” as this will shape expectations around the bill’s chances on the Senate floor and whether it can secure the 60 votes required to overcome a filibuster.

The Key Threshold for Markets

The key threshold is three to four Democratic votes in favour, ideally four, although securing more than that appears unlikely given recent objections. For context, 17 Democrats voted in favour of the GENIUS Act in July 2025. As a result, many market participants would interpret three or more Democratic votes on the Market Structure Bill as a sign of bipartisan support, increasing confidence that those same Senators could back the legislation in a full Senate vote.

The Math Behind Senate Passage

With Republicans holding 53 seats in the Senate, the bill would realistically require at least seven to ten Democratic votes to pass. Consequently, Thursday’s committee vote will play a critical role in shaping market expectations.

Market Positioning Ahead of the Vote

Heading into the vote, expectations are low that more than two Democrats will support the bill, which has limited speculative interest in Ethereum and other crypto assets. However, the risk of a positive surprise remains, and if it materialises, the vote could represent a major step forward for regulatory clarity and the broader crypto market.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.